Technology stocks have been the engine behind the stock market rally into 2024. Even better stated, tech stocks have been a market leader since 2009.

So it’s important to keep an eye on the performance of market leadership. And lately the tech-based Nasdaq indices have been slowing down.

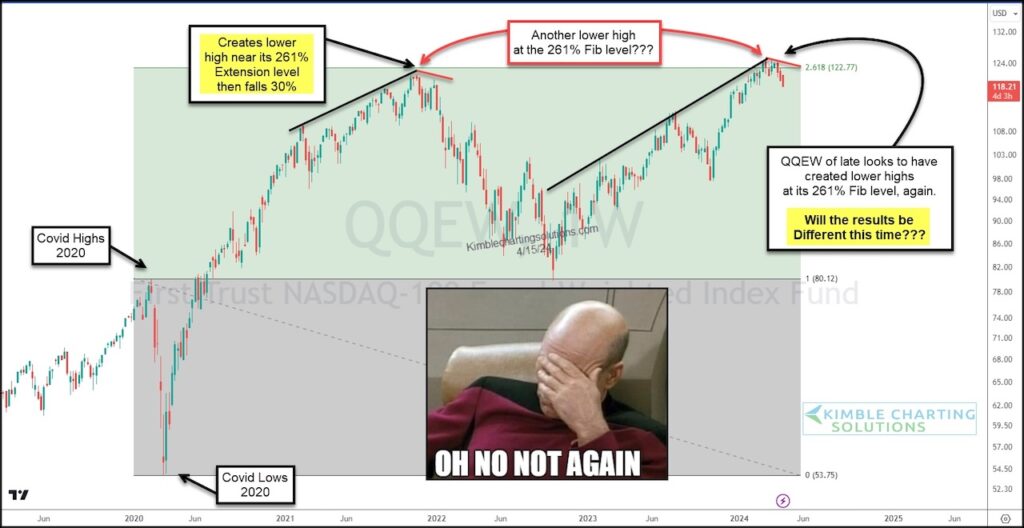

Today, we highlight this with one of my favorite ways to interpret market strength: equal weight indices & ETFs. The chart below is the Nasdaq 100 Equal Weight ETF (QQEW) on a “weekly” basis.

As you can see, price has stalled out yet again at the 261% Fibonacci extension level. And in a very similar way.

How long with this double top Fibonacci resistance hold for? Will it be long enough to send QQEW much lower? Or will it be different this time?

Keep an eye on this level. And stay tuned!

$QQEW Nasdaq 100 Equal Weight ETF “weekly” Price Chart

Note that KimbleCharting is offering a 2 week Free trial to See It Market readers. Just send me an email to services@kimblechartingsolutions.com for details to get set up.

Twitter: @KimbleCharting

The author may have a position in mentioned securities. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.