2016 got off to a rough start, with the S&P 500 Index dropping more than 1.5 percent on the first day of the year. This was the 6th worst first day of the year for the stock market since 1928.

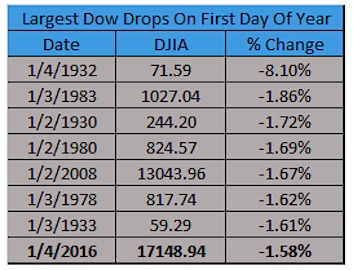

Stealing many of the headlines early in the day was that it was also the worst first day of the year for the Dow Jones Industrial Average since 1932. A late rally negated this, but it still ended up being the worst first day of the year since 2008.

This brings up the logical question, does a bad first day of the year tell us anything about stock market returns over the coming year? The last two times the first day of the year was down more than what we saw yesterday were 2008 and 2001, both bear markets.

Last year the first day of the year was flat and the full year ended up being flat. Then when you consider in 2013 the first day of the year was up +2.54%, the full year goes on to gain nearly 30% – maybe there’s something to the first day?

I love diving into things like this, but the reality is in this case there is no way one day’s worth of action sums up what might happen over a full year. My pal Anthony Valeri of LPL Financial summed it up like this to the Wall Street Journal, “[Monday] is not an omen for the rest of the month or year at all.” He called Monday’s losses an “overreaction” and said that a single day’s events or one batch of economic data doesn’t signal what’s to come for the remainder of the month for the stock market.

Sign up here (It’s Free) and receive research updates & alerts.

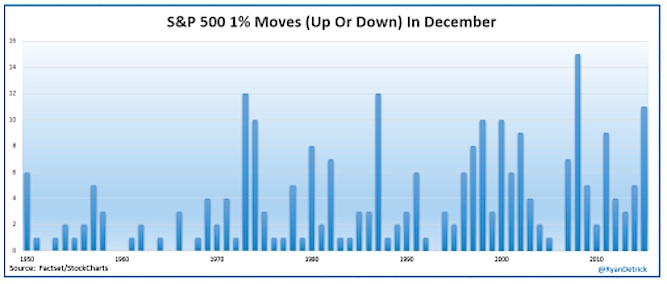

I agree with Anthony here. One day is fun to talk about and extrapolate out, but it really is totally random. Remember, the S&P 500 in December saw 11 days move more than 1 percent (up or down). That was one of the most volatile Decembers ever. To think that volatility would stop simply because it was a new calendar year is wishful thinking.

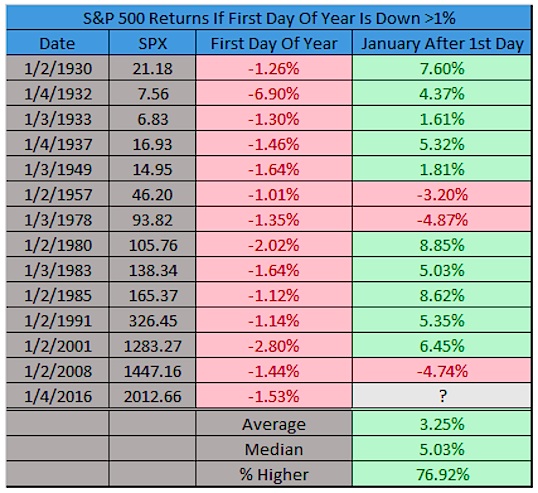

With the disclaimer that I wouldn’t too put much into this data, here’s what I found when I looked.

When the S&P 500 on the first day of the year is down more than 1 percent (like ‘16), the rest of January gains +3.3% on average and is up a median of +5%. Guess it isn’t as bearish as many were making it sound. Yesterday was only the 14th time this ever happened to the stock market index.

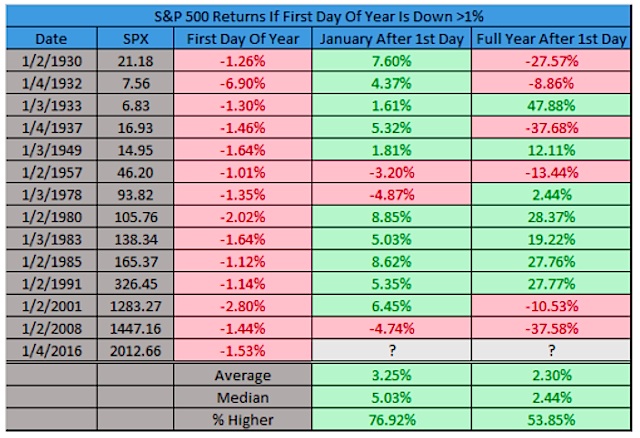

What about the full year? Remember 2008 and 2001 both saw big drops on the first day also. Doing this shows the rest of the year is up +2% on average. This isn’t a huge gain, but it sure isn’t wildly bearish like many made it sound like if all you listened to was ‘the last time this happened was 2008 and 2001′ crowd.

What stands out to me the most about above is the rest of the year has seen some big moves. Many moves of 20 percent or 30 percent (up or down) mixed in there.

continue reading on the next page…