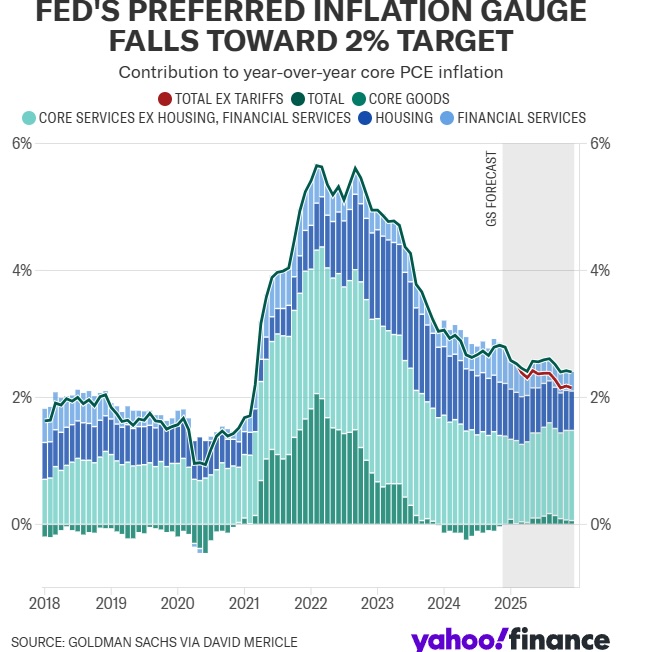

Do you believe the economy is heading towards inflation?

Well, the price will argue with that opinion.

Looking at my own trifecta of inflation barometers:

- The dollar would weaken

- The silver outperforming gold

- The price of Sugar escalating

They all say no inflation, at least right now.

Do you believe the economy is heading towards recession?

Well, the price will argue with that opinion.

- Yields would fall at the long end and short-term interest rates would decline via Fed policy.

- Copper would be declining

- The dollar would weaken

- The consumer would weaken

Well, the price will argue with that opinion.

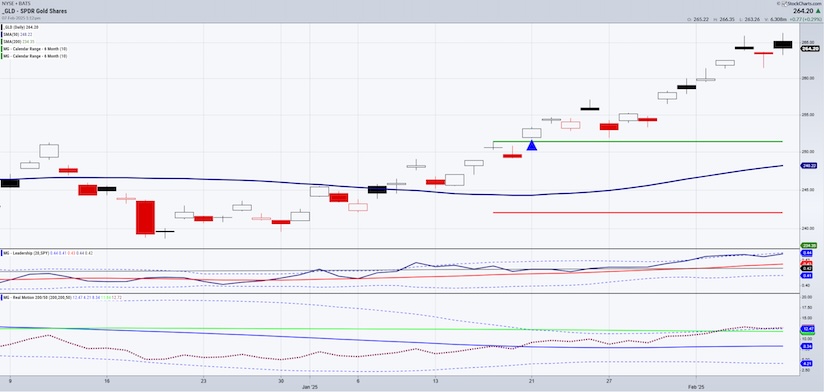

Do you believe that gold prices are sending a warning?

Well, price supports that opinion only, pick you warning

- Stagflation

- Tariffs and deglobalization

- Increasing global debt

- QE returning

- Geopolitical threats

- Fiat currency at risk

- Low supply

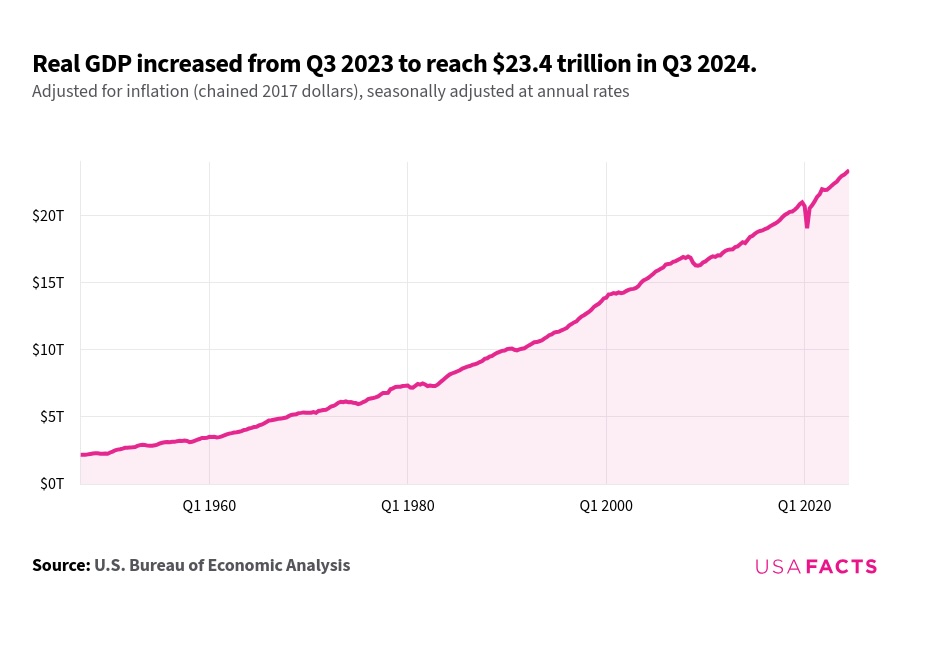

Do you believe we are heading towards substantial economic growth?

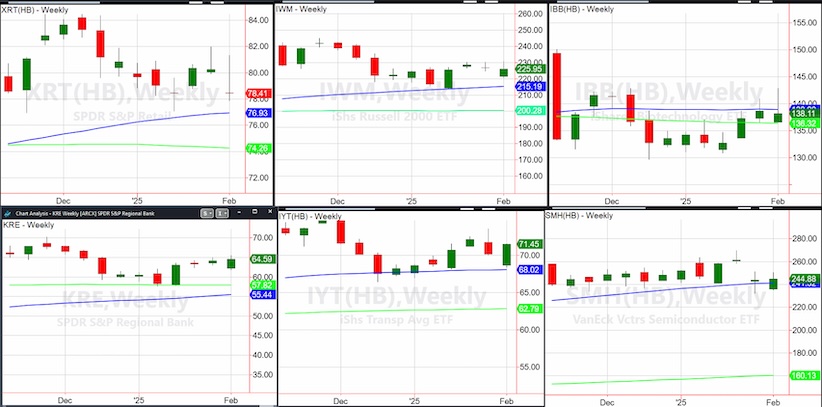

Well, here is where my Economic Modern Family tells the story..

Looking at these important stock market ETFs at large, the best one can say with current prices is that the economic picture or growth going forward remains unknown.

Gold loves uncertainty, so the only thing certain right now is uncertainty.

Considering that all the members except for Biotechnology (IBB), are holding their 50-Week Moving Averages (WMA), we can at least surmise optimism has not left the building.

The Semiconductor sector (SMH) sits on the 50-WMA. While money rotates out of chips, for US centric economic growth, we need her in the game, but not necessarily as a leader.

Transportation (IYT) held the 50-WMA and rallied mainly on strong UBER earnings. Nonetheless, transportation holding price is good.

The Consumer (XRT) is most likely the biggest key to growth signals on price as the consumer is 70% of the GDP.

That blue line of 50-WMA is close but still holding. Want to sound like an economist? If that line breaks, start talking the R word.

As far as the Russell 2000 (IWM) and Regional Banks (KRE), they are holding hence, the indecision as to the next move.

And Biotech (IBB), began last week with so much promise. Now, IBB is back to the 200-WMA (green) and in need of some of its own medicine.

Price will dictate the narrative. The time is now for traders who understand this.

Twitter: @marketminute

The author may have a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author and do not represent the views or opinions of any other person or entity.