According to the last week’s economic data inflation continues to surprise upside whereas the economy continues to surprise downside.

Nevertheless, the recession hasn’t come yet, but the 2 last adjacent quarters showed deceleration of the development, and a cut in the ensuing quarter estimated at 0.5%, as the Atlanta Fed stated last week.

Moreover, markets continue to make a big mistake believing that the FED’s strict policy in both ways respecting the hike in interest rates for four consecutive months and tightening with a double rate of change its balance sheet at $95 billion per month, could ‘’soft landing’’ the economy in the United States and drop the inflation at 2%. And why is that?

Because the entire economy was based on artificially low-interest rates for over a decade, the supply of money to the system was exceeding all-time highs increasing the U.S debt to unmanageable levels, the housing market is collapsing already, and due to higher prices in almost all products, we had the FedEx’s announcement for office closings and layoffs concerning the falling demand for transportation needs. In such a case, the only way to get back to a normal balance is through deflating the ‘’bubble’’ and sending the economy into a deep recession channel. Even if, on the 21st of September, FED raises the interest rates by 1%, it is going to lose the game of high inflation, because it will just kill the economy. Because, what someone can expect when the real rates are lagging by 5%?

Most people agree that the US economy will go into recession. But according to the FED’s officials and the real willingness of Jerome Powel to fight against the monster of inflation, everyone believes that even if we would have a recession, it should be short and shallow. And why shouldn’t be long and deep?

Markets every time have proven to all that in this randomness or manipulation of supply and demand, symmetries are depending on the preceding growths. Since the last so-called ‘’Great Recession’’ in the 2007-2009 crisis, the policy for the U.S economy changed concerning the risks taken in the Banking system. So, we saw enormous growth with such low-interest rates for so long. The assets are too big, the debt also, and the misallocations of capital and resources are running in the same manner as well. How are all of these ‘’mistakes’’ going to be fixed? With a short and shallow recession? That can not be done for sure.

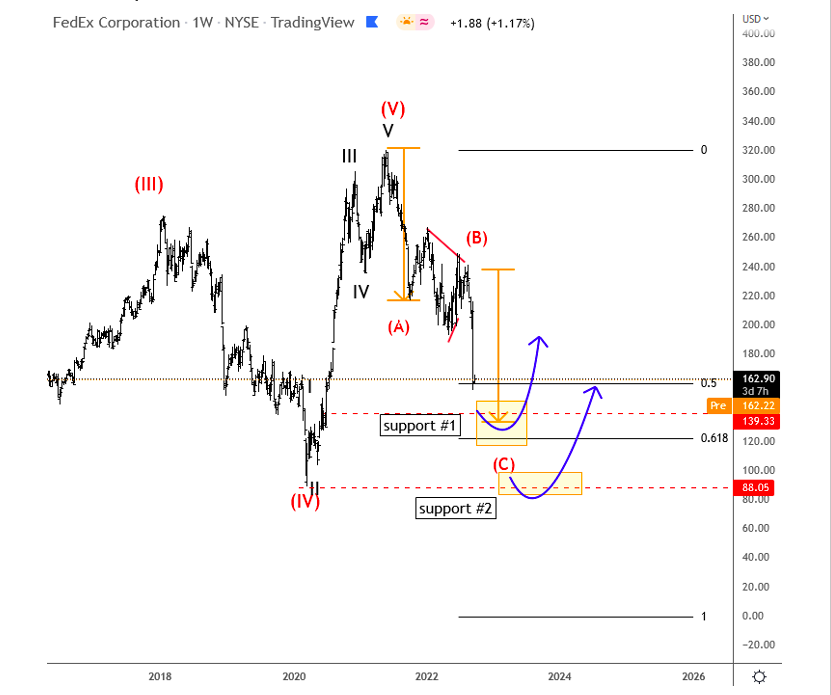

Reminding FedEx, just to illustrate from the Elliot Wave perspective our view for the stock, since it has lost almost 50% of its value. Its peak was at $319.90 and now is traded at $162.90.

FedEx Weekly Chart

Looking at the monthly chart we see ongoing correction, currently with three waves down with wave C targeting $140, followed by $90.00 supports. We think that down there FEDX can have an attractive support for a longer-term investment especially if FED will slow down the hawkish look, or possibly even turn dovish if recession will take place on a global scale.

This article was also contributed to by Stavros Chanidis.

Twitter: @GregaHorvatFX

The author may have a position in the mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.