The three-week surge in the stock market has been accompanied by improving breadth and momentum that has carried the S&P 500 Index INDEXSP: .INX to within striking distance of February’s record high.

The Labor Department revealed on Friday a stunning rebound in employment with the economy adding 2.5 million jobs in the month of May even though our economy has only partially re-opened.

Wall Street analysts were expecting a loss of 8 million jobs.

The unemployment rate fell to 13.3%, better than the 20% expectation. It seems likely that the bad news on jobs is behind us.

The Virus – We are seeing no evidence of a notable pick-up in the virus infection rates as the economy safely reopens. The daily growth rate of infections from the virus has dropped significantly.

Testing is catching up to demand and the virus is down to levels that hospitals can support.

The Economy – The surprising jobs numbers in the month of May and the unemployment rate point to a faster recovery than anyone expected.

Part of the good news on jobs centers on the manufacturing sector which showed a rebound of 225,000 manufacturing jobs added as the Federal Government is offering to pay moving costs and tax incentives for American companies to bring their overseas supply chains back to American shores. We expect to see these jobs numbers continue to grow.

Online reservations for vacation rentals have increased 127% since April. Mortgage applications moved above the pre-virus levels and auto sales have improved significantly since April. Travel and restaurant bookings are increasing.

Consumer spending will be the key to our economic recovery and the fact that the savings rate has soared during the shutdown should provide fuel to satisfy pent-up demand.

We will continue to have challenges – national civil unrest, elevated levels of unemployment with many jobs not coming back, rising tensions between Beijing and the U.S., and a possible second wave of the virus. We will need additional economic data to confirm the jobs numbers in order to establish that the economy is on a solid recovery track, but so far so good.

The Federal Reserve meets this week. Even though the Fed does not have any more room to cut interest rates, they have other tools such as forward guidance and quantitative easing. Additionally, there has been talk of “yield curve control” where the Fed instigates a policy of making sure interest rates stay at rock bottom all along the borrowing curve by buying Treasury bonds of different durations.

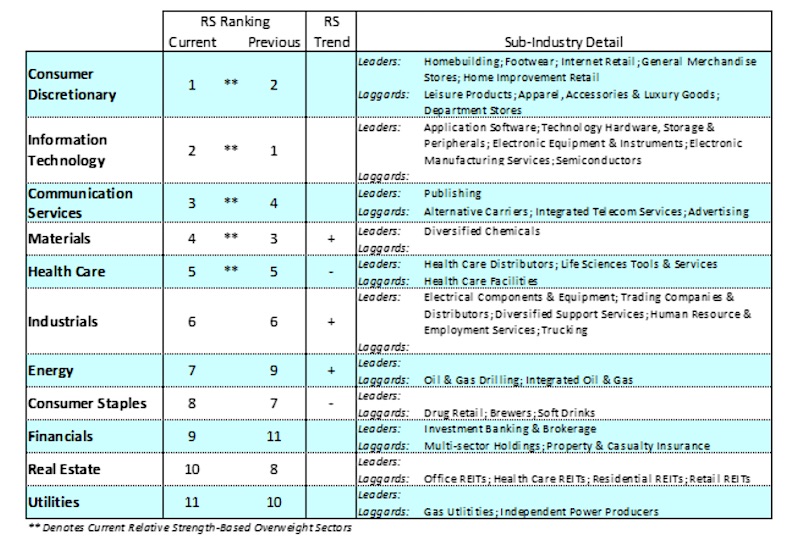

Technicals and Sectors – Over the past two weeks the stock market has broadened out from a small group of large tech and healthcare stocks to other sectors that are more closely tied to the economy, such as financials and industrials.

The Russell 2000, comprised of 2000 small-cap companies, gained 3.8% last week while the S&P Mid Cap Average soared more than 8%. Historically, small-caps outperform as the economy exits a recession. Small-cap stocks in this market are oversold relative to large caps.

Bottom Line – The economic recovery will depend on the path of the virus pandemic, the creation of medicines and vaccines and the continuance of fiscal and monetary stimulus.

Improving expectations for the economy along with additional stimulus is a winning backdrop for cyclical and small and mid-cap sectors. Financials, industrials, materials and communication sectors are areas where we suggest investors focus.

Twitter: @WillieDelwiche

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.