Prelude: This article was largely written before the emergence of the Coronavirus. Recent developments as a result of the pandemic only add emphasis and gravity to the points made here. – Michael

“…many people living in the West are dissatisfied with their own society. They despise it or accuse it of no longer being up to the level of maturity by mankind. And this causes many to sway toward socialism, which is a false and dangerous current.” – Aleksandr Solzhenitsyn, Harvard University, June 8, 1978

In the political primaries leading up to the 2016 and 2020 Presidential elections, the United States experienced something never before witnessed in its history; a major Presidential candidate who did not espouse democratic, free-market principles.

Bernie Sanders, a self-avowed “democratic socialist”, built a significant following beginning during the 2016 campaign and was a major threat in his pursuit of the Democratic party nomination.

Although he failed to capture the party’s bid, he successfully shifted the Democratic platform to the extreme left with arguments in favor of free college and free healthcare.

Let’s discuss…

The Path to Socialism

With the prosperity the United States has delivered over nearly 250 years, it is bewildering to think that the citizens who greatly benefited from its political, legal, and economic systems now think it inferior. How can we better understand this seismic shift in perspectives and what does it mean for investors?

Bailouts

In March 2008, the Federal Reserve (Fed) stepped in to broker what amounted to a bailout of sorts in the demise of Bear Stearns. JP Morgan, the only allowed bidder, won, or shall we stole Bear Stearns for $2 per share. After some heat from the media, JP Morgan was strong-armed by the Fed to pay $10 per share, partially rescuing equity shareholders and bondholders. As part of the agreement with the Fed to raise the stakes to $10 per share, the U.S. taxpayers assumed most of the residual credit risk of Bear Stearns, leaving JP Morgan with virtually no additional risk as a result of the purchase whatsoever. Bear Stearns real estate holdings alone were worth well in excess of the $10 per share price, not to mention many other valuable assets.

It was a sweetheart deal for JP Morgan as they got all of the upside. Not so much for the taxpayer who took all the risk. What was the reward for that assumed risk? Zero percent interest rates, languishing retirement fund returns, and a widening wealth inequality gap.

Later that year, as the financial fiasco gained steam and after the Lehman Brothers bankruptcy, the Fed directly lobbied Congress to provide $700 billion in taxpayer funds to bailout the United States banking system. In their words and with appropriate hyperbole, it was to prevent the collapse of the global financial system and modern society as we know it. Rumor has it that Treasury Secretary Hank Paulsen literally got down on his knees to beg Nancy Pelosi to quickly advance the effort (no doubt after looking at the value of his Goldman Sachs stock).

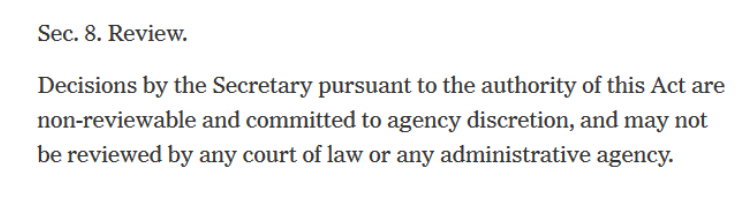

Sorry taxpayers, the bailout which gave ex-Goldman Sachs CEO Hank Paulson full authority to distribute funds to banks and make purchase of bank’s securities was not allowed to be checked for fairness, indiscretion, or quid pro quo actions from Paulson and friends.

Feed the Monster

As the Fed and U.S. Treasury were using all of their powers to pump trillions of liquidity into the financial system using highly unconventional fiscal and monetary policies, executives at big, white-shoe financial firms who had advertised themselves as intellectually superior had been caught front-running the system and were now at the mercy of that system and the ridiculous amounts of leverage they employed.

They were not actually that smart, they were like the campers being chased by a hungry bear. You don’t have to be the fastest, you just can’t be the slowest. The bankers were just a little bit smarter than the Fed and just happened to work for financial companies that the government would deem to be “SIFIs”, or “systemically important financial institutions.” Too big to fail. Jackpot.

That status gave them unprecedented special privileges unlike those any other company before had ever enjoyed. EVER. They were feeding at the trough of U.S. taxpayer generosity with a sense of arrogance and entitlement.

That pattern of corporate favoritism, dare we say welfare, took on a new monstrous form during the financial crisis and has stayed in place throughout the entire decade that followed. Although more heavily regulated, financial institutions were granted free money through four rounds of quantitative easing (QE). That policy expanded reserves and even paid the banks interest on excess reserves (IOER) generated from QE and held at the Fed. Just to be clear, that interest (IOER) too was from taxpayer funds.

“Democratic Socialist”

Those actions and many similar ones that have since transpired are now echoing in the Democratic primary. Bernie Sanders used language on the stump that was laced with vitriol toward politicians who in past years have used bailouts and tax cuts to enrich their wealthy constituents and harvest campaign contributions.

Ignore for a moment that Sanders himself owns three houses and often flies on private jets like the bankers; he has been properly critical of the bailouts received by the banks and other financial institutions. He singled out JP Morgan CEO Jamie Dimon in June 2019 after Dimon made a pointed case against Sanders and political socialism. Sanders’ response rang true. In a tweet he stated, “I didn’t hear Jamie Dimon criticizing socialism when Wall Street begged for the largest federal bailout in American history – some $700 billion from the Treasury and even more from the Fed.”

In response, Dimon said JP Morgan did not need the bailout money and only took it because they “were asked to” by the Fed so weaker rivals could tap it without being singled out. You may chuckle as do we at that odd effort to characterize a bailout as altruism.

Our view is that, if a financial institution assumes risks that jeopardizes their existence, they absolutely should be singled out. The equity owners should make it whole or suffer losses. Bondholders fight over the scraps. THAT is capitalism. Sanders is correct, Jamie Dimon too is a socialist when it suits his pragmatic preferences and wallet.

The Average Joe

As so many bankers were being spared wrath and enrichened for their role in the 2008 crisis, hundreds of thousands of homeowners across the country were coming under enormous distress as a result of unemployment, falling home prices, and unmanageable debt balances.

There is not much evidence that JP Morgan, the other banks, or the U.S. Government had much sympathy for the families of Americans who were suddenly displaced by the recession. In fact, in many cases, predatory practices against these struggling citizens were commonplace. Again, preferential treatment (socialism) was afforded to the poor unfortunate banks while taxpayers were offered rugged free-market capitalism in exchange for providing those benefits to the banks.

Not a Failure of Capitalism

Although socialism in various forms has been gaining traction in the United States since 1933 and The New Deal of the Roosevelt administration, what we are seeing today is radically different. People are generally confused and believe what we are seeing is a failure of capitalism. It is not.

What we are seeing is not capitalism at all. Bernie Sanders’ complaints were about the way socialism is applied to the corporate elite. It is an inauthentic argument from both directions. Capitalism does not rely on bailouts or preferential treatment. Capitalism depends on the rule of law being upheld equally for citizens and business owners. If a financial sector-induced financial crisis comes about, citizens should expect that exposed firms dissolve and those engaged in negligent and/or illegal conduct are prosecuted.

Neither of those things happened over the past ten years. Nothing could be further from the foundational principles on which this country is built and the basis of prosperity which it produced.

Minsky

Hyman Minsky famously outlined his theory that “stability breeds instability.” The paradox embedded in Minsky’s theory is that, while stability gives the appearance of comfort, security, and prosperity, it induces risk-taking behavior that creates financial instability and eventually causes panic and crisis.

In much the same way that Minsky describes an economic cycle, the good fortune of prosperity breeds dissatisfaction, entitlement, and contempt. As Soltzhenitsyn discussed in 1978, we have reached a flashpoint whereby the most radical ideas gain traction. A large enough segment of the population did not enjoy the benefits of a system that gave away money to the corporate elite and the wealthiest of citizens for the last ten years, and they will advance a misguided but purposeful agenda aimed at “equality” and “fairness”. It is, however, neither.

Summary

Bernie Sanders is correct. We are already a socialist nation for the nation’s wealthiest 5%. Banks and corporations enjoy the benefits of a government and Fed that takes extreme measures to protect the value of those businesses and their stock prices. At the same time, individuals are not so fortunate. You, my friend, are on your own.

Corporate margins lean? You’re fired. Meanwhile the C-Suite orders another debt issue and billion-dollar stock buyback to ensure their stock-laced compensation is intact.

Sanders’ political appeal reaches a large group of those citizens who did not benefit from and were often punished by, the preferential treatment of corporate fat cats. Treasury Secretary Mnuchin, among many other well-connected elites, was granted exorbitant privileges during the fall-out of the financial crisis and reaped exorbitant profits. Wealthy investors and Fed officials who advocate for capitalism are not clear-headed on the issue. They have been a part of and beneficiaries of corporate socialism, not capitalism.

And yet, we want to be clear –

I do not in any way endorse a socialist government.

I DO endorse free-market capitalism in true form.

I recognize that what we have today is far from free-market capitalism, and it explains the appeal of Bernie Sanders for many. It remains an incoherent and misinformed attraction. Any power granted to Sanders or those with his views, will further hobble an economy propped up by financial accounting gimmicks, Fed sorcery, and misguided government largesse.

The ideology of Bernie Sanders is not a remedy that investors or capitalism should welcome. Paradoxically, neither will the espoused policies of Donald Trump or Joe Biden rectify our problems. Given the already heavy debt load, weak economic growth, and poor productivity, it is difficult to see a path forward apart from devaluing the currency. That, however, presents an entirely different challenge and one history suggests we desperately should try to avoid.

As a country, we will either live with the short-term pain of discipline or the long-term pain of regret.

Twitter: @michaellebowitz

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.