Over the last several months I have said that I believe we have seen the market ‘highs’ (2133 on the S&P 500) and that we may see the recent lows (1810 on the S&P 500) broken.

As we entered into 2016, the S&P 500 had the worst first 6 weeks in the history of the S&P 500…. ever. It plunged 12%. Since then it has surged back up over 2070. If you listen to the Wall Street System pundits, you’d think that everything is fantastic!

Hmmm. I don’t agree. Let’s put this recent surge in the stock market in context.

Stocks versus bonds since market high last July

The S&P 500 is still negative relative to where it was last July. And those that have owned stocks during that time have experienced nail-biting volatility including two roughly 14% declines in August of 2015 and again in the first six weeks of 2016. Meanwhile, boring US Treasury Bonds like TLT have been positive that entire time! The return on boring US Treasury Bonds (TLT) is POSITIVE 13%! So rising bonds have been a winner.

Stocks versus bonds Year-to-date

The story year-to-date isn’t really any different. The first 6 weeks of 2016 were the worst 6 weeks at the start of a year in the S&P 500 ever…and ever is a long time. Luckily for those heavily invested in stocks the market has recovered since then. But, again, those investors don’t have any finger nails left. And I wonder how many have stayed invested during those two significant plunges in less than 6 months.

The financial media wants you to believe that this market is resilient; I instead wonder if those two plunges weren’t like seismic activity that signals the likely occurrence of an even worse seismic event ahead.

The scorecard for those invested fully in stocks year-to-date (S&P 500) is 0%. That’s correct; roughly 14% down then up 15-16% to end at a 0% return. Meanwhile, those boring US Treasury bond investors (TLT) are ‘only’ up around 9-10% versus the 0% of stock investors. Again, rising bonds have been a winner thus far.

If you listen to the Wall Street System–the financial news channels, radio programs and print media–the economy is strong and you should be fully invested. Anyone that has read any of my commentaries knows that I strongly disagree with that viewpoint in this environment.

When the Federal Reserve came out in December and announced a rate hike Wall Street was euphoric! The narrative was that raising rates was a sign that the economy was doing better… so it’s time to buy stocks!

Then when the Fed declined to raise rates at the last meeting the Wall Street was euphoric again! This time because lowering rates was bullish for stocks!

Huh?

How can you have it both ways? Simple – you can’t.

Or how about their ‘view’ on oil prices? If the price of oil is going down it is good for the consumer (because they are saving money) so you should invest in stocks. Then when oil prices go up Wall Street says that it is a sign that the economy is strengthening (because there is more demand) so you should invest in stocks.

Meanwhile, the global and U.S economies continue to slow in rate of change terms. There is still growth, but the growth is slowing quickly. Federal Reserve Chairwoman Janet Yellen had been telling people for the last year that the underlying economy is strong and that unemployment at 5% will cause inflation. And the Fed had been signaling another rate rise this month.

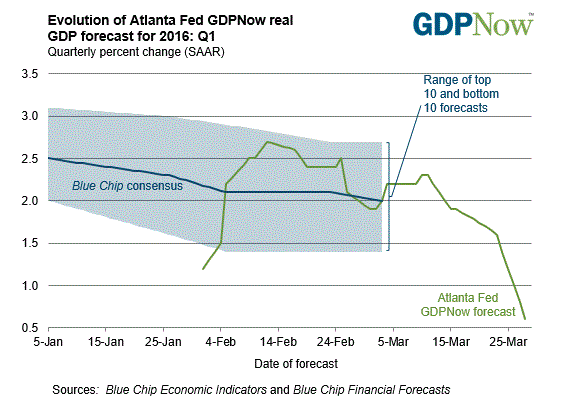

But she blinked. Maybe it was because she was aware of the data used by the Atlanta Federal Reserve that plunged the next day. It is now forecasting only 0.6% Q1 US GDP growth.

Ms. Yellen finally acknowledged that economic growth has been slowing and that the likelihood of the Federal Reserves’ GDP targets being reached in the short term is very low. Of course she still thinks those targets will be reached in the long-term! Their dot plot made it very clear that they don’t expect to raise rates any time soon. So, in essence, by not raising rates the way they said they would, they have actually lowered interest rates. And thus we have seen rising bonds (i.e. lower rates).

In the end, I am sticking with what has been working: US Treasury Bonds of various durations, municipal bonds, utilities and selectively shorting stock market indexes and sectors.

Thanks for reading.

Twitter: @JeffVoudrie

The author holds positions mentioned U.S. Treasuries securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.