On Friday, three of the major stock market indices gapped lower ultimately closing negative for the week. The Russell 2000, although down on Friday, closed up on the week.

With the media pointing to a slew of reasons for the price drop, like negative bank earnings, slow vaccination rates, fall in retail sales, rising wholesale prices, and more, it becomes tough to discern where the market might go next.

With that said, many of the points made are valid concerns for the economic future.

Whether you want to try to buy the next dip or feel it is best to be wary of another major correction, the charts can help guide us through both situations.

Knowing and managing your risk is one of the most important parts of successful trading.

Therefore, looking back on the chart to predict future price action is key for analyzing the market’s next move.

Looking at the S&P 500 (SPY), if we can stay over the 375.40 area, we hold the support of January 4th high or the first trading day of the year.

This is an ideal place to hold, for a large correction could bring the price down to the 50-day moving average (Blue line) sitting at 365.11.

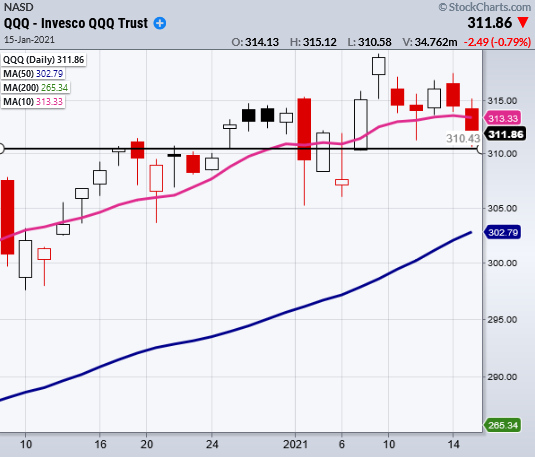

The Nasdaq 100 (QQQ) has minor support coming in around 310 with Friday’s low 310.58 and the low of 1/7 at 310.25.

The next strongest support is at 305 or the 50-DMA.

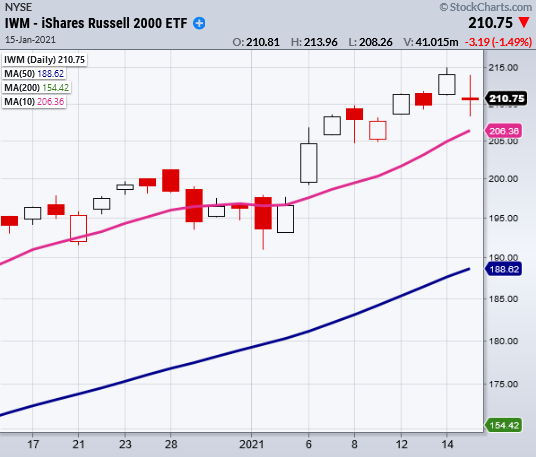

The Russell 2000 (IWM) sits with the largest space between the 50-DMA. The relative strength shows a slight overbought condition on the monthly timeframe even after Friday’s correction.

Even so, IWM had the most support throughout the day compared to the SPY and QQQ.

While it would be normal and healthy for a pullback, IWM has continued to show tremendous strength.

Friday’s doji candle (tight range day with the opening and closing prices practically the same) shows the battle between buyers and sellers is to be continued.

Mish discusses the agricultural tech space now that food commodities have blasted off. Also, she covers the rush to space. Here are actionable stocks to take advantage of as we explore the new space exploration frontier, a theme for 2021.

Key Stock Market ETF Trading Levels:

S&P 500 (SPY) Like this to hold 375.40

Russell 2000 (IWM) Doji day. 204.60 support.

Dow (DIA) Needs to get back over the 10-DMA at 308.56

Nasdaq (QQQ) 310 support. Resistance 319.39

KRE (Regional Banks) Resistance 63.82. Support 55.90

SMH (Semiconductors) 221.79 support.

IYT (Transportation) 225.80 the 10-DMA held.

IBB (Biotechnology) 158.42 needs to hold

XRT (Retail) 69.10 the 10-DMA closest support.

Twitter: @marketminute

The author may have a position in the mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.