The primary reason for the latest bout of dollar strength is the Fed’s increasingly hawkish talk and markets putting increasing odds that the Fed would hike in the December meeting.

With the relentless rally, the us dollar index is now in overbought territory – not only on a daily chart but also weekly. In the right circumstances, this is a good spot to retreat and unwind those conditions.

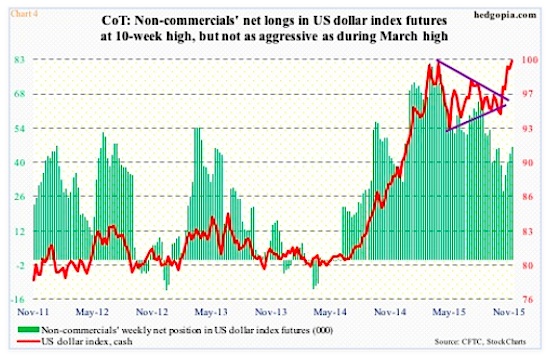

This is probably the reason why non-commercials have not gotten as aggressive as they were back in March, although the price is at a comparable level. Back then, they were net long 81,270 contracts in US dollar index futures. As of Tuesday last week, even after four consecutive weekly increases, net longs have only totaled 46,527 contracts (see chart 4 below).

So how long with U.S. exports have to deal with a strong dollar as a tailwind?

To reiterate, the us dollar index sits at a crucial level technically, is overbought, and has priced in a hike in fed funds.

Markets currently do not expect an aggressive tightening cycle, and they are probably right. The only reason the Fed might get aggressive is if it is (1) trying to fill its monetary quiver with arrows, no matter what, and (2) forced by a pickup in inflation.

Barring that, the odds of the us dollar index retreating soon are decent. And that should be music to the ears of multinationals from the currency standpoint. Although a lack of end-demand should continue to be a limiting factor.

Thanks for reading!

Twitter: @hedgopia

Read more from Paban on his blog.

No position in any of the mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.