Tag: stock market analysis

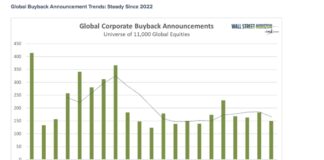

Record Q4 Stock Buybacks Give Way To Softer Trends Into 2025

Last year was a record for S&P 500 Index (INDEXSP:.INX) stock buybacks, led by the now “Lag 7” companies, though the SPX buyback yield...

Transportation ETF (IYT) Underperforming Major Stock Indices

On Monday, we looked at and analyzed the Retail Sector (XRT) in detail.

And we determined that Monday’s action is still within the range of...

Stock Market Update: What’s Next For Retail Sector (XRT)?

This is a big week for data concerning the consumer.

PCE inflation price data is coming out Friday. Tariffs remain a political football. And the...

Are Stocks Bottoming? Investor Sentiment vs Investing Reality

The S&P 500 Index (INDEXSP:.INX) and financial markets are trying to climb a wall of worry this week. While sentiment indicators flash red, real-time...

Mergers & Acquisition Deals Chill On Economic Headwinds

Corporate dealmaking continues to struggle in 2025, with Q1 M&A announcements currently set to come in at their lowest level since the COVID-19 pandemic

Stubbornly...

Post FOMC: A Look at 2 Commodity ETFs

I cannot remind you all enough of how important it is to check the Inflation Trifecta before getting too attached to inflation, stagflation or...

S&P 500 Index: Key Price Reversal Levels To Watch

The S&P 500 Index (INDEXSP: .INX) has experienced an uptick in volatility over the past few months.

In December, the S&P 500 hit our MFU-4...

Intel Stock (INTC) Traders Have Not Missed the Boat

This is technically, turnaround Tuesday.

And yet, I struggled to find something that is truly turning around.

Plus, I found it difficult to decide on whether...

Cracks In The Consumer? Watch Lululemon and Disney Shareholder Meetings

Amid uncertain tariff policy, American consumers are in limbo after a strong Q4 spending performance

Earnings from Lululemon (NASDAQ: LULU) and Disney’s (NYSE: DIS) annual...

S&P 500 (SPY): Two Important Price Levels To Watch

The past month has been a rough one for investors, watching the S&P 500 drop just over 10 percent to qualify as a "correction".

Will...