The popular stock market indices continue to pursue a slow and persistent track to new record highs. The S&P 500 (INDEXSP:.INX) is trading at new all-time highs in Tuesday trading.

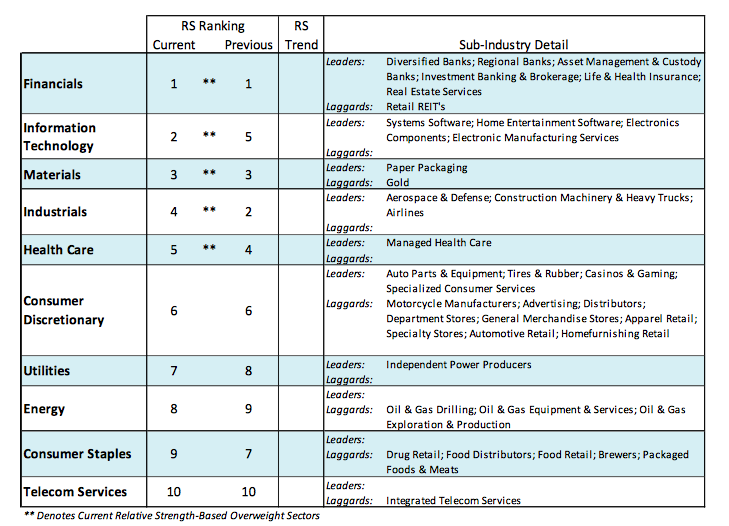

Stocks have been supported by improving second quarter earnings and by CFO reports of stronger top-line growth. The decline in the U.S. Dollar Index (CURRENCY:USD) this year is another unexpected benefit to large-cap multinationals.

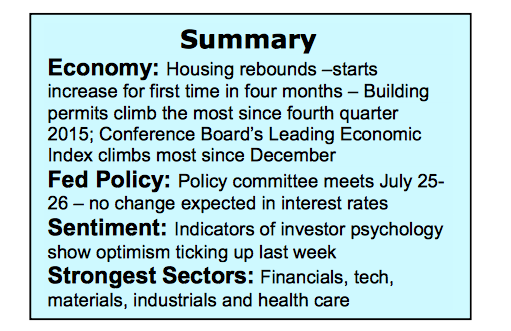

The combination of stronger economic growth, weak dollar and low and stable interest rates have caused upward revisions in S&P 500 second quarter earnings growth from 8% to 10%. GDP growth for the second quarter to be reported this week is anticipated to be in the vicinity of 2.50% to 2.70%. That’s a significant improvement over the 1.4% economic growth reported in the first quarter.

The fact that inflation remains anchored is another unexpected bullish factor for stocks this year. The Fed’s Open Policy Committee meets this week against a near perfect backdrop of improving economic growth and little pricing pressure. The Consumer Price Index rose only 1.6% year-over-year, which is far short of the Fed’s 2.0% goal. As a result, the fed funds futures market now suggests little chance of a September rate hike and less than a 40% probability the Fed will raise rates in December.

Given the likelihood that the Fed will continue to pursue a strategy of a measured approach to monetary policy it is not surprising that the CBOE Volatility Index INDEXCBOE:VIX) hit a 23–year low on Friday. Low VIX readings suggest widespread complacency but the super-low VIX Volatility Index reading is a mirror image of the measured pace of the advance in stock prices in 2017. In the late stages of a bull market investors typically barge in with the last of the sidelined cash causing volatility to jump and prices to rise rapidly for a period of time. The slow steady grind higher in July argues that a final capitulation stage is somewhere in the distant future.

The technical indicators, on balance, suggest the intermediate-term trend of the stock market will continue higher. More than 400 issues hit new weekly highs versus 300 the previous week and 200 early in July. New highs by the large cap averages were joined by new record highs of small- and mid-cap stock indices and the NY Stock Exchange Composite. Over the very near term, however, the market could be vulnerable to a pullback given that stocks enter the new week in an overbought condition.

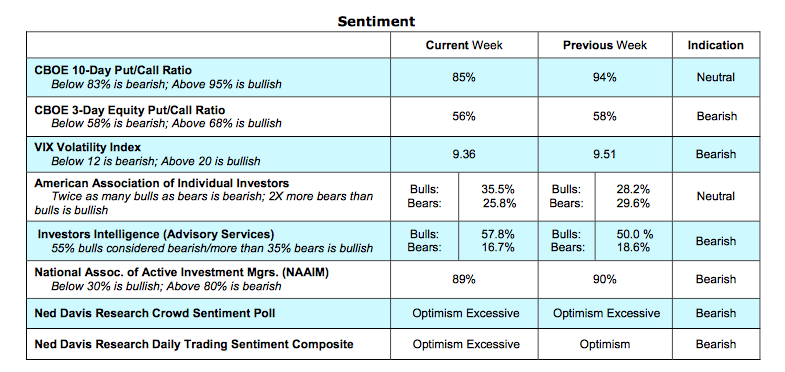

New highs by the S&P 500 last week and higher prices in eight of the last nine trading sessions by the NASDAQ caused investor confidence to uptick for the first time in many weeks. The latest report from Investors Intelligence (II) showed 57.8% bulls up from 50.0% the previous week and a drop in bears to just 16.7%, one of the lowest readings of the year. The latest survey from the American Association of Individual Investors (AAII) showed more bulls than bears for only the second time this year. Additionally, the Chicago Board of Options Exchange (CBOE) reported a significant decline in the demand for put options (puts are bought by investors expecting a market decline). This resulted in the overall CBOE 10-day put/call ratio to drop to 85%. Below 83% would trigger a caution signal. The CBOE equity only put/call ratio remained in the caution zone for the second week in a row. The increase in bullish sentiment is not seen as a threat to the intermediate-term trend of the stock market. Near term, rising bullish sentiment increases the odds of a short-term pullback in the traditionally weak seasonal period of August and September.

Thanks for reading.

Twitter: @WillieDelwiche

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.