Spartan Energy Acquisition (SPAQ) announced its acquisition of Fisker, another California-based electric vehicle (EV) manufacturer.

The deal values Fisker at $2.9B.

Spartan Energy Acquisition is a special purposes acquisition company controlled by Apollo Global Management (APO).

This year has been very bullish for EV stocks.And the largest player in this group is Tesla, Inc NASDAQ: TSLA.

Tesla’s stock price is up around 297% on the year and has a market cap of over $327B. On Friday, Reuters published an article comparing Tesla’s (TSLA) meteoric rise to that of Yahoo before its inclusion in the S&P 500 in 1999.

From the date of the announcement in November 1999 to its inclusion just 5 days later, Yahoo jumped 64%.

As of July 13th at 11 AM ET, Tesla is up 81% in just 10 trading sessions. In order to the considered for inclusion in the S&P 500, Tesla needs to produce 4 consecutive quarters of positive earnings according to GAAP (Generally Accepted Accounting Principles).

Tesla has the opportunity to achieve this objective when it reports Q2 earnings on 7/22/20. We believe that the market is already pricing in a potential inclusion in the S&P 500. Let’s review our weekly cycle analysis.

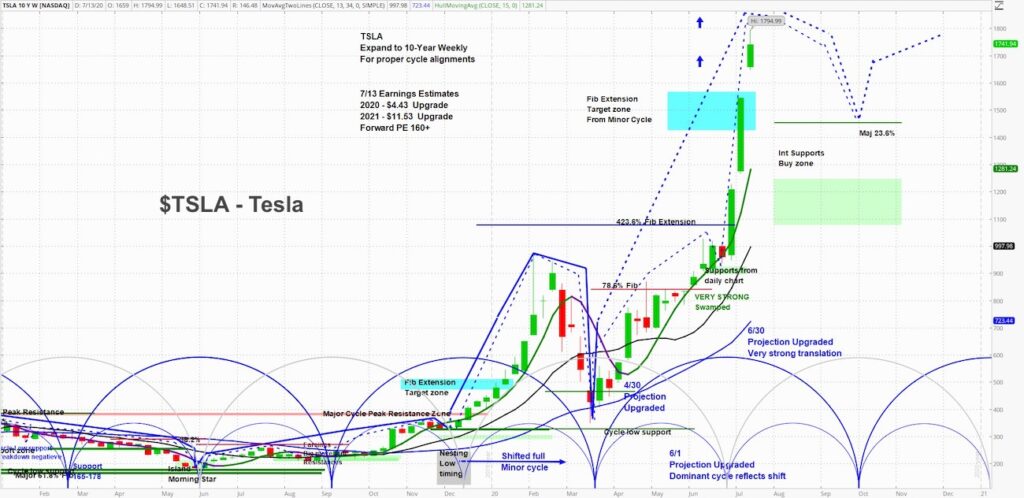

Tesla (TSLA) Weekly Chart

At askSlim we use technical analysis to evaluate price charts of stocks, futures, and ETF’s. We use a combination of cycle, trend and momentum chart studies, on multiple timeframes, to present a “sum of the evidence” directional outlook in time and price.

askSlim Technical Briefing:

The weekly cycle analysis suggests that Tesla is about mid-way through a rising phase. The next intermediate-term low is due between the end of September and early October. Weekly momentum is positive.

On the upside, there are no visible resistance points with the stock at an all-time high. On the downside, Tesla has rising intermediate-term support at 1454 followed by another zone of support from 1243 – 1073.

askSlim Sum of the Evidence:

Tesla is in a rising phase in a very overbought condition. We believe that the market is pricing in a potential inclusion in the S&P 500 and the odds favor a test of the rising intermediate-term supports beginning at 1454 by the end of September.

Interested in askSlim?

Get professional grade technical analysis, trader education and trade planning tools at askSlim.com. Write to matt@askslim.com and mention See It Market in your email for special askSlim membership trial offers!

Twitter: @askslim

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.