M&A activity has been low over the past few years given a number of factors from higher yields and confidence. However, there are signs of improvement as headwinds are changing to tailwinds.

Merger and Acquisition (M&A) activity is a sign of a healthy market. Business managers and boards are confident about the environment and economy, desiring to grow their business at a faster pace compared to organic efforts alone. So they go out and buy.

It is not just confidence in the economy, the cost of including available yields and the accessibility of capital matter too. The rise of private equity has been an additional factor for M&A activity over the past decade – those that acquire to take private, restructure and then often re-IPO a company.

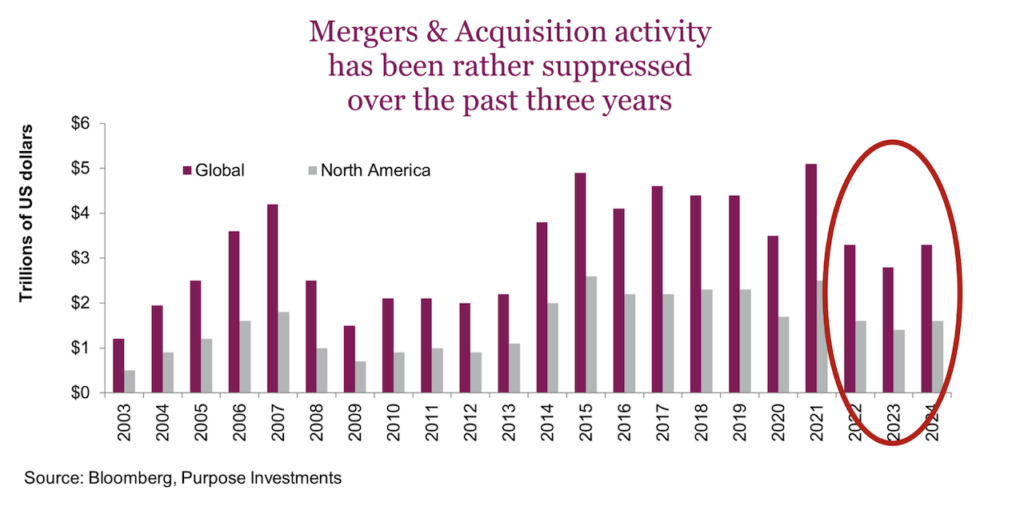

Over the past few years M&A activity has been dormant both in absolute dollar terms and even more so on a relative basis to the size or value of the overall market. From 2014 to 2021, global M&A activity averaged between $4 and $5 trillion in US dollars.

Over the past three years this has been a somewhat suppressed $3 trillion pace. These are nominal dollar values, so if you put that into constant dollars or measured against the total market capitalization of equity markets, the drop would be even more pronounced.

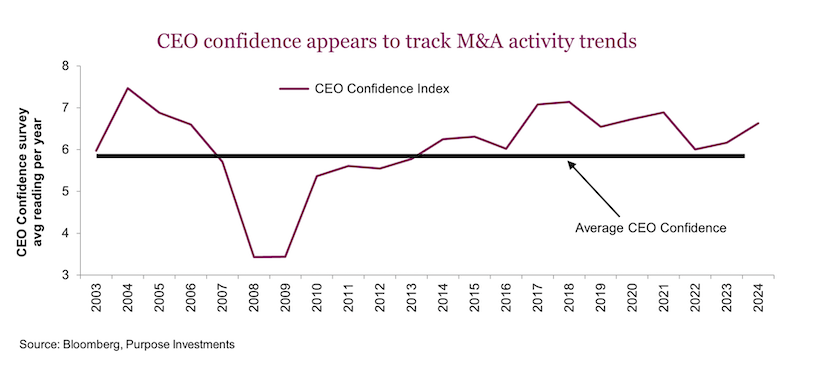

Before we jump into our thoughts on M&A activity for 2025, let’s take a quick historical trip to put things into some context. Not surprisingly following the financial crisis of 2008, M&A activity really dried up. Banks were busy trying to repair balance sheets and financial conditions were historically tight. Not many bankers were running about offering up attractive financing to entice CEOs to go out and buy a competitor. At the same time, CEO confidence was low, as many had to manage their companies through a near-death experience during the financial crisis.

Around 2015, CEO confidence rose back to more normal levels, coincidentally around the same time M&A activity started to re-accelerate. Financial conditions also improved greatly during this boom time for deals. The other factors that really contributed to M&A activity were yields and private capital. Bond yields, using the 10-year Treasury yields as a proxy, fell down to the 2% zone at the end of 2011 and remained low until early 2022. Combine low yields with higher CEO confidence that kicked in after a few years, and the deals ballooned. An additional boost came from private equity during this period as the asset class attracted more capital that had to be put to use.

The drop in M&A activity during 2022-24 also makes sense through this lens. CEO confidence dropped, perhaps due to inflation. Bond yields spiked higher, making the cost of capital much more expensive, raising the bar for doing a deal. Higher cost of capital requires a higher IRR (internal rate of return) for doing a deal or making an acquisition. Add that all up, and even with a decent economy, fewer deals got done.

In 2025, this M&A dry spell is showing signs of ending and there certainly appear to be more tailwinds than headwinds. Here is our thinking:

CEO confidence – As of December 31, the CEO confidence survey has moved over 7, well above the average during the past twenty years. That is a positive.

Financial conditions – This one is a bit mixed. While debt costs are still high given current yields, short-term rates have started to come down. Add to this the fact that financial conditions are rather good. Corporate spreads are near or at historic lows and the availability of credit remains healthy. Bank lending practices too are seeing a steady trend in looser lending practices.

Pent-up demand – Given muted M&A activity over past couple years, there may be a large amount of pent-up demand – whether it’s companies that have been holding off on deals finally pulling the trigger or private equity becoming a bit more confident to put dry powder to work.

Regarding President Donald Trump, it seems like we have to include something about the new leadership in the U.S. The tariff risk is a headwind to M&A as it injects a level of uncertainty for many companies ‘operations, depending on jurisdiction. Countering this is a move towards less regulation that means potentially even lower-risk deals get blocked. Let’s call this one, in aggregate, a mild headwind.

Final thoughts

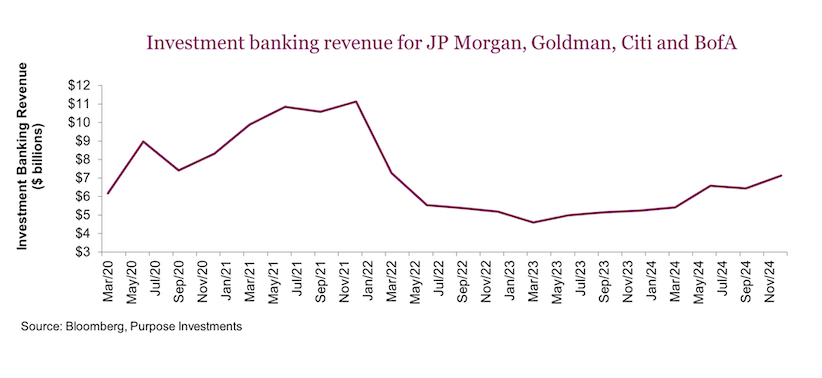

More tailwinds than headwinds mean we could be in for at least a year with increasing M&A activity. It is starting to show up among the big U.S. money center banks when drilling down to investment banking revenue. Not saying this is boom times for investment bankers, but the trend is moving in the right direction. While this trend could of course change, for now this is a positive for financials, notably those with more capital markets exposure.

Source: Charts are sourced to Bloomberg L.P., Purpose Investments Inc., and Richardson Wealth unless otherwise noted.

Twitter: @ConnectedWealth

The author or his firm may hold positions in mentioned securities. Any opinions expressed herein are solely those of the authors, and do not in any way represent the views or opinions of any other person or entity.