The major stock market indices started the day lower as traders showed some jitters heading into the start of the two day Federal Reserve meeting. Note that the meeting ends tomorrow and the markets will get the FOMC statement at 2pm EST, followed by the Fed presser.

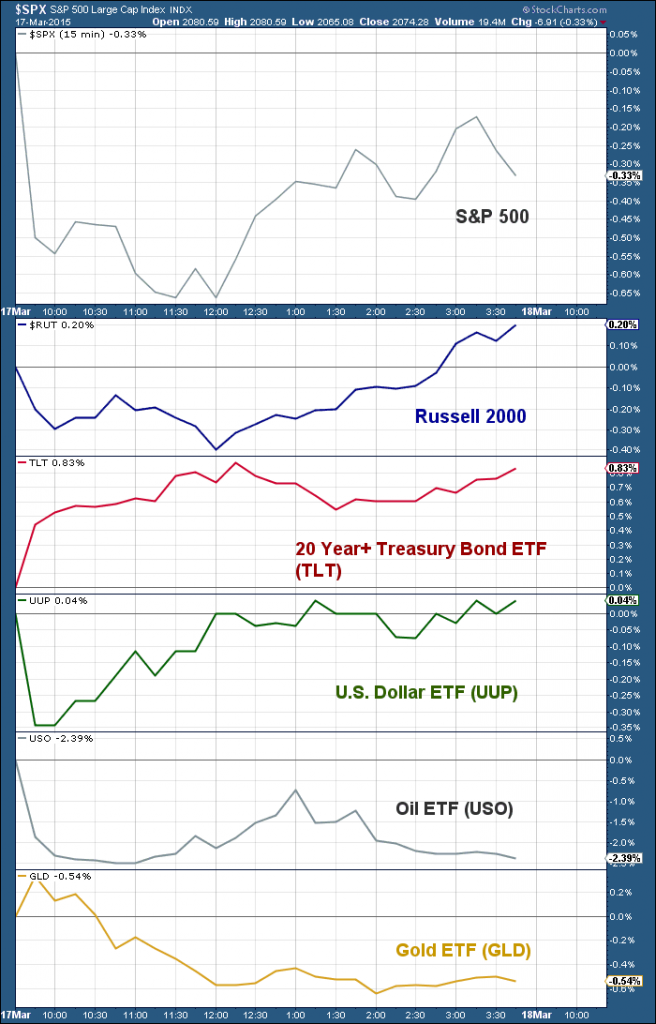

Back to the market action… stocks managed bounce higher after the early stumble, recovering much of the days losses by the closing bell. The S&P 500 was down 0.33% on the day, while the Nasdaq was up 0.16%. The tech sector was helped by a 2.07% rise in Apple (AAPL). And beta was given a lift with the Russell 2000 posting a gain of 0.20% – the major small cap stocks index closed within an eye lash of its all time highs.

Other intermarket indicators flashed mixed signals as investors put things on hold for the fed. Bonds closed the day largely higher as yields fell. The US Dollar dropped early in the day but recovered to close near par. And Crude Oil and Gold fell on the dollar’s recovery. Note that Gold and Crude Oil are pressing up against 52 week lows.

So while traders were doing some light shuffling throughout the first two days of the week, the tone under the surface was definitely mixed with bonds higher, commodities lower, and the dollar remaining firm.

Below is a financial market recap of the intraday performance, using popular ETFs for bonds, oil, gold, and the dollar.

For more weekly insights, be sure to sign up for our free “Market Navigator” newsletter.

Follow Andy on Twitter: @andrewnyquist

Author has net long exposure to US equity indices via ETFs at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.