US Dollar Index

Off the February 11th intra-day low through Friday’s high, the spot rallied 2.1 percent in five sessions – hugging its 200-day moving average in the past four.

Dollar bulls have so far been unable to push through resistance at 97. Technically, there is room, as oversold daily momentum indicators have unwinding left still. It needs a fundamental push. The dismal exports news out of both China and Japan was not enough. In January, Japan exports fell 9.1 percent year-over-year, and China’s dropped 11.2 percent.

Non-commercials continue to cut back net longs – now at 17-week low.

COT Report data: Currently net long 31.3k, down 3.7k.

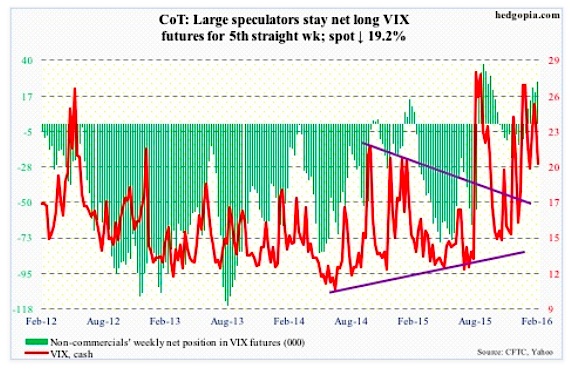

VIX Volatility Index

Last week’s spike-reversal signal was spot-on. Spot VIX lost 19 percent for the week. With this drop, it has now lost the 50-day moving average. In a worse-case scenario, the 200-day moving average (18.24) could be in play.

Last week on Thursday, using intra-day highs, the VIX-to-VXV ratio spiked to 1.05. This was preceded by a similar intra-day reading of 1.11 in the prior week. This week, the ratio closed at 0.9. Ideally, if equity bulls had their way, the ratio has room to go lower – toward high 70s to low 80s).

COT Report data: Currently net long 26.7k, up 7k.

Twitter: @hedgopia

Read more from Paban on his blog.

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.