Entering the second half of the year investors are faced with conflicting prospects for the U.S. economy, central bank tightening of monetary policy.

As well, investors be aware of political headwinds as we approach 4th quarter: Mid-term elections have historically caused stocks and the S&P 500 (NYSEARCA:SPY) to struggle.

It was reported on Friday the Personal Consumption Price Index (PCE), the preferred inflation indicator of the Federal Reserve, rose 2.3% in May. That was the largest rise in more than six years and a signal the economy could be gaining upside momentum.

Meanwhile, the yield curve between the 2-year Treasury note and 10-year Treasury note fell to the lowest point since 2007. An inverted yield curve typically indicates central bank tightening making credit less available which leads to slower growth and lower inflation.

This week the Federal Reserve will release the minutes of its latest monthly policy setting meeting which will shed light on their interest rate stance. Threats to the bull market have risen but for now a healthy economic backdrop should offset the growing concerns. Consumers continue to spend and business investment is rising.

Over the near term we expect a wide swinging trading range for stocks within the confines of an ongoing bull market. Recent gains in relative strength in defensive sectors including Health Care (NYSEARCA:XLV), Utilities (NYSEARCA:XLU) and Consumer Ataples (NYSEARCA:XLP) represent attractive areas for investors.

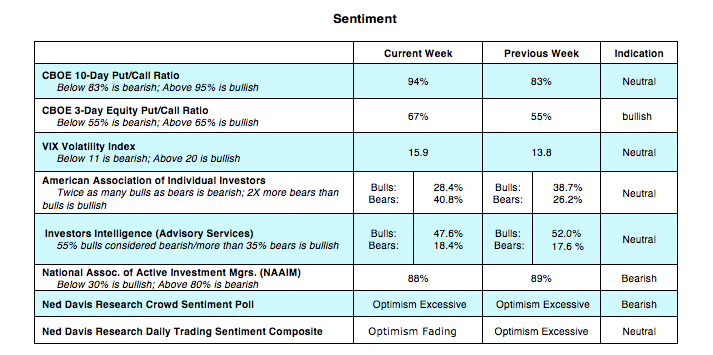

The technical indicators for the stock market support the prospects of a trading range for the S&P 500 Index. Several indicators of investor sentiment show modest improvement and relief from the extreme optimism found in early June. This, however, is offset by further deterioration in stock market breadth. The latest reports from Investors Intelligence (II) and the American Association of Individual Investors (AAII) show a contraction of the outright bulls and a rising percentage of bears. The widely followed Ned Davis Daily Trading Sentiment Composite moved away from the extreme optimism zone to a neutral reading.

From a contrary opinion perspective, these are seen as positive developments. Despite the improving trends in sentiment, we would need to see investor psychology fall into the extreme pessimism zone to signal that a sustainable rally is approaching.

Stock market breadth remains problematic. Less than 55% of the S&P 500 issues are above their 50- and 200-day moving averages. Upside volume has been conspicuous by its absence in the current cycle. Despite the improvement in the popular averages since the February lows there has not been a single session where upside volume has exceeded downside volume by a ratio of 9-to-1 or more.

This explains the lack of upside momentum that has caused rallies to stall the past three months. Additionally, unlike 2017 when foreign markets were rising in harmony and global synchronization was in effect, world equity markets and global economies are moving in a decidedly different direction. In a healthy bull market, most areas including foreign markets are in gear with the primary trend.

Twitter: @WillieDelwiche

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.