The price of gold, and gold-related equities, have enjoyed a very strong run over the past few quarters.

This is almost a perfect environment for gold, benefiting from real yields, a falling U.S. dollar and demand for safe-haven assets.

Of course, the question remains after a +30 rise in bullion prices and +53% in gold stocks so far in 2020, where to next?

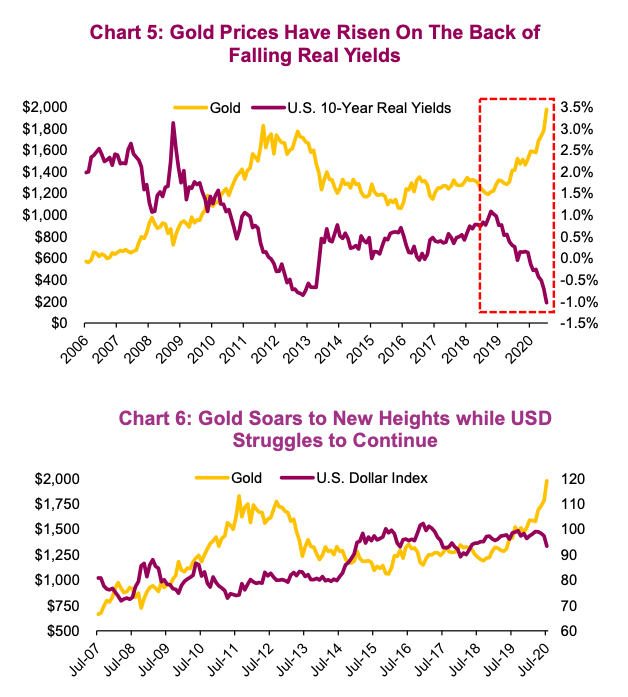

Real yields, that is nominal bond yields less consumer prices (CPI or inflation), have a strong negative correlation with gold prices.

With real yields in the U.S. now at -1%, gold has broken through its previous 2011 high set when real yields were at similar levels. (Chart 5).

There is also a common feeling that the Federal Reserve will allow inflation to run above its 2% target to justify ultra- accommodative monetary policy. As this will continue to suppress nominal yields, and should we see a rise in inflation as the recovery takes hold, real yields could fall even further.

When yields do rise, we would expect to see gold head lower. Gold works like an inflation-adjusted risk-free asset; when real yields are low or negative and risk-free bonds are yielding less than inflation, gold is priced higher (and the opposite is true). However, this is not our near-term expectation at this point.

Gold has also been benefiting from structural flows. Even today, among Canadian funds & ETFs, the Materials sector which is about 50% comprised of gold companies, remains one of the biggest underweight in portfolios. This may be changing as demand for safe-haven assets continues to rise.

Another reason to own some gold or gold stocks is the U.S. dollar. There is a strong long-term inverse correlation between the U.S. dollar and gold prices.

The U.S. dollar continues to be under pressure due to the Trump administration’s (mis)handling of the pandemic, election risk and narrowing interest rate differentials. Gold provides a good hedge for investors against a falling U.S. dollar.

Momentum is certainly working against the dollar currently. We would likely need to see a reversal in equity markets and sentiment to buck that trend. However, that is exactly why adding to your USD positions across asset classes is a prudent portfolio protection strategy given where the dollar is trading.

Holding gold should also help mitigate portfolio volatility. However, if you had a healthy weight coming into the crisis, you would have a large position now. Given how aggressive the move has been higher it could be time to book some gains and trim your positions.

This article was written by Chris Kerlow.

Source: All charts are sourced to Bloomberg L.P. and Richardson GMP unless otherwise stated.

Twitter: @ConnectedWealth

Any opinions expressed herein are solely those of the authors, and do not in any way represent the views or opinions of any other person or entity.