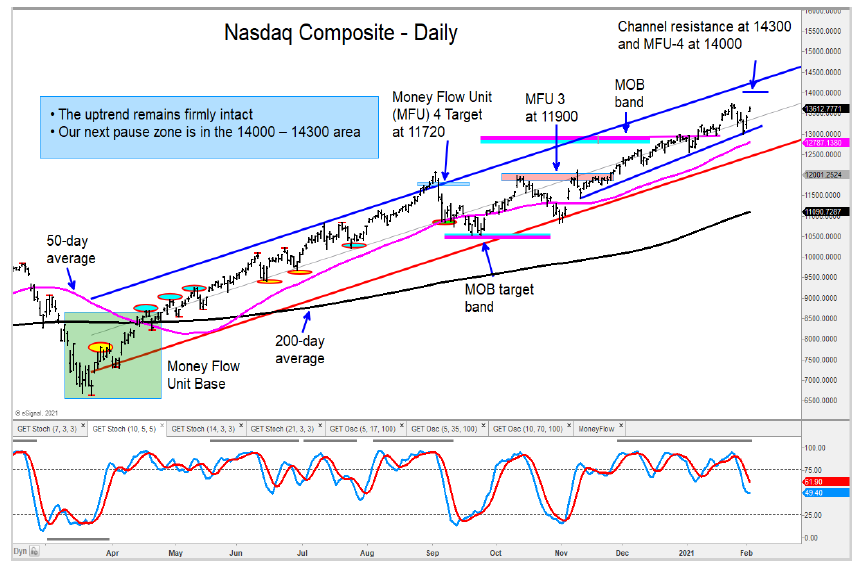

The uptrends in the major U.S. stock market indices remain firmly intact.

The recent pullback in the S&P 500 Index and Nasdaq Composite held at an important price support zone, and I see the start of another leg higher for these stock market indices.

We continue to favor the Russell 2000 (RUT) and Mid-Cap (MDY) as the long-term charts look very bullish.

The Dow Transports (DJT) need a bit more strength from here to clear a near-term resistance area. Another laggard, the Utilities, have been range bound and are an area to avoid for now.

I liked the action on the recent pullback in the Semiconductors ETF (SMH), and expect more upside.

The author has a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.