Stocks declined last week amid more government shut-down of entire industries and the extension of laws mandating most of the country stay at home in an effort to stem the spread of the COVID-19.

This has driven a sharp slowdown in the U.S. economy.

Financial markets have been volatile as investors try to think through the likely outcomes.

As we start the second quarter, the pandemic continues to spread throughout the country. The economic impact is just starting and will begin to become more visible.

Everything hinges on the slowdown of this virus. As I read my local Sarasota newspaper this morning, there is a report that hospitals in my area are expecting a peak in the growth of the COVID-19 by May 3.

Center for Disease Control (CDC) maps and data suggest to me that, at least for today, Florida may be one of the last hot spots of this virus as it moves around the country.

If April/early May does indeed mark a significant slowdown in the virus outbreak, that would fall in line with the consensus economic forecast.

A containment of the virus in the spring along with the massive amounts of fiscal and monetary stimulus being injected in our economy suggests the U.S. would undergo a sharp, brief recession and then experience a robust rebound in the fourth quarter of 2020 or first quarter 2021.

However, the recent jobs report for March reported that 6.6 million people filed new claims for unemployment benefits as government-mandated shutdowns to help contain the virus began to take their toll.

The two-week total of unemployment claims has now risen to 10 million+ claims. We do not yet know the number of unemployed workers and failed businesses this virus will leave in its wake. Once we are on the other side of this situation, it may take time for businesses to regroup and consumers will then need time to overcome their fear of this virus and their own safety concerns. It seems now that a more likely scenario is that we will face a slower recovery as unemployment numbers rise and social distancing measures detract from service sector activities like travel, dining, retail and recreation.

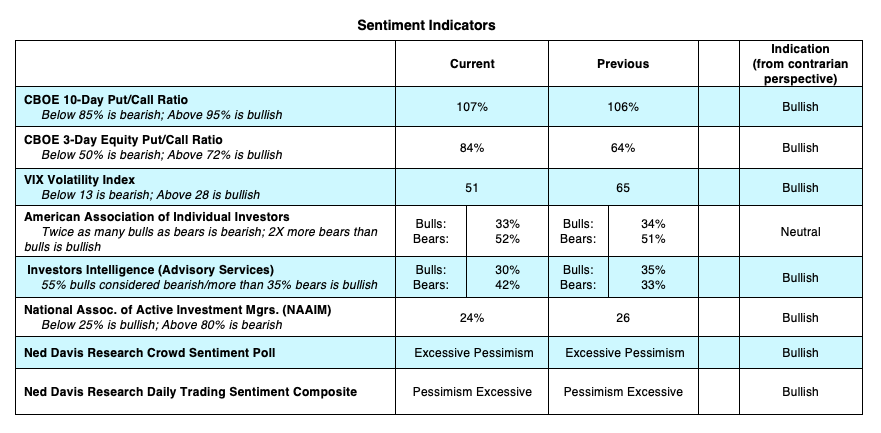

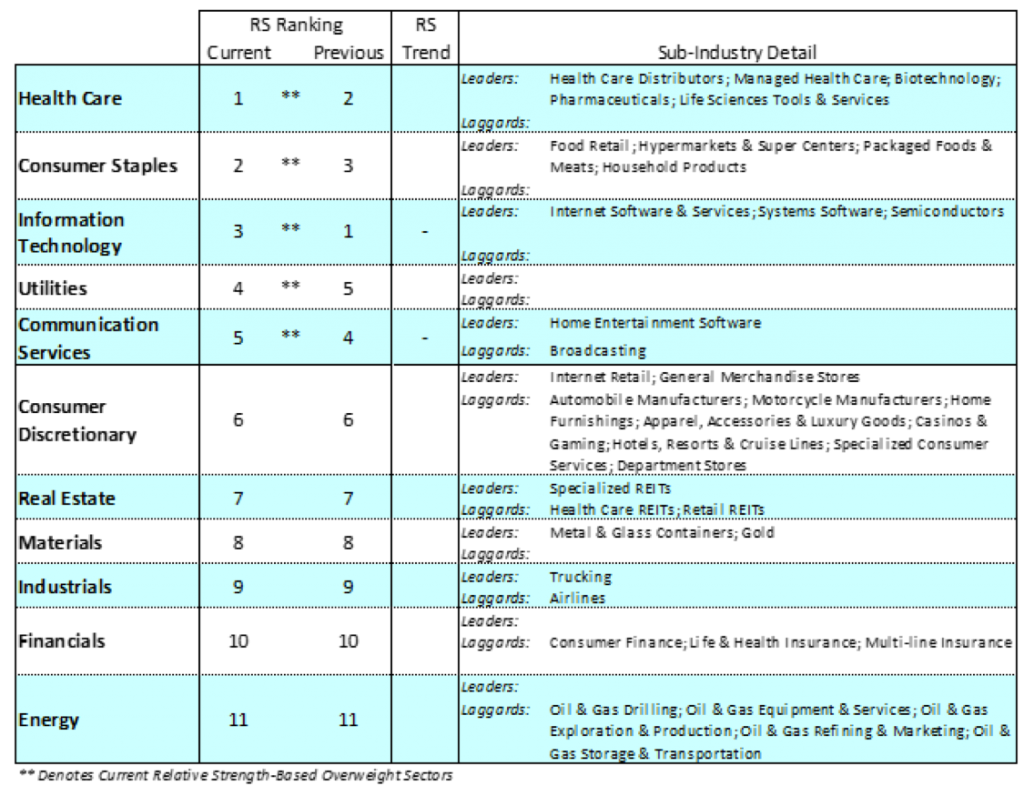

All of the major stock market indexes ended the quarter trading below their 200-day moving averages. Although the pace of the downturn in stock prices has slowed, we are watching for a market bottom based on retests where there is less downside volume, fewer stocks making new lows and fewer stocks trading below their moving averages.

There have been technical improvements but we remain cautious until we see clear proof that the downside momentum has been broken. The market and the economy cannot begin to recover until we see evidence of a nation-wide virus slowdown.

For investors: Resist the urge to sell solely based on market volatility. If you are uncomfortable with volatility, you may want to reduce your exposure to high yield bonds or lower-quality stocks on rallies. In most cases, crisis ultimately creates opportunities to buy good quality investments for the long term.

The Bottom Line: No one knows what is going to happen with the coronavirus. We will not see a rebound in the economy or the stock markets until consumers feel safe enough to return to normal interactions. The good news is that social distancing, testing availability and expanded research are encouraging. Containment measures in other countries such as China, Italy, Spain and Germany have slowed the growth rate of the virus. The hope is that the U.S. will follow similar patterns.

Twitter: @WillieDelwiche

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.