We continue to see uncertainty surrounding tariffs, inflation, and the financial markets. Albeit, the S&P 500 Index (INDEXSP: .INX) has stabilized a bit over the past week.

Earlier this week, we shared 27 datapoints and focused specifically on how market movements are likely being exaggerated by technical factors- specifically, funds unwinding leveraged positions. But let’s take a step back.

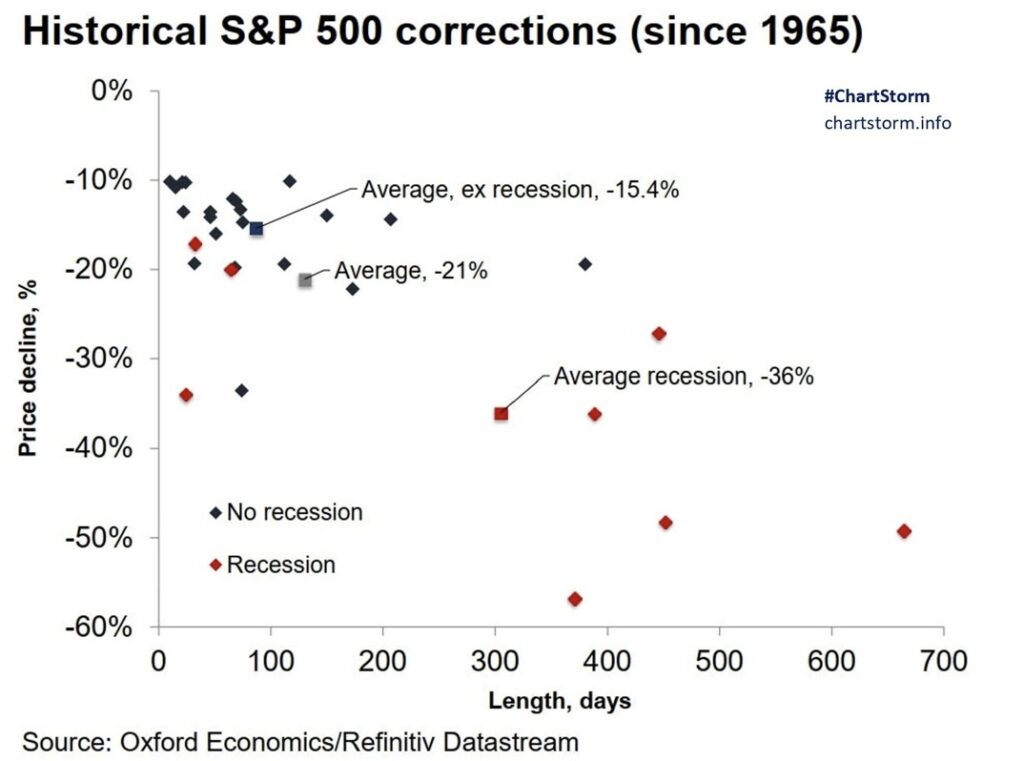

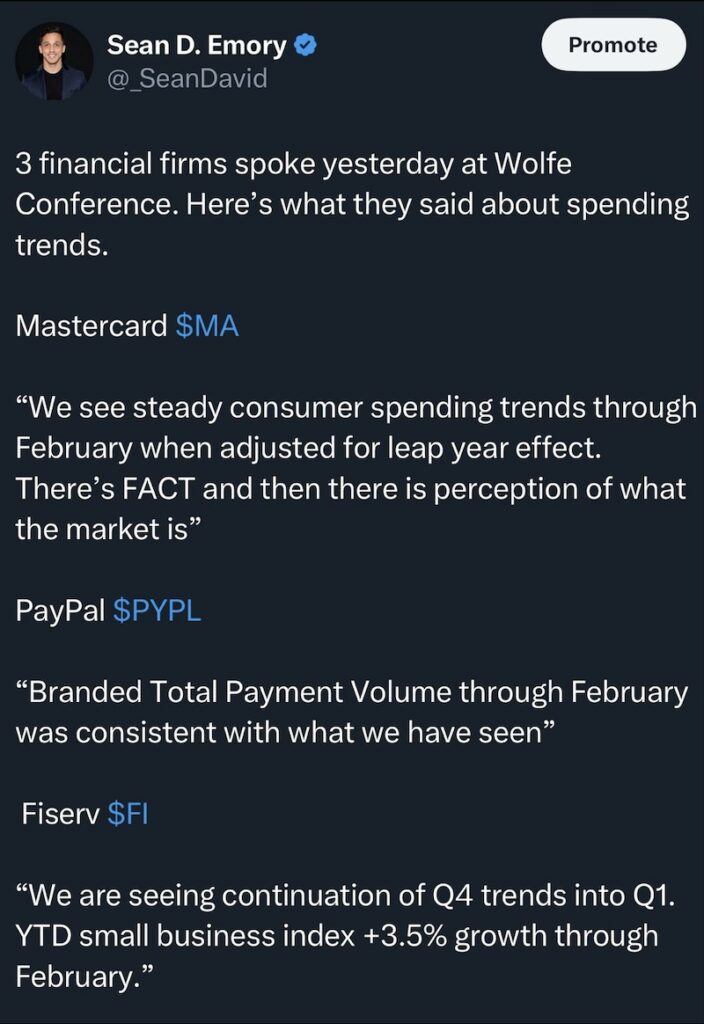

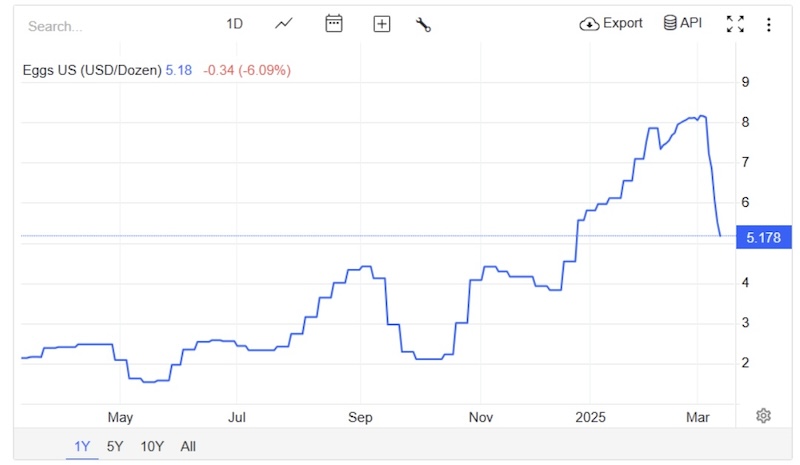

Stock market corrections are normal. The real question is how quickly they recover. This week, we share data showing that when there’s no recession, corrections tend to bounce back fast. Beyond that, three major financial firms-Mastercard, PayPal, and Fiserv -weighed in on consumer spending, reinforcing that trends remain stable and in line with year-end patterns. And finally, egg prices have dropped sharply, which may be shaping inflation sentiment even though they make up a small share of household budgets.

Let’s dive into the data.

- Market corrections recover fast when no recession follows.

- Payments data shows stable spending trends – Mastercard, PayPal, and Fiserv see steady consumer activity.

- Egg prices down 6% recently – A small item, but a big factor in inflation perception.

Data Point #1: No Recession = Swift Market Recovery

Markets have been volatile, but corrections are nothing new. The real question is how long they last and how deep they go.

- The Data: Historically, S&P 500 corrections average -21% overall, but there’s a key distinction—when a recession follows, the average drawdown is longer. However, when no recession occurs, the market typically bottoms and recovers quickly.

- Investor Takeaway: With ongoing debates about economic slowdown risks, this data suggests that if the economy holds up, we could see a sharp recovery rather than prolonged pain. Investors often price in worst-case scenarios, but history shows that markets can reset faster than expected. So let’s look at some economic insights…

Data Point #2: Payments Data and What Financial Firms Are Seeing

Three of the largest financial companies—Mastercard, PayPal, and Fiserv—spoke at the Wolfe Conference this week, offering a window into consumer spending. Their message? Things are stable.

- The Data:

- Mastercard: Spending remains steady when adjusted for the leap-year effect.

- PayPal: Total payment volume is in line with recent trends.

- Fiserv: Small business spending is up 3.5% YTD—showing momentum.

- Investor Takeaway: Despite the noise around macro uncertainty, payments data suggests consumers and businesses are still transacting at a healthy rate. That’s a strong counterpoint to fears of an imminent spending slowdown.

Data Point #3: Egg Prices Drop Sharply— Sentiment Follows?

Egg prices have plunged in recent weeks, and while this is a small piece of household budgets, it’s a big psychological driver of inflation sentiment.

- The Data: Prices are down over 6% recently after a sharp rise last year.

- Investor Takeaway: Inflation expectations are often shaped by highly visible items like food and gas. While broader inflation trends are more complex, a noticeable drop in egg prices may help cool consumer anxiety—even if the Fed isn’t making decisions based on the cost of breakfast.

Twitter: @_SeanDavid

The author and/or his firm have positions in the mentioned companies and underlying securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.