U.S. stock market indices surged for the fifth week in a row last week, catapulting the popular averages into positive territory for the first time in 2016.

The first 2016 stock market rally, which began in mid-February, developed from a severely oversold condition and amid widespread and deeply seated investor pessimism. The markets found a higher gear when the European Central Bank ushered in a new round of monetary stimulus and the Federal Reserve followed by moving back to the center on monetary policy.

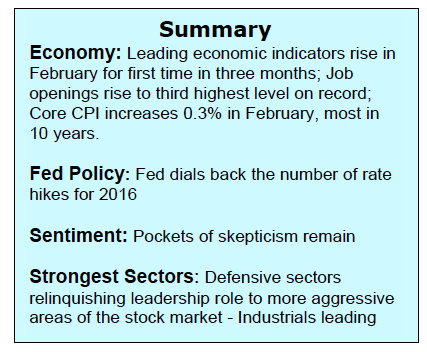

Federal Reserve Chief Janet Yellen surprised the financial markets by cutting in half expectations of four rate hikes in 2016. This triggered a sharp decline in the U.S. dollar. A weaker dollar is considered bullish for the economy while reducing the drag on corporate earnings. As a result, the initial surge by stocks that was triggered by bullish technical and monetary factors could now gain support from improving fundamentals.

Consensus estimates are that first-quarter S&P 500 earnings will be weak which opens the possibility for upside surprises. Year-over-year comparisons will be much easier following the weak first-quarter performances from the economy in 2014 and 2015. The largest risk to the financial markets is that a stronger economy and rising oil and commodity prices will add to inflationary pressures that have begun to surface with core CPI already above the Federal Reserve’s 2.0% target.

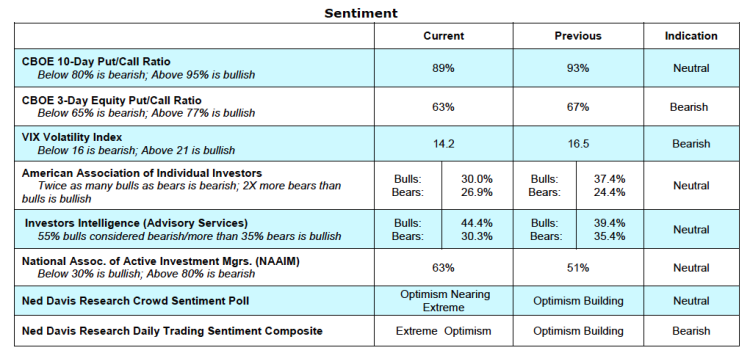

Near term, we expect that the stock market will enter a consolidation phase with the risk to 2000 using the S&P 500 and the reward to 2075. The market is overbought and investor psychology has moved near full circle away from the extreme pessimism found five weeks ago. This can be seen in the steep drop in the demand for put options (puts are hedges against falling stock prices) and the plunge in the CBOE Volatility Index (VIX) to 14 from 30 in February. A low VIX reading suggests investors are becoming complacent. Further evidence of investor optimism creeping into the financial markets can be found in the fact that inflows into high yield and junk bonds are at the highest level in four years. Given the strong upside momentum, any weakness that does develop is anticipated to be limited in both time and price.

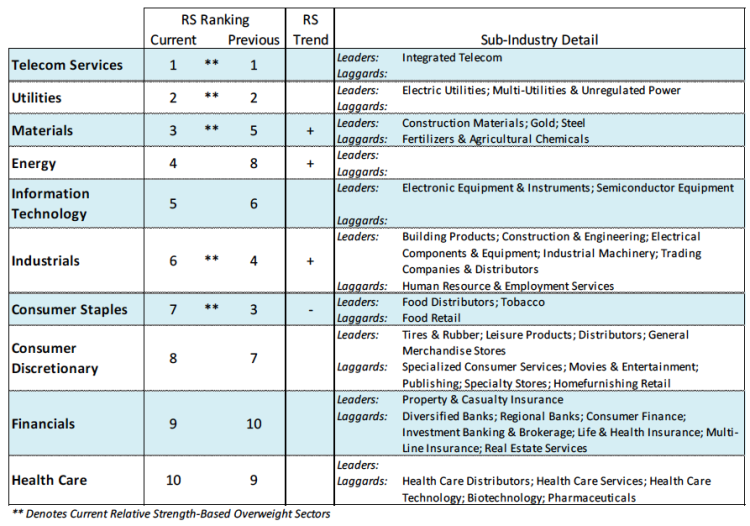

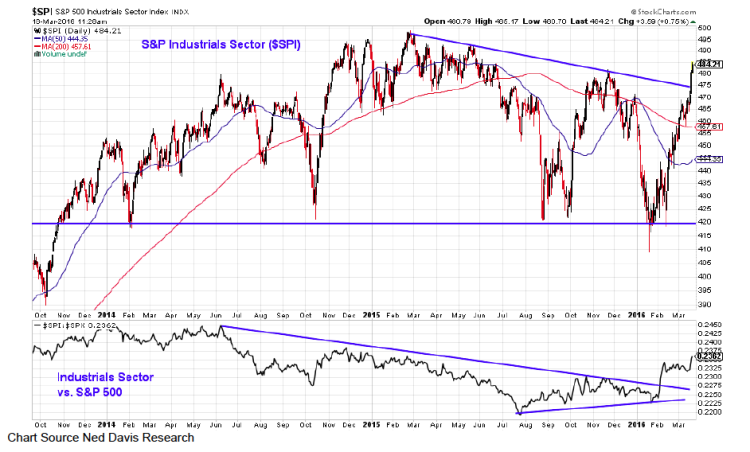

Looking further out we are particularly encouraged by the strong recovery in the broad market. The number of issues reaching new 52-week highs is the best since June of 2015. In addition, defensive sectors are giving way to more aggressive areas of the market that are outperforming, suggesting investors are becoming more positive toward the economy. Further evidence that the rally is becoming more widespread is seen in the improvement in lagging sectors whereby the spread between the best-performing sectors and worst-performing has narrowed considerably, which historically is a bullish technical development. The largest threat to the early 2016 stock market rally is that investors become excessively optimistic. Extreme optimism argues that little cash remains on the sidelines to support the demand side of the equation.

Thanks for reading.

Twitter: @WillieDelwiche

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.