The stock market rally hit overdrive this week with investors buying up tech stocks and other large caps.

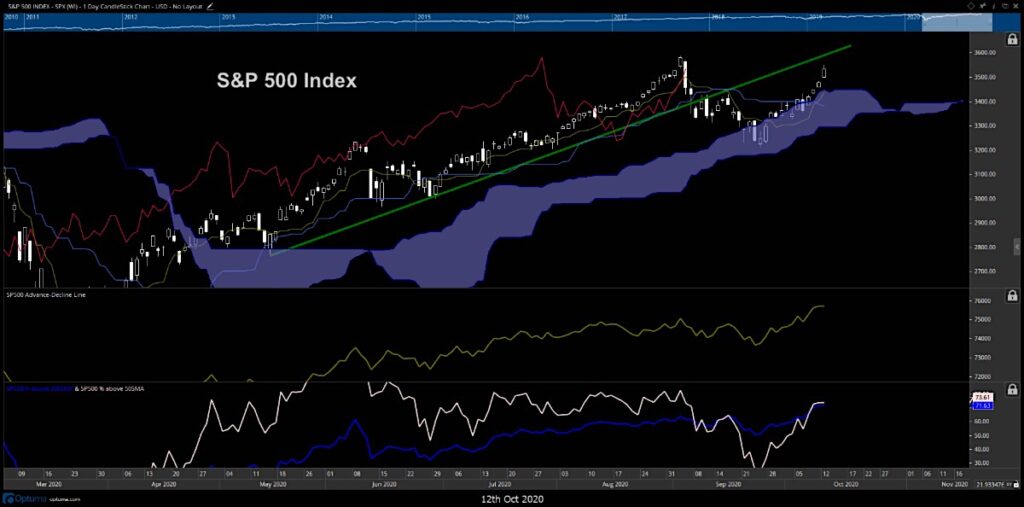

For stock market indexes like the S&P 500 and Nasdaq 100, there is very little resistance between current prices and all-time highs. Those record highs could be tested by end of week.

Stock market trends accelerated last week despite Technology’s absence. Everything flipped this week with Tech now charging back higher while Industrials and Discretionary lag. As discussed in recent days, quite a few sector ETF’s are trading now right near prior highs which is serving as resistance in Financials, Discretionary and Healthcare.

The thrill of buying Tech stocks ahead of major event to “front-run” the news is a bit late and should have been done last week. Apple’s stock (AAPL) surged 6% despite much news on the heels of its massive launch event. Meanwhile, Amazon’s “prime” day” upcoming has helped not only Amazon (AMZN) and Netflix (NFLX) but also stocks like Walmart (WMT). Furthermore, we’ve started to see defensive trading widen its recent lead with Staples nearly doubling the performance of Discretionary while both Utilities and REITS also show impressive gains.

Overall, technically speaking, this bounce has proven stronger than expected. Yet, former highs are likely to provide some stalling out, and it’s imperative to pay attention to any evidence of trend reversal over the next 2-3 trading sessions. Considering implied volatility with a 4-6 week time frame makes a world of sense with three weeks to go til the Election.

Twitter: @MarkNewtonCMT

Author has positions in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.