The equity markets were virtually unchanged last week against a mixed news backdrop.

The stock market has been bolstered by mostly positive earnings results and the traditional “January effect” of buying stocks that were beaten down in the December correction.

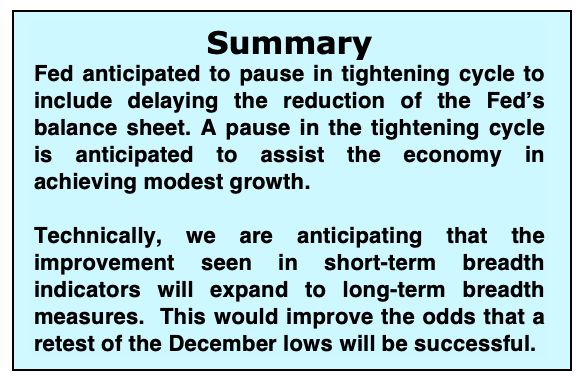

The Federal Reserve Open Market Committee will meet this week and is expected to make a decision on possibly aborting the process of reducing its bond holdings on its balance sheet earlier than expected. The Fed has been reducing its balance sheet by allowing a level of proceeds from bonds to roll off each month while the rest has been reinvested.

Markets are likely to react positively to the news as holding more U.S. Treasuries would help support the economy. This is important given that the Conference Board Leading Economic Index (LEI) shows slower growth ahead and the Bloomberg Consumer Comfort Index is down to the lowest level in six months suggesting slower consumer spending.

Reports last week showed that China’s economy grew at the slowest pace in nearly three decades in 2018. In order for the market to continue on an upward path, investors will need to feel more positive that trade worries are on the decline and global growth concerns are abating.

Comments from Federal Reserve officials have indicated they will be patient in raising interest rates helped buoy stocks in January. According to Ned Davis Research, historically a pause in the Federal Reserve tightening cycle has produced modest results with the S&P 500 Index up a median of 1.5% in the six months after the Fed quits tightening.

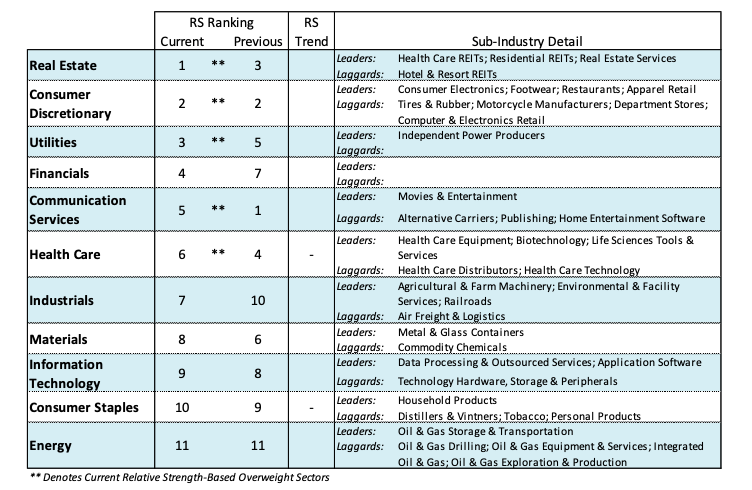

Additionally, after the Fed pauses, leadership in the stock market tends to favor value stocks over growth and small-caps over large-cap stocks with commodity and defensive sectors showing the best performance. Currently our weekly analysis suggests investors focus on the strongest areas in terms of relative strength which include utilities, consumer discretionary and communications systems.

The technical indicators suggest that further upside progress in the stock market could become more challenging. The S&P 500 has rebounded 13% from the December low but has done little to change the longer-term trend.

Since the December lows, short-term market breadth indicators improved with two breadth thrusts where upside volume overwhelmed downside volume by a ratio of 10-to-1 or more. But despite the large price rally since the Christmas Eve lows, less than 30% of the 100 industry groups within the S&P 500 Index are in defined uptrends. This would need to improve to 50% to support the thesis that a broad-based uptrend is emerging.

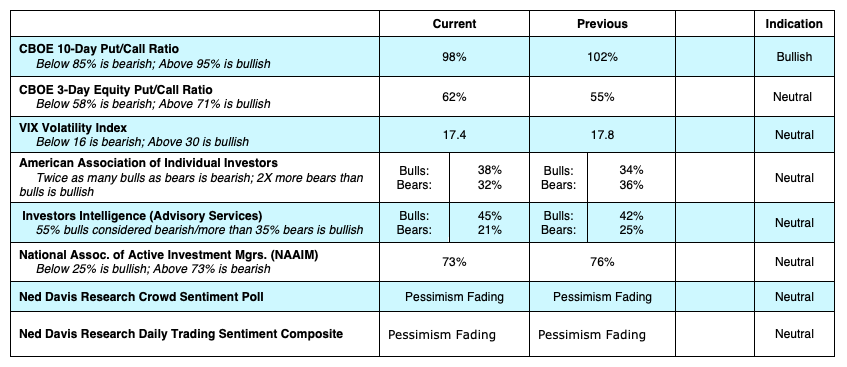

Investor sentiment measures show psychology has shifted significantly in recent weeks as pessimism has faded with optimism now creeping into the market. This can be seen in the latest data from Investors Intelligence (II), which tracks the opinion of Wall Street letter writers. The most recent II report shows twice as many bulls than bears with the bearish camp plunging to 21% down from 34% in late December. From a contrary opinion perspective, this is a negative development. In order for the longer-term bullish case to be made, the market should retest the December lows.

Twitter: @WillieDelwiche

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.