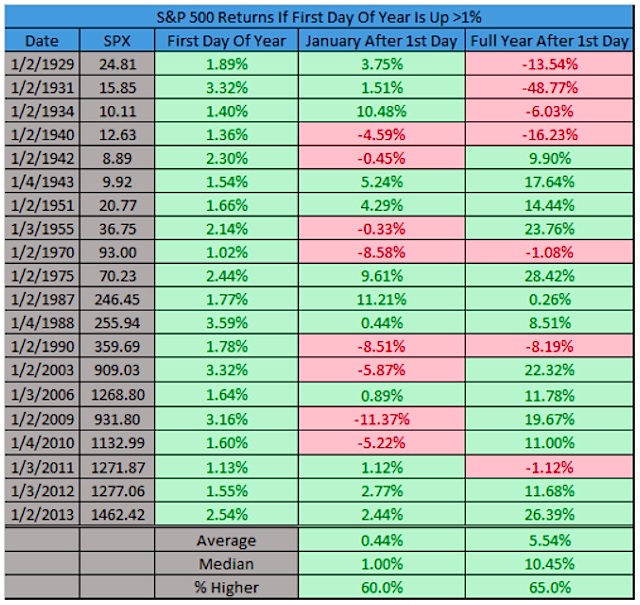

Here’s what happens when the first day of the year is up more than 1 percent. Wouldn’t you know it, the rest of January is actually weaker than when the first day is down big. The rest of the year is skewed by a big drop in 1931.

To summarize, there’s no way one day tells us much of anything. We’ve seen some big drops on the first day of the year before that lead to bear markets, but we’ve seen it happen in bull markets also. Remember, don’t get sucked into the scary headlines and take a closer look at things before panicking.

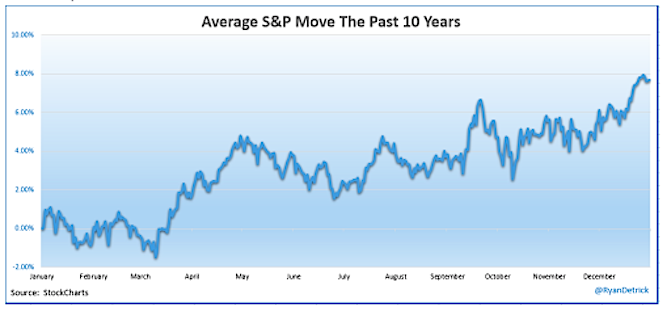

Lastly, here’s a chart I made this morning. Is early year weakness really a rare thing? If you look at what the average S&P 500 looks like over the past decade, early weakness is actually normal.

Thanks for reading.

Read more from Ryan: “Diversified Investors Faced Historically Tough Year In 2015“

Twitter: @RyanDetrick

Read more from Ryan on his tumblr.

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.