Last week I wrote on how I interpret corporate credit and credit derivatives as guideposts for equity markets. In this piece I am going to show you some data to put in perspective where the credit markets currently stand, and, where relevant, how this compares to where we were during the ’07-’08 credit crisis, and where we have been since then.

Let’s start with the most important figures in the credit markets: corporate credit issuances. If I had to ignore everything else, this is the single piece of data I’d care about: how much debt is being issued and how it trades in the secondary market.

Q1’s Corporate Bond Issuance:

2009 → $399B

2010 → $338B

2011 → $429B

2012 → $457B

2013 → $448B

2014 → $429B

2015 → $496B

Obviously year-to-date issuance is blowing away all years post financial crisis. As a point of reference, Brian Reynolds suggests that an annual average of approximately $100B per month suggests that companies are issuing debt not only to refinance maturities and for operating cash, but to also to fund buybacks.

As to how recent issues trade in the secondary market, I track a cross-section of new bonds, trying to cover most industries and credit quality. My only filter is the size of the offering, a minimum of $750MM. Below are screenshots of the current batch, the oldest vintage being February 1. Of all the rolling periods I have monitored over the last 3 plus years, this is by far the strongest new bonds have traded post issuance.

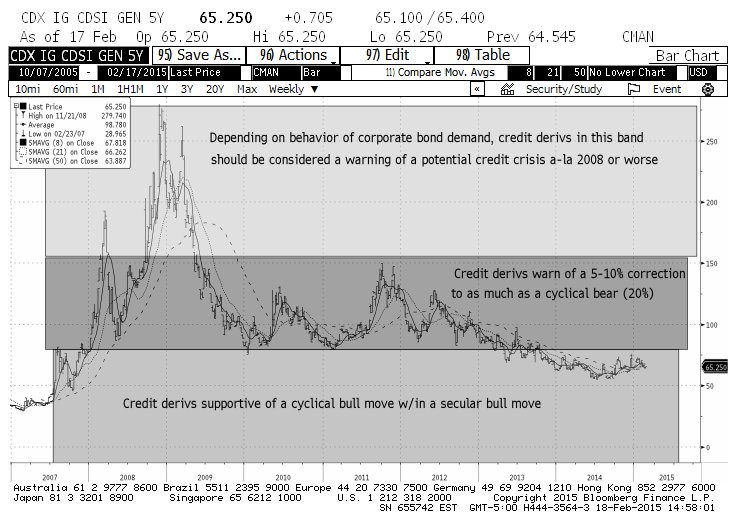

Next are the generic Investment Grade and High Yield Credit Default Swaps (CDS) Indices. In the context of a powerful credit cycle, these have become the most important derivatives because it’s what credit bears aim for when they want to disrupt the credit markets. A few weeks ago I tweeted the following chart of the IG CDX with bands that can be used as guides for when: i) bulls are firmly in control; ii) things are getting agitated; and iii) bears may be gaining the kind of upper hand that has been a precursor to the ‘00’-02 and ’07-’09 financial debacles.

When I captured that screenshot, the IG CDX was a little bit above 65bps. On Thursday the index closed at 63.1bps. Please note that the 60bps has been a line in the sand for credit bears. Below that level it is likely they would be forced to initiate a whole new round of short covering, which – as I explained in the articles referenced in last week’s piece – would likely spill over into more buying in the equity markets.

The HY CDX is basically in the same shape, if not even closer to a level that would further spook credit bears.

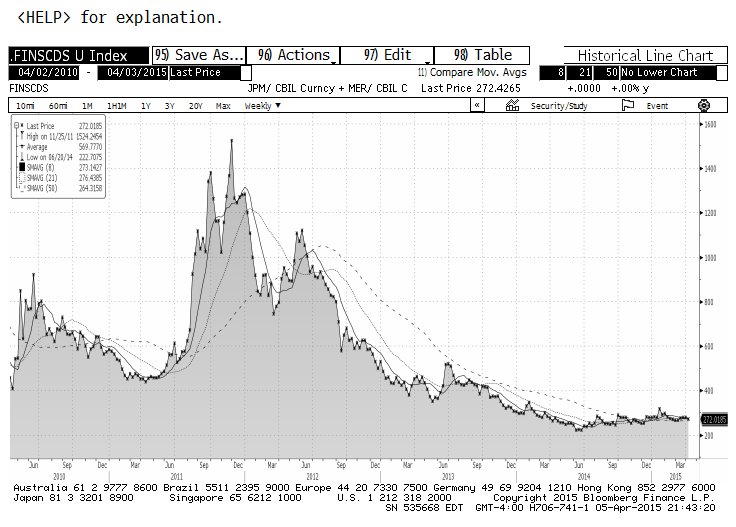

As further confirmation of the state of credit derivatives I created my own index of CDS on debt of large US financials. The thinking is that if/when a credit accident of consequence is forming, it will show up first in the credit of large financial companies. If someone knows of something meaningful brewing, please pick up the phone and call the big banks because no one else seems to be noticing.

The widening of high yield spreads is another common worry in the financial media. Here is the chart of high yield spreads going back 10 years. If it does not seem sufficiently innocuous consider this: after $98B of new junk bonds sold in Q1 of this year (post-crisis only 2013 registered a higher total at $106B and by comparison in Q1 of ’09 the total was $11B), high yield spreads are 12bps lower than at the close of 2014. Not even an avalanche of supply can push prices down.

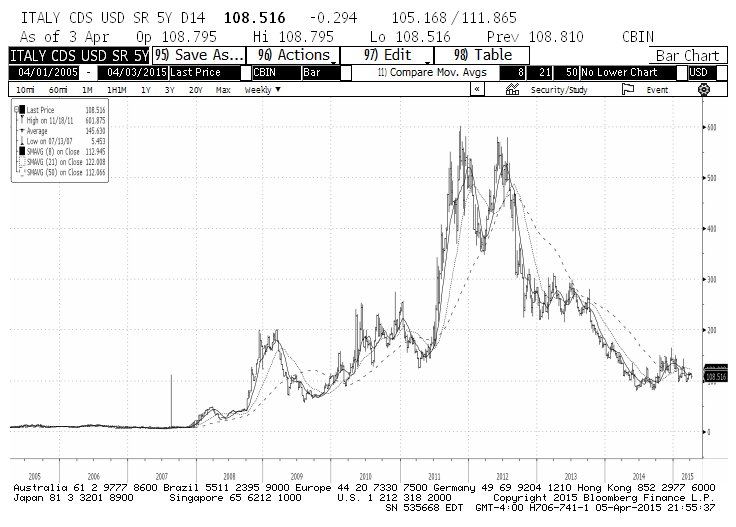

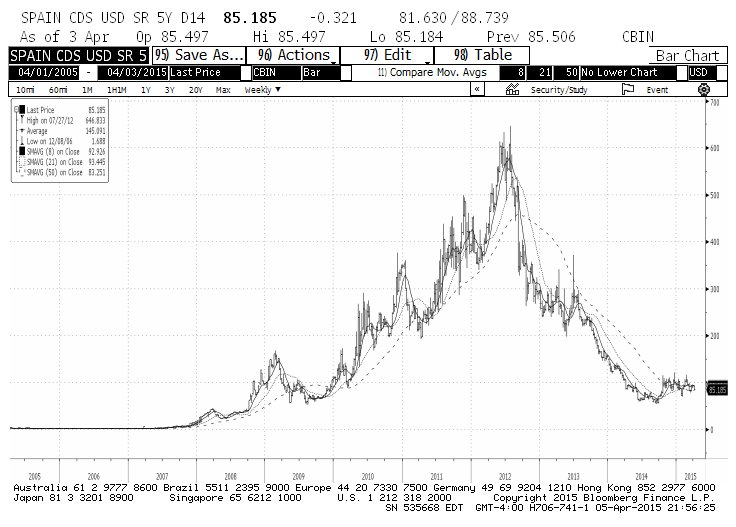

Next let’s look abroad. Am I missing the fact that the next disaster is taking shape in the Eurozone?

Below are the sovereign CDS of Italy and Spain, and the index of CDS on subordinated debt of EU financial companies.

No sense showing the spreads since – manipulated as they may be – they are pretty much at zero. Either way, good luck finding stress in these indices.

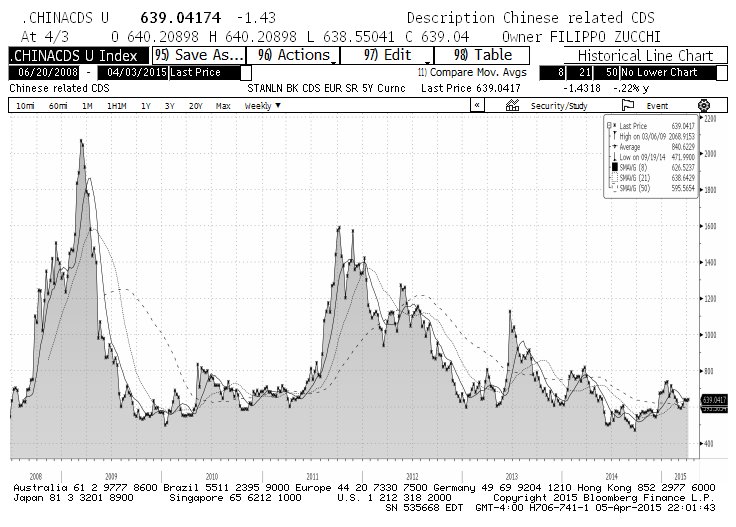

What about China!?!?!

This is my index of financial institutions highly sensitive to potential Chinese credit disruptions. Sorry folks, nothing festering here either.

And the Grexit issue? Right or wrong I’m on record that if Greece defaults it will result in a scary headline, some nasty trading, and a disaster of tragic proportions for Greece (pun intended). Meanwhile, Spain and Italy will find fiscal religion in order to avoid the same fate, and the EU will come out of it healthier than it is right now.

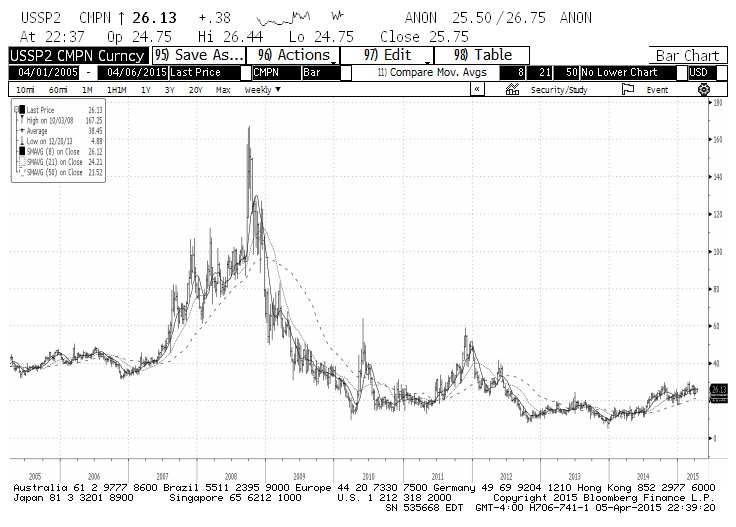

Lest I be accused of having rose-colored glasses on my nose, even though the CDS of EU and EU financials are quiet, keep an eye on the US 2yr swaps, which reflect the EU-sensitive Libor rate, and has been creeping toward the high end of where credit market bulls would like to see it (30-35bps).

In sum, I’ll be the first to admit that stocks are trading heavy and seem to be looking for any excuse to take another leg down. But to the extent that the secular nature of the bull market depends on the credit markets, the latter suggests that any drop in stocks will be yet another buying opportunity before companies’ buybacks and M&A drive equities to new highs.

Follow Fil on Twitter: @FZucchi

The author has no positions in any of the mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.