Target (TGT) traded 5% higher on Wednesday morning, after posting earnings that beat analyst estimates.

The company reported earnings per share of $1.47 and total revenue of $17.5 billion, above Wall Street expectations of $1.40 and $17.2 billion. Comparable store stores grew at a rate of 6.5% compared to a year earlier, far above the average analyst estimate of 4.1%. This was Target’s fastest rate of growth since 2005.

Regarding the near-term, CEO Brian Cornell explained, “We’re on track to deliver a strong back half and we’ve updated our full year guidance to reflect the strength of our business and the consumer economy.” Their new full year guidance is $5.30-5.50, above the consensus of $5.28.

The S&P Retail Index (XRT) rose by 1% to 52.95, which marked a new all time high.

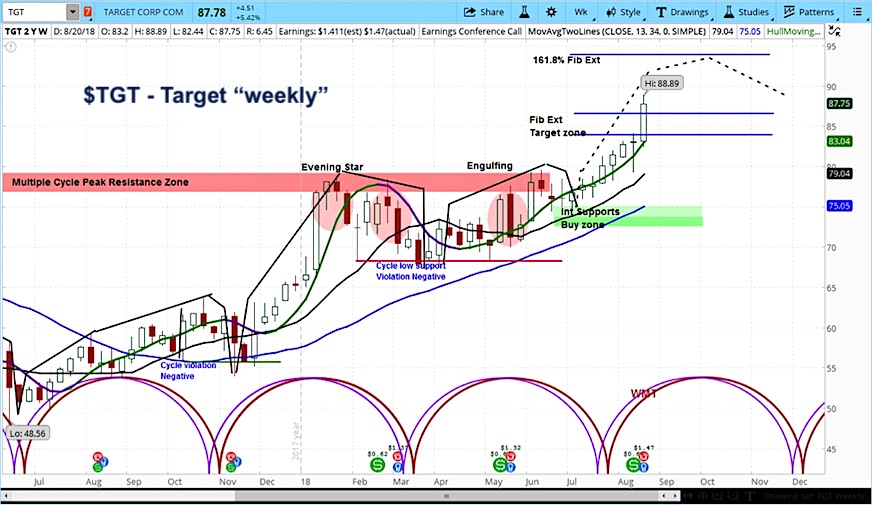

In analyzing the market cycles of TGT we can see that it continues to trade in the rising phase of its current market cycle.

As the stock surged through our target zone, this is a positive cycle pattern. Our new projection, around $94, is marked by the 161% Fibonacci extension.

Target (TGT) Stock Chart with Weekly Bars

For more from Slim, or to learn about cycle analysis, check out the askSlim Market Week show every Friday on our YouTube channel.

Twitter: @askslim

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.