Turns out short interest was indeed a tailwind for stocks in the two weeks ended October 15th. Earlier this month, I speculated that short interest could be a deciding factor over the near-term.

Although that has likely played a role during the recent stock market rally, we have seen some changing dynamics in short interest.

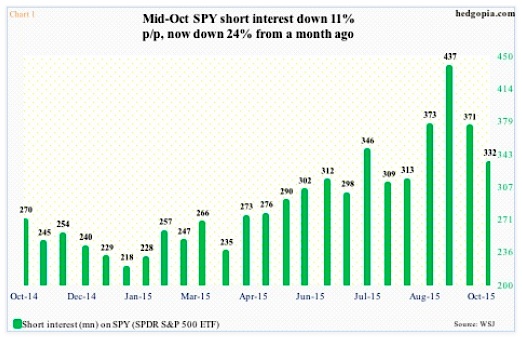

On the SPDR S&P 500 ETF (SPY) short interest declined 10.6 percent, to 332.1 million (see chart 1 below). The S&P 500 ETF rallied 5.6 percent during the period. It is possible more shorts gave up since then, as the SPY rallied another 2.8 percent.

As well, stops probably got taken out as the S&P 500 bulled its way through resistance levels at $204 and the 200-day moving average.

S&P 500 ETF (SPY) – Short Interest Chart

If we go back one more period, to mid-September, SPY is up 2.5 percent. During that time, short interest fell 24 percent. It almost feels like equity bulls were not able to fully take advantage of the drop in short interest. Perhaps the short squeeze is exhausted near-term.

The only way to explain this is that longs took advantage of the rally and exited even as shorts were being squeezed. Equity flows seem to indicate this as the likely scenario.

Stocks – most of them, anyway – bottomed on August 24th. Since the week ended September 9th, on a cumulative basis $7.6 billion has left U.S.-based equity funds (courtesy of Lipper).

This behavior is also evident elsewhere.

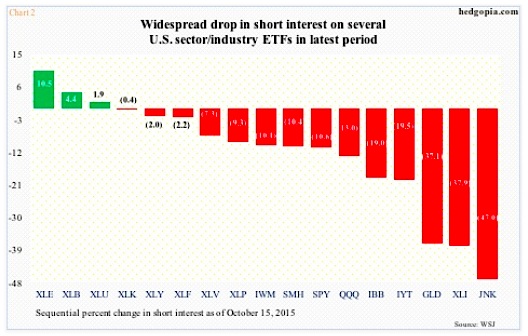

Between the October 2nd intra-day low of $35.10 and high of $36.28 on October 15th, the SPDR High Yield Bond ETF (JNK) rallied 3.4 percent. On the surface, it might look like traders were gravitating toward risk-on. Probably not. Short interest collapsed 47 percent, to 18.2 million – a six-month low.

Chart 2 above highlights period-over-period decline in short interest on several ETFs across sectors and industries. The only ones to see decent increase in short interest even as they rallied are the SPDR Energy ETF (XLE) and the SPDR Materials ETF (XLB). On the former in particular, shorts were spot-on as the ETF is coming under renewed pressure.

They have not shown the same level of conviction — willing to add to shorts even as the underlying rallies – as relates to other sectors or industries.

continue reading on the next page…