Tag: crude oil

S&P 500 Futures Trading Outlook: Pullback Price Supports

Broad Stock Market Futures Outlook for April 6, 2018

Yesterday's big bounce poked above our second target at 2667.50. That move marked a short-term high as...

S&P 500 Futures Update: Higher Low and Away We Go

Broad Stock Market Outlook for April 5, 2018

For those of us who like to watch intraday bottoms form, it is important to look for ONE...

S&P 500 Futures Update: Trapped Buyers

Broad Stock Market Outlook for April 4, 2018

As mentioned yesterday, in these selling territories, bounces are usually relief spots for only a time and send us...

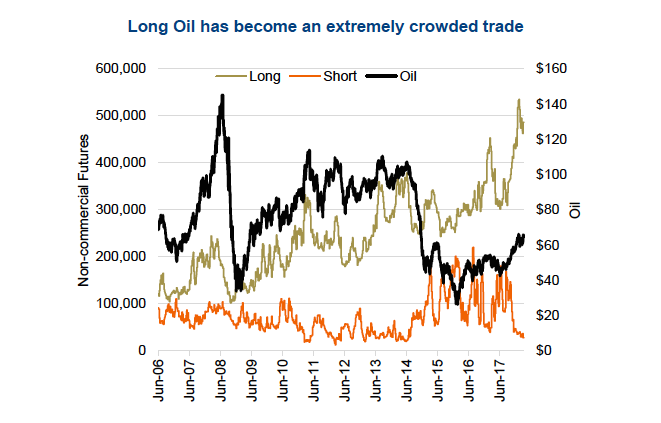

Energy Sector Update: Stocks Disconnect From Oil Prices

A barrel of oil, West Texas Intermediate, currently fetches $65 per barrel, that is a fairly decent price looking back over the past three...

S&P 500 Futures Update: Stocks Rally… Into Overhead Supply

Broad Stock Market Outlook for April 3, 2018

Deep dips hold us in sellers territory. Bounces are afoot but weak and likely to find trapped buyers...

S&P 500 Futures Outlook: 2600 Support Looms Once Again

Broad Stock Market Futures Outlook for April 2, 2018

For the fifth day, we sit in a range of motion and though the range is a...

S&P 500 Trading Update: Bulls Need To Defend 2600

Broad Stock Market Outlook for March 29, 2018

A short-term bottom might be forming as we attempt to stabilize around 2600 in the S&P 500 e-minis.

The Nasdaq...

S&P 500 Futures Trading Outlook: Weekly Support At 2600

Broad Stock Market Futures Outlook for March 28, 2018

As mentioned yesterday, holding higher support lost would color the day and we did drift lower -...

S&P 500 Trading Outlook: Can Bulls Create “New” Support?

Broad Stock Market Trading Overview for March 27, 2018

Buyers took advantage of the retest of higher support yesterday (intraday) and traders are continuing their buying into...

S&P 500 Trading Update: Trapped Buyers Limit Rally

Broad Stock Market Outlook for March 26, 2018

Intraday motion faded sharply on Friday and the dips presented value buyers overnight opportunities to pick bottoms. Formations like this suggest...