The following is a recap of The COT Report (Commitment Of Traders) released by the CFTC (Commodity Futures Trading Commission) looking at futures positions of non-commercial holdings as of October 27, 2015. Note that the change in COT report data is week-over-week.

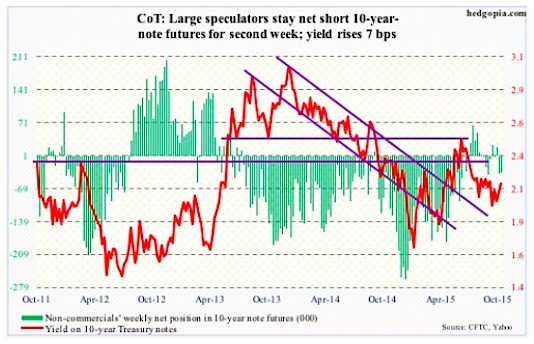

10-Year Treasury Note: Once again, the Fed took a pass. Its decision this week not to raise interest rates was expected. What was not expected was markets’ spur-of-the-moment reaction to the FOMC statement.

Post-statement on Wednesday, the front end of the curve sold off hard, with the two-year yield rising eight basis points to 0.72 percent (closed the week at 0.75 percent)! The 10-year treasury yield rose, too, up six basis points to 2.09 percent on Wednesday.What changed?

“In determining whether it will be appropriate to raise the target range at its next meeting, the Committee will assess progress—both realized and expected—toward its objectives of maximum employment and 2 percent inflation.”

The sentence above was from the October FOMC statement and was interpreted as the Federal Reserve leaving the door open for a December rate hike. To be fair, global risks were mentioned in the statement, but not with the same level of concern as was the case at the September meeting.

But it also said economic growth is moderate, with a slowed pace of hiring. And of course, consumer inflation is below the Fed’s target of two percent. Is it any surprise that markets are not fully buying a ‘hike in December’ scenario?

In the futures market, traders boosted chances of a rate hike in December from 35 percent pre-FOMC statement to 50 percent after the release. It is a coin toss essentially – not a done deal, not according to these traders.

With that said, it is possible the Federal Reserve has really boxed itself in. Unless economic data deteriorate significantly in the next six weeks, it will now need a really good excuse not to move. If it indeed moves – not a base case on this blog – the key thing to watch is how the long end of the curve reacts.

COT Report data: Currently net short 35.7k, down 2.2k.

30-Year Treasury Bond: Next week’s major economic releases are as follows.

On Monday, we get the ISM manufacturing index for October. In September, it slid to 50.2 – the lowest since 50 in May 2013. The new orders index was 50.1 – on the verge of contraction and matching the December 2012 reading. This will be followed on Thursday by the non-manufacturing index, which is faring much better. The PMI was 56.9 in September – a three-month low – and orders 56.7 – matching the low of February 2015.

September’s non-durable goods data, plus revised data for durable goods, will be reported on Tuesday. The latter was reported this week, and was weak. Orders for non-defense capital goods ex-aircraft – a proxy for business capex – have contracted annually for eight consecutive months.

Preliminary productivity numbers for the third quarter will be reported on Thursday. Recent trends have been very disappointing. The last time non-farm output per hour grew year-over-year with a two handle was back in 3Q10.

Friday comes out the all-important employment report for October. Non-farm jobs momentum is on the wane. August and September saw sub-150,000 new jobs. Year-to-September, it has averaged 198,000, versus 260,000 in 2014. Wages are stuck in the mud, with annual growth in average hourly earnings of private-sector employees in the two-percent range throughout this recovery.

Eight FOMC members are scheduled to speak on weekdays. Let us get ready for conflicting messages!

COT Report data: Currently net short 20.2k, up 17k.

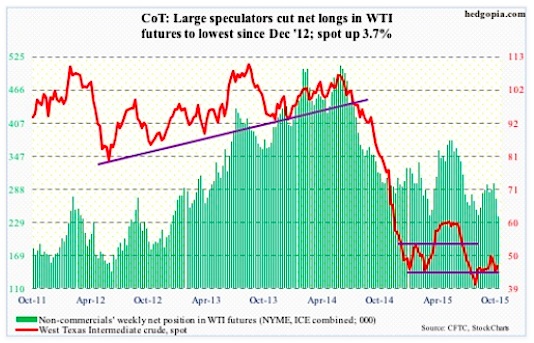

Crude Oil: Once again, the $43 support on spot West Texas Intermediate crude oil was tested and saved. The action on Wednesday in particular was interesting as crude oil prices completely ignored the 0.9-percent rally in the US dollar index, surging 6.4 percent. The weekly EIA report was the catalyst.

For the week ended October 23rd, U.S. crude oil inventory rose by 3.4 million barrels, to 480 million barrels – the highest since the May 15th week. This was a fifth straight weekly increase. Days of supply came in at 31.1. As well, Production rose by 16,000 million barrels per day, to 9.11 mb/d. Production peaked at 9.61 mb/d in the June 5th week.

Other data were positive – relatively.

First off, gasoline stocks fell by 1.1 million barrels, to 218.6 million barrels – a six-week low. Days of supply was 23.9… Distillate stocks (diesel, heating oil, etc.) fell by three million barrels, to 142.1 million barrels – a three-month low. Days of supply was 35.8… Refinery utilization rose for the second week running, to 87.6 percent, up 1.2 percentage points week-over-week. Utilization peaked at 96.1 percent in the August 7th week… And last but not the least, crude oil imports fell to 7.03 million barrels – a four-month low – down 439,000 barrels from the prior week.

All in all, it was a good week for WTI crude oil prices, up 3.7 percent. With that said, it is still stuck between $43 and $47-$48.

For a longer-term perspective, BP is cutting costs (capex, and asset sales) as it is now planning for around $60/barrel for Brent crude oil until at least 2017.

Non-commercials seem to be giving up, cutting net longs to the lowest level since December 2012 per the recent COT report data.

COT Report data: Currently net long 239.7k, down 30.1k.

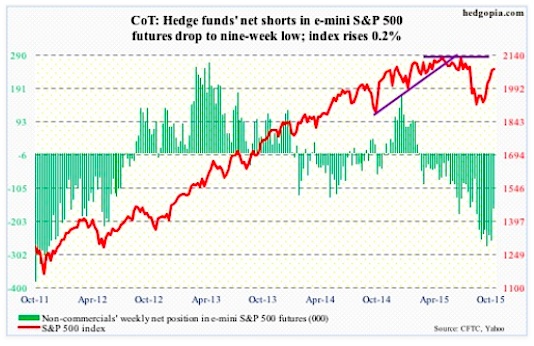

E-mini S&P 500: For the third straight week, U.S.-based equity funds have now seen inflows. In the week ended Wednesday, flows were $8.4 billion – the largest in six weeks (courtesy of Lipper). Although going back to the September 9th week, it is a wash – up a mere $761 million.

While the trend in recent weeks is good, the bigger question is, would it continue? Would fund managers, particularly those in need of making their year, begin to chase the rally?

As of Wednesday, money-market fund assets have gone up by $135 billion in the past six months, and by $42 billion since mid-August, to $2.72 trillion (courtesy of ICI). Having done a good job of squeezing the shorts, bulls are hoping – and positioned that way – at least some of this money begins to come back into stocks.

Then there is this. Since the September 29th low, the S&P 500 has rallied 11 percent. Which means plenty of buying power has been expended in such a short amount of time. Unless stock market inflows cooperate, with two months remaining in the year, the urge to lock in profit will have risen with each passing day.

Consider this. Per COT report data, non-commercials reduced net shorts by 36 percent. The S&P 500 essentially went sideways – up 0.2 percent for the week. Someone is taking advantage of the rally, and exiting.

Risk is elevated for stocks (i.e. the S&P 500).

COT Report data: Currently net short 166k, down 93.4k.

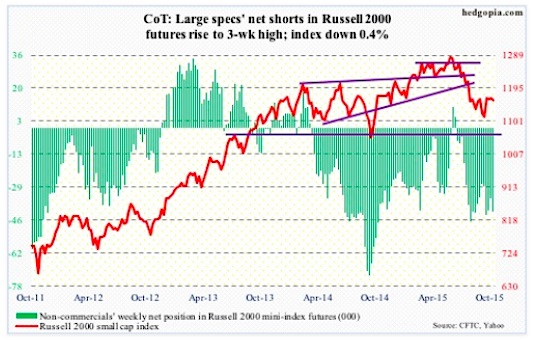

Russell 2000 mini-Index: By nature, small- and mid-cap companies tend to be domestically-focused, and they have been lagging large-caps. Big time! Since the September 29th low, the Russell 2000 small cap index is up seven-plus percent. Ditto with the S&P 400 mid cap index.

On Wednesday when most asset classes acted like a December hike was a done deal, the Russell 2000 jumped 2.9 percent, in the process breaking out of two-month resistance at 1170. Rather counterintuitively, the Wednesday action was telling us that higher rates were supposedly good for small cap stocks. Maybe not.

Come Thursday, the Russell 2000 was back below that technical support/resistance. A breakout quickly turned into a fake out. The 50 day moving average, which is no longer dropping, is 1.3 percent away. Let us see if buyers show up to defend that support in the coming days. It will be important to any rally in small cap stocks.

Incidentally, the daily Bollinger band is tightening. A break is coming, likely to the downside.

COT Report data: Currently net short 41.4k, up 6.9k.

Next up is Gold.

continue reading on the next page…