Large cap tech stocks and the tech sector as a whole are receiving a boost from big earnings reports last night and the morning.

Earnings reports from Amazon (NASDAQ:AMZN), Microsoft (NASDAQ;MSFT), Google (NASDAQ:GOOGL), First Solar (NASDAQ:FSLR) and more have boosted the Nasdaq this morning. One notable dud this morning is Baidu (NASDAQ:BIDU)…

All-time highs on the way for the Nasdaq on Friday, October 27.

AMZN, MSFT, GOOGL, and FSLR are gapping higher today. Below I take a look at each of these charts, along with BIDU (all pre-market charts, with an arrow approximating the gap at the time of this writing). For each stock name there is a brief analysis & update post-earnings.

Amazon (AMZN) – Post-earnings analysis

Amazon’s stock price is set to gap higher to new all-time highs, but it is quite stretched here short-term.

Google (GOOGL) – Post-earnings analysis

Google’s stock price is also set to make new all-time highs, but similar to much of the tech landscape, it is quite stretched.

First Solar (FSLR) – Post-earnings analysis

FSLR is gapping above prior highs. This is a good sign technically, and despite nearly 2 years of range-bound trading, this week’s price movement bodes well for further gains.

My Intermediate-Term targets run all the way up into the low 70’s.

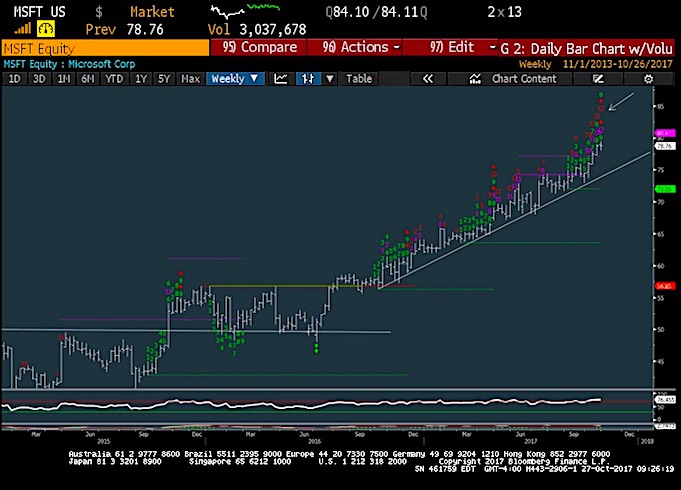

Microsoft (MSFT) – Post-earnings analysis

Microsoft’s stock price had already run up into earnings, and is now gapping higher yet. This name is prone to a trading reversal, in my opinion, and now is a good spot to book some gains.

Baidu (BAIDU) – Post-earnings analysis

Baidu is gapping lower. This pullback is occurring from very stretched conditions It should provide a good buying opportunity at lower levels near 217-224. Still early here.

The broader market is stretched here so factor that in as well. Have a great weekend.

If you are an institutional investor and have an interest in seeing timely intra-day market updates on my private twitter feed, please follow @NewtonAdvisors. Also, feel free to send me an email at info@newtonadvisor.com regarding how my Technical work can add alpha to your portfolio management process.

Twitter: @MarkNewtonCMT

Author has positions in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.