As U.S. equities prepared for a gap down at the open, investors were greeted with an assortment of headlines blaming anything from worries about weak earnings to a slowing global economy. But now that the market has battled back by mid-day, the headlines are shifting to highlight overblown fears. Worth a chuckle, as we still have two hours to go and plenty of time for more back and forth.

The bottom line is that active investors and fund managers caught a whiff of uncertainty and that was a quick catalyst for a bout of risk aversion this morning. Although several macro themes are on investors minds, it’s hard not to think about being more proactive (and somewhat defensive) with each push higher.

Recent pullbacks have been shallow and short-lived. And considering that this is the third day of selling in the past four days, it will be important to watch how the markets behave over the next 24-48 hours. Will risk aversion continue?

With that said, here are a few mid-day observations:

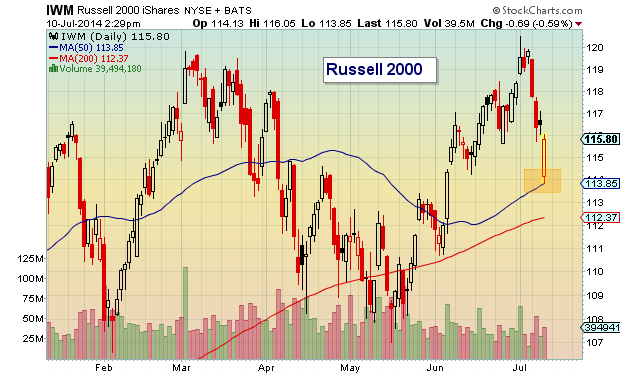

1. The Russell 2000 touched its 50 day moving average just after the open.

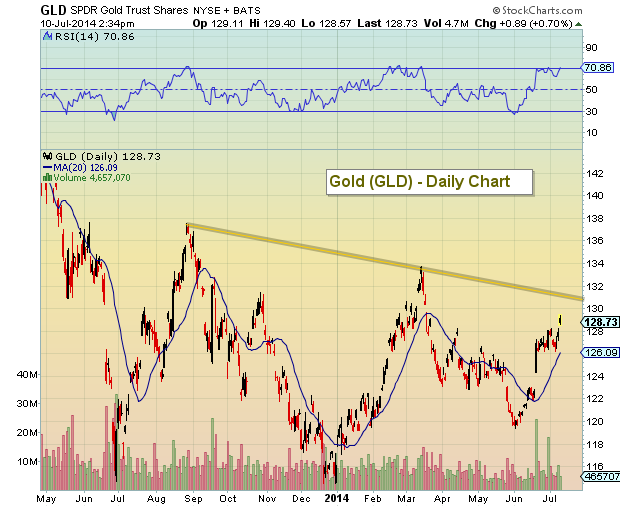

2. The rally in Gold prices has the Gold ETF (GLD) fast approaching downtrend resistance.

3. The Volatility Index (VIX) woke up from a multi-week slumber – but will this rally in volatility fade like the past 3 flare ups?

No position in any of the mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.