The following is a recap of The COT Report (Commitment Of Traders) released by the CFTC (Commodity Futures Trading Commission) looking at futures positions of non-commercial holdings as of September 22, 2015. Note that the change is week-over-week.

10-Year Treasury Note: Last week, post-FOMC decision not to hike, stocks fell. The stock market had rallied strongly into the meeting, and were probably set to drop either way – hike or no hike. But the drop seems to have created an impression – probably false – that stocks are begging for the Fed to tighten.

The FOMC statement last week could not possibly have been more dovish. But in weekend comments, Federal Reserve officials’ tone was leaning hawkish. John Williams, president of the San Francisco Federal Reserve, said last week’s decision was a “close call.” James Bullard, president of the St. Louis Federal Reserve, said “the case for policy normalization is quite strong.” Jeffrey Lacker, president of the Richmond Federal Reserve, reminded us that “interest rates have been near zero for over six years.”

Then on Thursday, Janet Yellen, Federal Reserve chair, said this: “Most of my colleagues and I anticipate that it will likely be appropriate to raise the target range for the federal funds rate sometime later this year and to continue boosting short-term rates at a gradual pace thereafter as the labor market improves further and inflation moves back to our two percent objective.” Of course, she hedged all this by saying they would continue to be data-dependent.

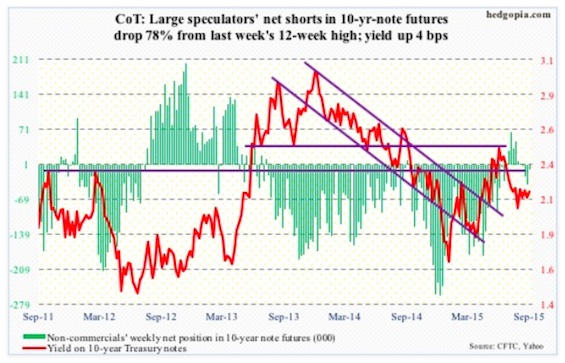

On Friday, two-year treasury yields, which tend to be the most sensitive to Fed policy, only rose three basis points to 0.70 percent; they were 0.82 percent right before the FOMC decision last week. In fact, 10- and 30-year yields rose four and five basis points, respectively. Not sure what the message is – if there is any. But perhaps any Fed tightening cycle would be shallow.

On a side note, did John Boehner just make Ms. Yellen’s job harder?

Per the the September 22 COT report data, non-commercials significantly cut back net shorts – betting on lower rates. Although, ten-year yields are oversold near-term.

September 22 COT Report: Currently net short 8.5k, down 30.9k.

30-Year Treasury Bond: Next week’s major economic releases are as follows.

On Monday, August’s personal income is published. All eyes will be focused on the PCE deflator – the Federal Reserve’s favorite measure of consumer inflation. In July, core PCE rose 1.2 percent annually – the lowest since March 2011. The last time it rose at a two percent annual rate was in April 2012.

Also on Monday, we get the pending home sales index for August. This correlates well with existing home sales. July came in at 110.9, up slightly from 110.4 in June, but down from 112.3 in May, which was the highest since 112.5 in May 2006. In August, sales of existing homes fell by 4.8 percent month-over-month. July sales of 5.58 million (seasonally adjusted annual rate) were the highest since 5.79 million in February 2007.

The ISM manufacturing index for September comes out on Thursday. August was 51.1 – the lowest since 50 in May 2013. The new orders index was 51.7 – the lowest since 49.6 also in May 2013.

Friday, we get the all-important employment report for September and factory orders. The advance report on durable goods was published this week. Next week, we get revised and more detailed estimates, as well as non-durable goods data. There is no momentum in this series. Year-over-year, orders for non-defense capital goods ex-aircraft – proxy for business capital expenditures – have dropped for seven straight months.

On the employment front, August was weak – saw a mere 173,000 non-farm jobs, versus a monthly average so far this year of 212,000, which itself is much weaker than the 2014 average of 260,000. Average hourly earnings of private-sector workers rose a healthy $0.08 to $25.09. With that said, annual growth is stuck around two percent, give and take.

10 FOMC officials are scheduled to speak on weekdays, including Ms. Yellen, Stanley Fischer, Federal Reserve vice chair, and Bill Dudley, president of the New York Federal Reserve. Get ready to get confused.

September 22 COT Report: Currently net long 7.7k, down 1.8k.

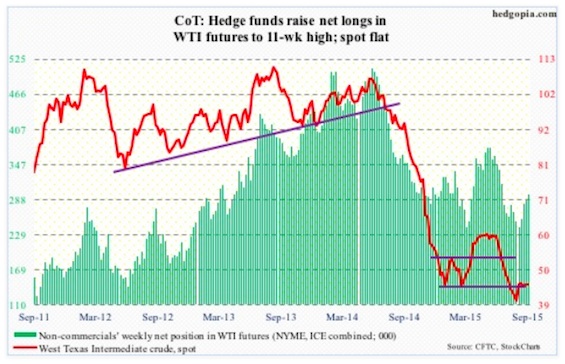

Crude Oil: In the week ended September 18, crude oil inventories fell by 1.9 million barrels, to 454 million barrels. This came on the heels of a drop of 2.1 million barrels last week. Other data were not as encouraging.

Crude oil production rose 19,000 barrels a day, to 9.14 million barrels a day (it peaked at 9.61 mb/d in the June 5th week). Refinery utilization rates fell 2.2 percentage points to 90 percent. Gasoline stocks rose 1.4 million barrels, to 218.8 million barrels; they have risen by six million barrels in the past five weeks. It is a double whammy – an end to the summer driving season even as refineries shut down for maintenance.

Globally, end-demand could be better.

The preliminary Caixin/Markit China PMI fell to 47 in September – the lowest since March 2009. South Korean exports shrank 14.7 percent from a year earlier in August. China’s was down 6.1 percent in that month, Taiwan’s down 14.8 percent. You get the picture.

In the end, the positive rig count news on Friday was not much help to oil. U.S. oil rig counts declined by four to 640 – a fourth weekly decline. Counts are now at a 10-week low.

The WTI was flat for the week. In three of the past four weeks, it has been rejected by its 13-week exponential moving average. The path of least resistance is down, with 43-44 a must-hold; that level did provide support on Thursday.

Non-commercials are optimistic, with net longs at an 11-week high.

September 22 COT Report: Currently net long 295.6k, up 10.3k.

E-mini S&P 500: Back in March, the S&P 500 had a bearish monthly MACD crossover. This does not happen that often. In the current bull market, there was a brief crossover in late 2011, and before that in late 2007 and in late 1999. The March crossover, it turns out, was prescient.

Fast forward to the present, and now there is another similar rare occurrence about to flash a bearish signal. The last time the index dipped below its 20-month exponential moving average was four years ago – or in January 2008 and in November 2000 before that. With three sessions remaining in the month, the index is 33 points below that average. Can it be saved?

continue reading on the next page…