Tag: options trading

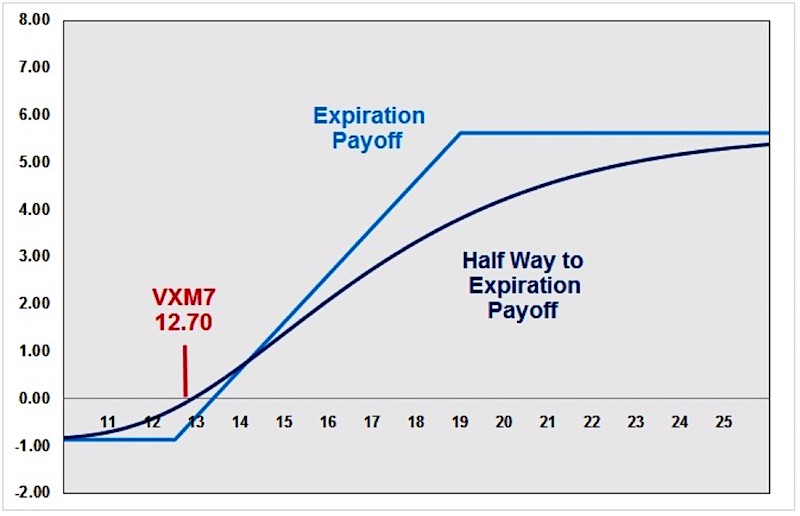

Volatility Traders Betting On Higher VIX Via Call Spreads

Traders are always asking me how to trade volatility.

Short volatility has certainly been the way to go this year with VIX Short-Term Futures (NYSEARCA:VXX)...

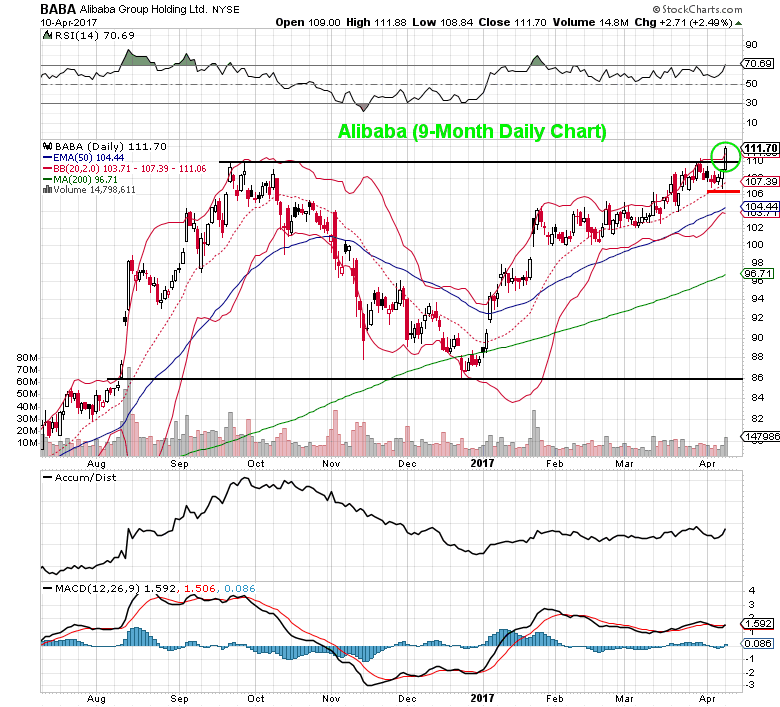

Alibaba (BABA) Shares Look Poised To Hit New All Time High

Alibaba Group (NASDAQ:BABA) had a successful start after going public in late 2014, pricing at $68 per share and quickly soaring to $120 by...

Options Traders Position For Energy Recovery With Risk Reversals

Energy has been one of the worst performing sectors in Q1 of 2017. The Oil & Gas Exploration ETF (NYSEARCA:XOP) is down 10% and...

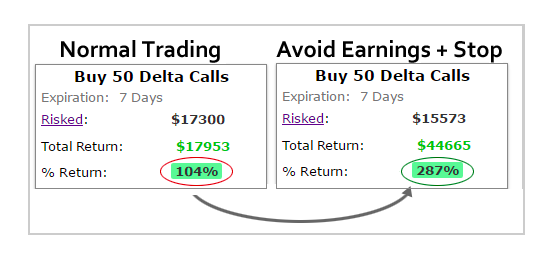

Tesla Stock Options Case Study (TSLA): Finding A Winning Strategy

Tesla Inc (NASDAQ:TSLA) Inc has been on a historic run of late much to the dismay of the doubters on Wall Street.

And there is...

Lumentum Stock (LITE): Playing The Pullback With Options

Michael Lamothe from Chart Your Trade recently posted a chart that caught my eye. The stock is Lumentum Holdings (NASDAQ:LITE) and to be honest,...

Euro Stoxx 50: Options Traders Position For Post-Election Strength

The SPDR Euro Stoxx 50 ETF (NYSEARCA:FEZ) trades on average 9,427 options per day with 5,356 calls and 4,071 puts, but recently has seen...

Options Strategists Position For Biotech “Company Specific” Events

One of the better uses of options trading is for event-driven strategies due to the ability to define your risk and the flexibility of...

Russell 2000 (IWM) Options: Using Long Strangles For Range Expansion

In the markets, periods of consolidation are generally followed by periods of contraction.

The Russell 2000 ETF (NYSEARCA:IWM) has been trading sideways for 2 months...

Verizon (VZ) Stock Options Strategy For Cautious Investors

Verizon has taken a beating lately having dropped from $54.80 down to $48.40, a decline of 11.7%. Verizon has long been a favorite for...

Options Trading: Using Covered Calls To Increase Yield

When starting out with options, a natural place to begin is with covered calls. It’s a very easy to understand strategy for those that...