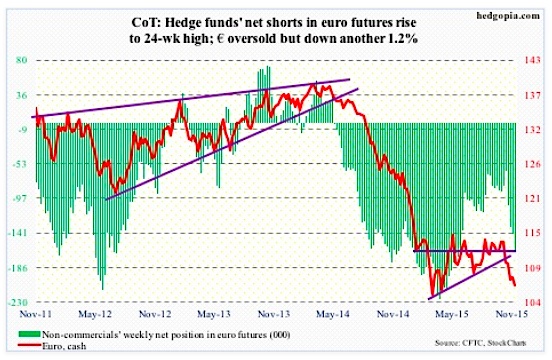

Euro: Increasingly it feels like the ECB is taking a cue from the Fed, with an assortment of bank officials offering conflicting opinion.

ECB chief economist Peter Praet on Tuesday said downside risks to the Euro-Zone economy may have increased due to the terrorist attack in Paris. Implication: More stimulus is needed.

A day later, Wolfgang Schaeuble, German finance minister, said “I would prefer higher interest rates than we have today”, at the same time recognizing that the ECB has to set monetary policy to fit 19 national economies.

Yesterday, Mario Draghi, ECB president, in a speech to a banking conference, had another opportunity to send a signal to the market, and he did not waste it, saying the bank is prepared to deploy its full range of stimulus measures to fight low inflation.

He has now increasingly painted himself into a corner, and will probably have to announce something at the December 3rd meeting.

Having dropped seven-plus percent in a little over a month, the euro is ready for it. Either way, the odds of a rally for the Euro are growing. If Mr. Draghi does not oblige, the euro surges. If he obliges, the odds of a ‘buy the news, sell the rumor’ have grown.

COT Report Data: Currently net short 164.2k, up 21.2k.

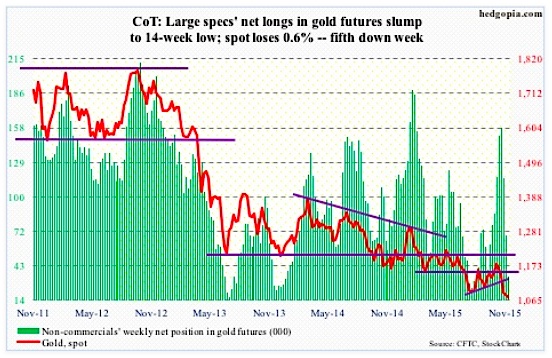

Gold: In a little over a month, spot gold prices gave back nearly 11 percent. That drop has brought the metal to testing the July (this year) low. As a matter of fact, that low was slightly undercut last week, before bouncing.

Having retraced 50 percent of the July 1999-September 2011 advance, Gold is currently sitting on an important technical level.

If gold prices can hang in around here for maybe one more week, odds favor the recent low holds – at least near-term. Maybe even medium-term. We will see.

Not surprisingly, this area is being fought very hard by both the bulls and bears. There were two back-to-back daily dojis.

COT Report Data: Currently net long 34.4k, down 34k.

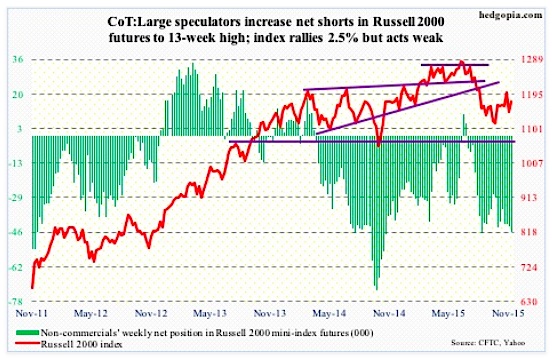

Russell 2000 mini-Index: The last time the small-cap index was above its 200-day moving average was on August 17th, right before the seven-day, 10-percent drop. Other major large-cap-dominated U.S. indices went on to recapture that average. But not the Russell 2000.

The good thing, from small-cap bulls’ perspective, is that the index took out the 1170 level this week – though ever so slightly. A bigger hurdle remains overhead – 1210-1215.

Bulls need to build on this week’s action – if nothing else not to let the 50-day moving average, which is just about flat, begin to turn lower.

Per the COT report, non-commercials continue not to buy the small-cap story.

COT Report Data: Currently net short 45.3k, up 2.4k.

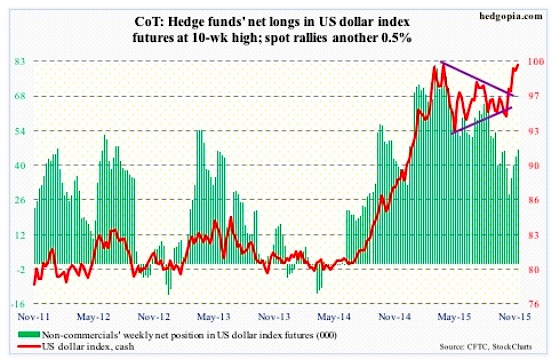

US Dollar Index: The US Dollar has been rallying incessantly since the middle of October, up 6.5 percent through Wednesday’s intra-day high – 1.1 percent from the March 2015 high. Going back to July last year, and the US Dollar Index has rallied nearly 26 percent.

Between the July 2001-April 2008 decline, the US dollar index dropped 41 percent. The subsequent rally to that March high brought it close to retracing nearly 61.8 percent of the decline. This is a Fibonacci number, and technicians pay close attention to it. This is as good a place as any for momentum to stop/pause.

At least near-term, some signs of fatigue are showing up.

Per the COT Report, non-commercials continue to add to net longs, but do not look as enthusiastic as they were when the dollar index was trading at a similar level back in March/April.

COT Report Data: Currently net long 46.5k, up 2.7k.

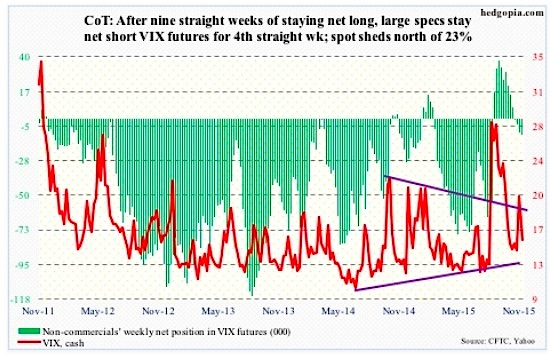

VIX Volatility Index: The spot VIX dropped 23 percent in the week, and has room to drop more, if equity bulls can capitalize on it.

Last week, the Volatility Index retook both its 50- and 200-day moving averages. This week, the VIX lost both.

COT Report Data: Currently net short 10k, up 1.4k.

Thanks for reading.

Twitter: @hedgopia

Read more from Paban on his blog.

No position in any of the mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.