From the very beginning, this recession was destined to be like no other. Coronavirus, lock-downs, gradual re-openings, partial shutdowns, etc…

For comparison, a normal recession usually goes something like this:

1) A certain industy or industries enjoy strong growth and success.

2) As capital flows to these industries, capacity expands.

3) Sooner or later, capacity or supply growth exceeds demand growth, or there is a shock to the high-growth industry.

4) The successful industries begin to correct and growth slows.

5) Initially isolated, the knock-on effect of slowing growth begins to spread to other industries.

6) This accelerates to drag down total economic growth and then you fall into a recession.

7) Contraction begins to burn off excess capacity and central banks/governments embark on providing stimulus.

This recession has not played out that way. There were no big excesses – instead an exogenous shock resulted in a rapid fall in demand which created overcapacity. Society stopped or slowed big swaths of the economy to combat a health crisis. Instead of waiting for the economic data to confirm a recession had begun, stimulus came fast and furious even before the data rolled over (everyone knew the bad data was coming).

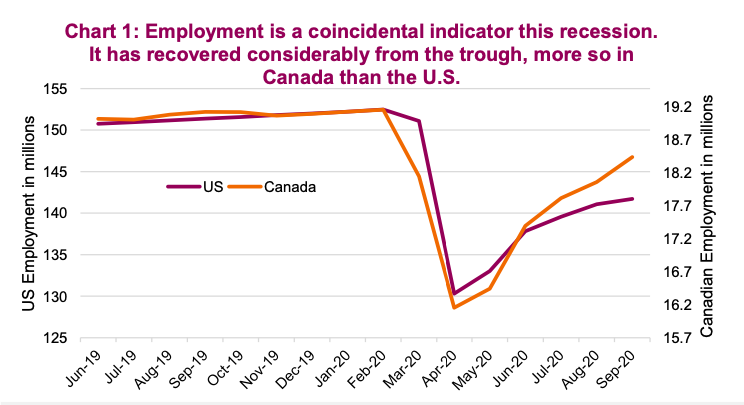

Typical recessions see employment slow in key industries such as housing, technology or manufacturing. Employment losses then spread to service industries. As a result, employment is usually a lagging indicator of the economy. This coronavirus recession hit services first, and given that is where more people work, this made employment trends more of a coincidental indicator.

The good news is that labour has staged a material recovery. After shedding 20 million jobs in America and 3 million jobs in Canada, the deficit relative to pre-pandemic levels is 10 million and 750,000, respectively. Canada has recovered more, likely thanks to the type of government policy responses. Without these policies, both employment lines in chart 1 would be materially lower and more people would be on direct government assistance instead of government assistance through their employer.

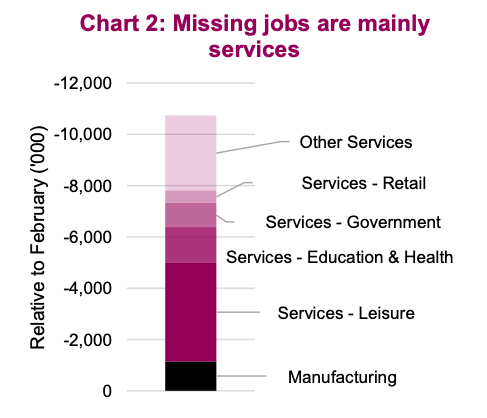

The good news ends there. For one, the employment gains in the U.S. have slowed. Some jobs came back quickly while many others will require the broader economy and certain industries to return to normal. And we are starting to see layoffs mount. Primarily this is focused in the leisure, travel, tourism and restaurant sectors, where the return of demand will require customers to feel safe again.

Spending patterns like no other

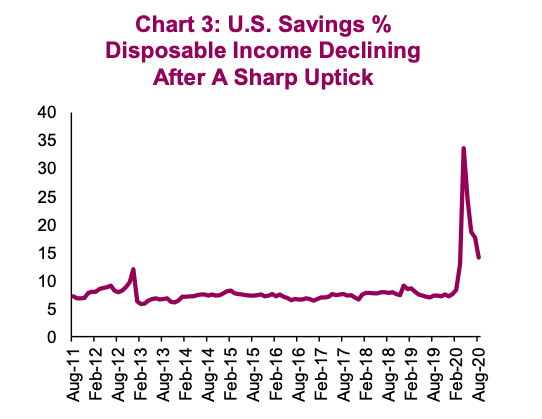

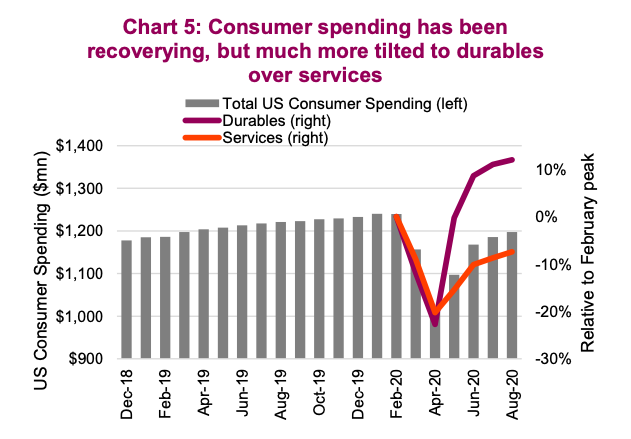

Another reason this recession is like no other is because of consumers spending response. We have become a service-based economy with 66% of total consumption spent on services. That changed significantly at the onset of the pandemic-related lockdowns. Many services were shut down and air travel was largely put on pause. Despite severe job losses, many were able to pivot to working from home and many also received government stimulus efforts in both Canada and the U.S.. With fewer services to spend money on, the savings rate in the U.S. skyrocketed to the highest level on record (Chart 3).

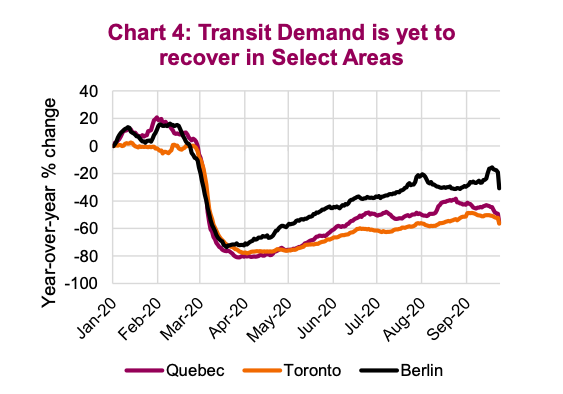

The cash in consumers’ pockets was burning a hole and led to a spending spree on durable goods such as cars, RVs, boats and houses. People moved away from using transit, which remains well below pre-pandemic levels (Chart 4), and bought cars to remain in isolation. There was no better way to isolate with your bubble than on a boat or taking an RV road trip. We have seen home sales remain strong and rally in recent months as pent up demand was building for people wanting to move out of city centers or into a bigger home. That trend is the opposite of what we would expect to see in a more normal recession as defined in the aforementioned 7-stage process. In the housing crisis and recession of 2008, we saw the consumer-spending mix pivot towards services and away from large-ticket durable items.

U.S. personal savings as a percentage of disposable income have been quickly normalizing but still remain about twice as high as the 10-year average. This unique recession has us opining on where those dollars go next. It is unlikely that we see a continuation in purchases of durable goods – most people don’t need a second RV or boat. If services are crimped by rolling lockdowns – as were just announced last week in Ontario – and have been seen in other parts of the continent as well, we won’t see spending going there. So that leaves non-durable goods or savings remaining elevated. Higher-than-normal savings are a headwind for economic growth because this slows the velocity of money. The government isn’t giving away free money for it to sit in a savings or brokerage account. It is to be spent and stimulate the economy.

Investment implications

Clearly those that can spend are spending, on durables and not services given that services spending often requires more interaction with people. The problem is that while a large portion of the economy is doing OK, a big portion is not, leading to what is being deemed a K-shaped recovery. For now, government stimulus is attempting to hold up the lower part of the “K” until a vaccine is developed, or people feel safe to become more “economically” active again. The longer this persists, the greater the risk that the lower part of the “K” drags down the upper part. If this occurs, the pandemic was just the exogenous shock that pushes us into a more traditional recession.

This is not our expectation, but the chance is high enough for us to

remain with a slight defensive tilt. On a positive note, this may very well end up being a rather short recession. The pain is still mainly in services and has not spread too much. Once a vaccine does become available, along with rapid testing to make us feel safe again, there is SO MUCH pent-up demand for doing things, going places and experiencing life – that will be the real recovery.

The build-up of savings could act as demand for some of the hardest hit, like travel, leisure and hospitality companies. It is also unlikely that the durable goods “winners” as of late will be able to repeat the success they saw in 2020. With the amount of money and effort being put behind vaccine research and development, our base case is that a vaccine is eventually available, accelerating the timing of herd immunity. The exact timing is still impossible to foresee but when there is clarity, we will likely see the winners and losers of the K-shaped recovery switch places.

Twitter: @ConnectedWealth

Any opinions expressed herein are solely those of the authors, and do not in any way represent the views or opinions of any other person or entity.