In last week’s market commentary, I mentioned that currency wars and deflationary headwinds are curtailing growth. And this makes it hard to buy stocks at elevated levels. In my reviews I talk about how there are market cycles and that the old adage ‘buy low and sell high’ is good advice. This current market trend started in March of 2009 and has gone an extraordinary length of time without a 10 percent correction. So we all knew that we were due for a stock market correction–we just didn’t know exactly when it would occur.

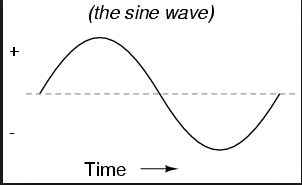

When talking about economic and market cycles it is helpful to think in terms of early cycle, mid-cycle and late-cycle. This sine wave illustrates this, but the image doesn’t start at the beginning of the cycle. The beginning of the cycle is at the lowest point about two-thirds of the way to the right. That would represent where we were in March of 2009. Mid-cycle would include the run up through the center line and on up near the ‘highs’. The late-cycle occurs where you see the highest point, the peak (roughly under the word ‘the’ in ‘the sine wave’.

When talking about economic and market cycles it is helpful to think in terms of early cycle, mid-cycle and late-cycle. This sine wave illustrates this, but the image doesn’t start at the beginning of the cycle. The beginning of the cycle is at the lowest point about two-thirds of the way to the right. That would represent where we were in March of 2009. Mid-cycle would include the run up through the center line and on up near the ‘highs’. The late-cycle occurs where you see the highest point, the peak (roughly under the word ‘the’ in ‘the sine wave’.

Now let’s think of this in economic terms. In early 2009, the US economy was in recession and the outlook seemed the darkest. In that situation, it is very hard for companies to increase sales and increase their profits. So their stock price was reflecting that difficulty—it would be selling ‘low’. Fast-forward six years and we are in the late-cycle stage. In the later stage of market cycles, companies are generating blow out numbers—their best ever sales and profits. That leads to stock prices that typically are at all-time-highs.

The problem is that those all-time-highs in sales and profits may be as good as it gets before we enter the downturn in the economy and the market. That’s why we don’t want to be that person buying as all-time-highs are chopping and moving sideways.

The main question that I ask clients in my reviews is whether they think we are nearer the beginning or the end of the current cycle for stocks and the economy? Most agree that we are at or near the end. So we currently don’t have a very large allocation to stocks right now.

The stage of the cycle we are in also impacts the strategy that I use in buying and selling stocks. Early stages of market cycles often make sense to follow a more buy-and-hold strategy. But those that do this during the later stages of market cycles can see significant losses. So, in my reviews, I explained that during late cycle, the amount I would be investing in stocks would be less than normal and that I would use more of a days-to-weeks trading window when buying select stocks on pullbacks. The underlying assumption is that I would continue to do that if the stock market stayed in the general range.

It became very obvious that the correction we have been waiting for started on August 20th. Since then the S&P 500 ETF (SPY) has plunged as much as 13 percent from its all-time-high, before rebounding sharply over the past couple of days.

The key question is whether this is just a short-term market correction or is it the end of the late economic cycle?

My view is that the recent correction is reflective of the problems that have been building on a global basis—specifically a lack of economic growth. If that is the case, then the likelihood of the economy beginning to move toward recession is increasing. And the earnings reported by 484 of the 500 S&P 500 companies reflect this trend with revenues DECLINING 3.8% year-over-year and profits DECLINING by 2.5%.

I have written extensively about the lack of growth, the ensuing currency wars and how it results in importing deflation to the United States. I expect that to continue.