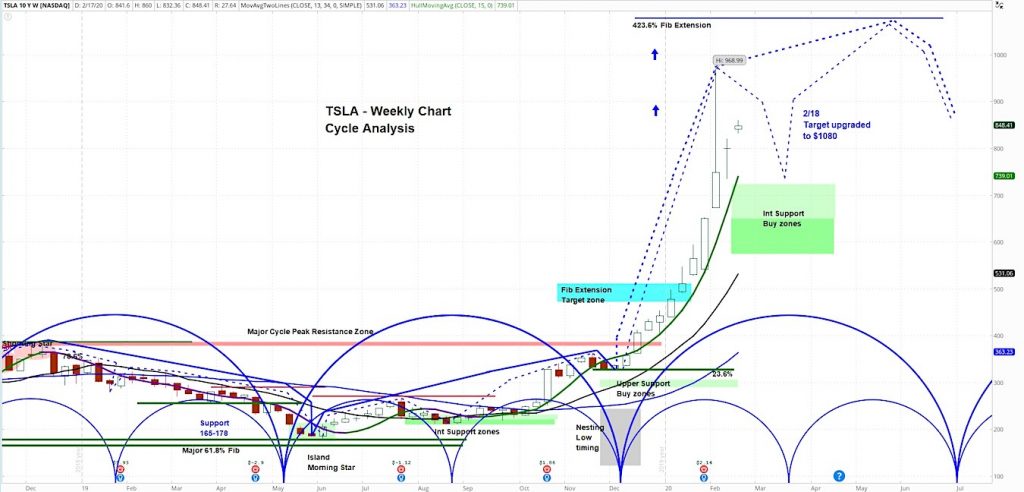

Tesla (TSLA) Weekly Stock Chart

A series of analysts raised their price targets on Tesla (TSLA) this morning.

Investors cheered the news and bought the stock, despite several analysts maintaining bearish stance / price targets.

Bernstein raised their price target from $325 to $730 and maintained a market-perform rating on the Tesla stock price.

Morgan Stanley raised their price target from $360 to $500 and maintained an underweight rating.

Lastly, Cowen & Co raised their price target from $280 to $290 and maintained an underperform rating.

Let’s see what the charts suggest.

At askSlim.com we use technical analysis to evaluate price charts of stocks, futures, and ETF’s. We use a combination of cycle, trend and momentum chart studies, on multiple timeframes, to present a “sum of the evidence” directional outlook in time and price.

askSlim Technical Briefing:

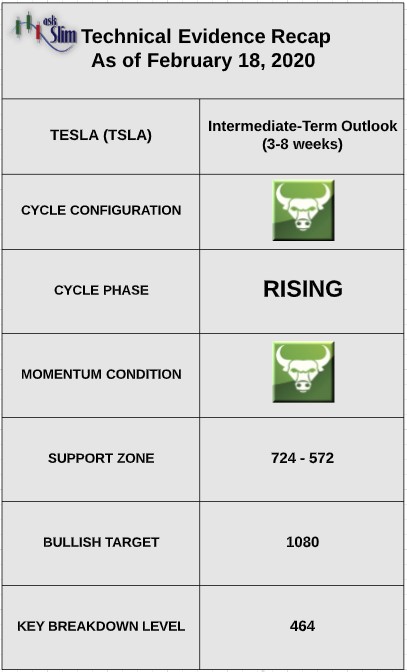

The weekly cycle analysis suggests that TSLA is in a very positive intermediate-term pattern. Weekly momentum is firmly positive.

On the upside, there is a Fibonacci extension level at 1080. On the downside, there is an intermediate-term support zone from 724 – 572. For the bears to regain control of the intermediate-term, we would likely need to see a weekly close below 464.

askSlim Sum of the Evidence:

TSLA is in a very positive intermediate-term cycle pattern with positive momentum. Given these conditions, we would expect short-term sell-offs to be limited to the intermediate Fibonacci support zone beginning at 724. There is a likelihood the stock tests 1080 by June.

Interested in askSlim?

Get professional grade technical analysis, trader education and trade planning tools at askSlim.com. Write to matt@askslim.com and mention See It Market in your email for special askSlim membership trial offers!

Twitter: @askslim

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.