Quarterly Investing Outlook – Highlights:

- Economic Data Surprising to Downside

- Global Weakness Weighs On Earnings Growth

- Fed Moving Beyond Focus On Core Inflation

- Expansion Moves Toward Record Territory

- Optimism Easing As Volatility Picks Up

- S&P 500 (NYSEARCA: SPY) Found Little Support At New Highs

After a strong start to 2019, the stock market rally has stalled in May. The second-longest streak without even a 3% correction since 2009 came to an end and the S&P 500 has seen its first 5% pullback of the year (though it has held on to double-digit year-to-date gains).

On average, 5% pullbacks emerge more than three times a year. The still-unresolved question is whether the May decline represents a pause that refreshes the 2019 rally or an opening move in a more protracted period of weakness.

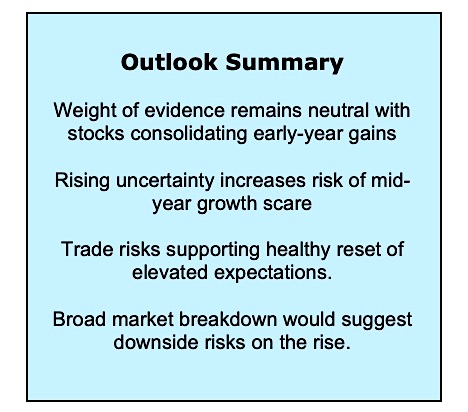

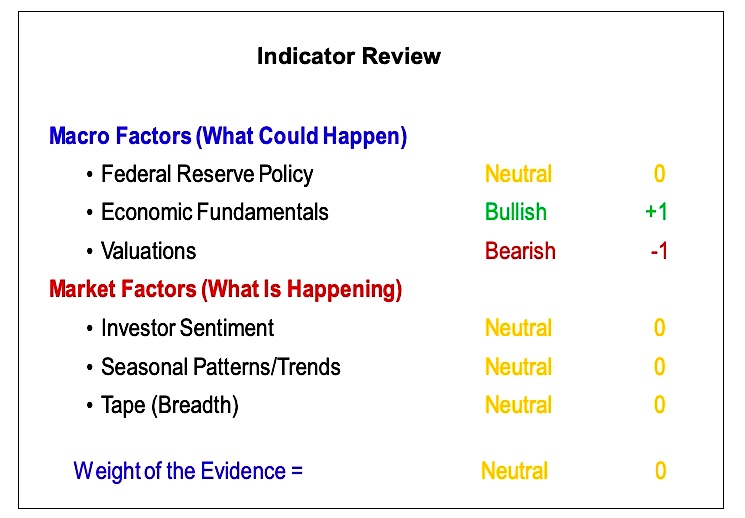

We will rely on our weight of the evidence to provide support in leaning in one direction or the other. For now the evidence remains in neutral. A positive resolution would be supported by evidence that investor sentiment is turning excessively pessimistic while breadth trends start to improve. A more bearish resolution would be supported by evidence that investor optimism remains elevated with breadth trends continuing to deteriorate.

Discussions of the status of trade talks, rising global policy uncertainty, and the implications for earnings guidance for the remainder of the year are likely to be noisy and could produce outsized near-term swings in stock prices. Beyond this we are looking at two more basic (and relevant) macro questions that linger just beneath the surface: Has the outlook for the U.S. economy meaningfully deteriorated and what, if anything, will the Federal Reserve do about it?

Trade talks with China have hit an impasse and financial markets in May are trying to sort out what implications this may have on a global economy that is struggling to sustain greens shoots. A renewed rise in global economic policy uncertainty could weigh on economic sentiment and activity, threatening to cut off a global recovery before it even gains traction.

While tariffs are likely to have outsized impacts on specific areas of the economy, their direct effect on total economic activity (while negative) is likely to be minimal. The greater effect comes from the noise generated in the financial markets and the additional uncertainty that follows. If uncertainty is followed by depressed economic sentiment, downside risks for the economy could increase.

This rise in uncertainty comes at a delicate time for the economy. Global growth is trying to stabilize and there may be reasons to take a more cautious view on the U.S. economy. To be clear, we do not expect the current U.S. expansion (which will soon set a record for length) to end soon. That does not preclude concerns about weakening growth to build in the wake of uncertainty.

One area of concern is that economic surprises domestically and overseas have been to the downside of late. The latest rise in uncertainty could offset some of the stabilization that has been seen in the economic surprise indexes. On the other hand, a quick reset in economic expectations could help fuel further improvement in these indexes and lead the way to consistent upside surprises for the first time since mid-2018.

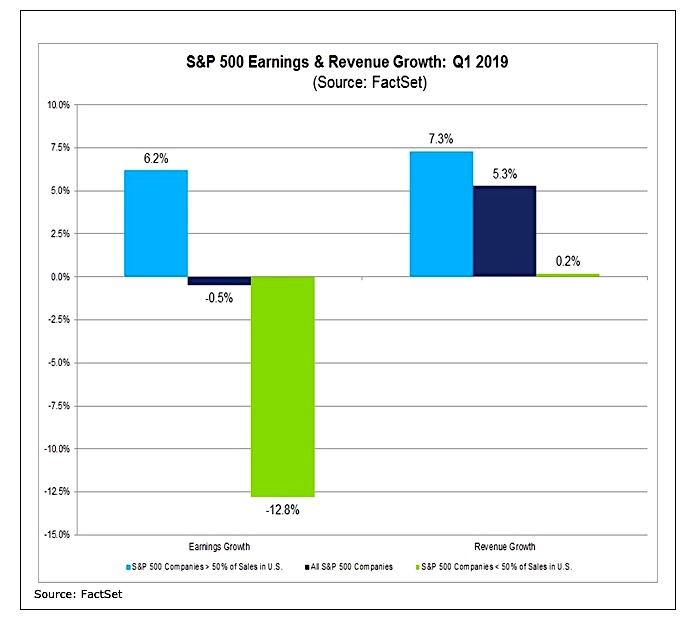

Even if global trade and policy uncertainty has more outsized effect on the relatively weaker (and more trade-dependent) global economy, the U.S. is not likely to be immune from the fall-out. While direct economic effects may be limited, it could still impact earnings and revenue growth for the S&P 500.

Looking at first-quarter results, the S&P 500 overall saw earnings fall slightly. Companies that get a majority of their sales in the U.S. saw earnings growth of over 6%, while companies that get a majority of their sales overseas saw earnings decline nearly 13%. Revenue growth in the first quarter saw a similar split. In other words, the domestic economy and domestic stocks could be negatively impacted if the global green shoots whither.

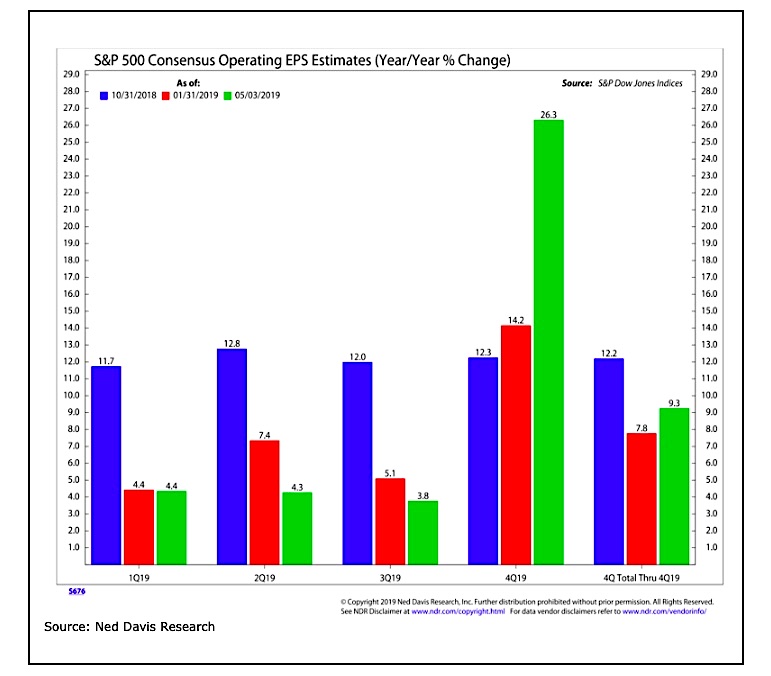

In addition to reset economic expectations, heightened uncertainty could have the benefit of reining in earnings expectations. Expectations for operating earnings growth in Q2 and Q3 have come down since the beginning of the year, but growth expectations for Q4 remain elevated. This may be more reflective of the weakness seen in Q4 2018 than overt optimism about Q4 2019.

Either way, stocks have historically fared better when earnings expectations were muted than when elevated. If economic concern now helps lower expectations for the remainder of the year, it could help provide a more favorable earnings backdrop in the second half. Positive earnings revisions that begin from a point of reduced expectations can be a strong tailwind for stocks.

Economic growth concerns can also be reflected in a reset in equity prices. Index-level movements can be noisy, especially in an environment where the market’s attention seems to jump from headline to headline. Watching trends beneath the surface can help screen out some of that noise. Sometimes this is a focus on indicators of stock market breadth (more on this below), other times it can include looking at sector-level indexes.

continue reading on the next page…