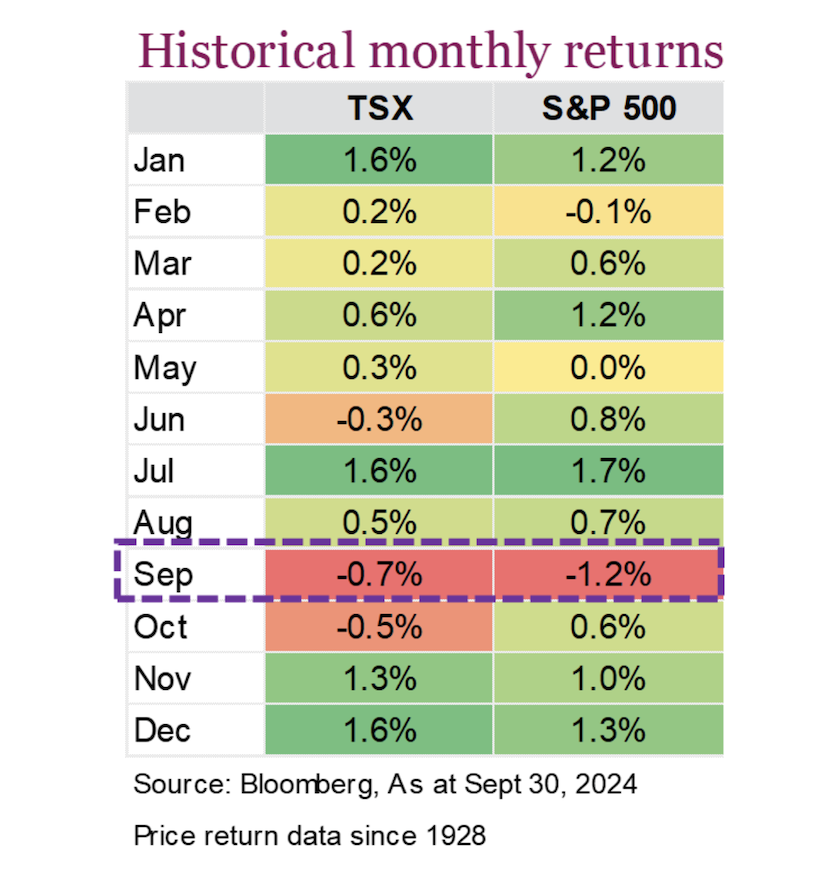

Anticipated volatility has not arrived as seasonally expected. Though markets wobbled at the beginning of the month, risk appetite and optimism came back in a hurry following the Federal Reserve jump-starting its easing cycle with a 50-basis point interest rate cut mid-month.

With more interest rate cuts on the horizon, global stock markets pushed to all-time highs this month in both Canada and the United States. The focus has now shifted towards economic data, Q3 earnings, and of course the U.S. election in November. The path ahead remains uncertain with the fog of the election all around. Regardless of the limited visibility, financial markets appear cautiously confident.

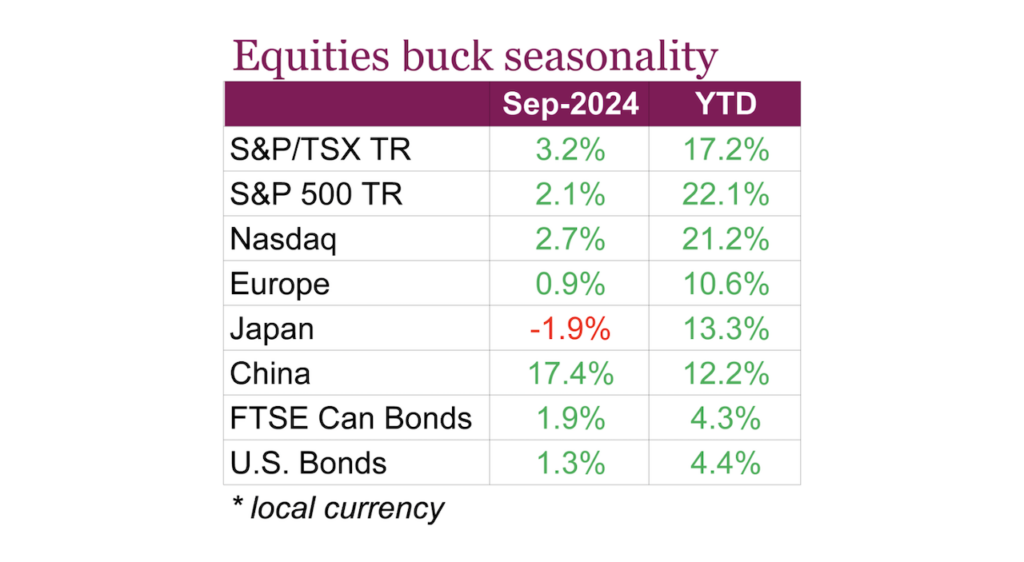

Despite historically being a tough month for markets, equities and bonds rallied in September. What’s more impressive is that equity markets were able to rebound with strong gains after falling at the beginning of the month, with the Nasdaq, S&P 500, and TSX having -5.8%, -4.2%, and -2.4% declines respectively in the first week of September.

Investor sentiment quickly shifted after the Fed’s jumbo 50 bps interest rate cut on September 18, and while recession concerns remain front of mind, there is growing confidence that the Fed will continue to loosen policy and that a soft landing in the U.S. can be achieved.

Adding to this, inflation in Canada surprised to the downside, falling to 2.0% on a y/y basis in August. The headline figure reached the BoC’s target interest rate for the first time since 2021, primarily on falling gas prices. The Bank of Canada has already reduced interest rates three times since June, bringing the overnight rate to 4.25%, however, August’s inflation data reinforced confidence that inflation is under control, leaving room for further cuts. When it was all said and done, on a total return basis, the S&P 500 finished 2.1% higher for the month while the TSX was up 3.2% and the Nasdaq up 2.8%. The S&P 500 saw its fifth consecutive month of gains and had its best start to a year since 1997, now up 22.1% YTD.

Global stocks also saw strong gains after China’s central bank made its largest-ever one-year policy rate cut, lowering the medium-term lending facility rate by 30 bps to 2%, as part of a broader stimulus package aimed at reviving its slowing economy and avoiding deflation.

This move was followed up by further measures to lower borrowing costs, boost market confidence, and help China achieve its 5% growth target for 2024. The Hang Seng Index finished the month up 18.3% while the CSI 300 closed 21.1% higher on a total return basis.

Bond markets were helped by encouraging economic data and the Fed’s rate decision, which helped both the Canadian and U.S. 2/10-year yield curve to un-invert. Global bond yield curves, which have been inverted for years, are now normalizing as central banks lower interest rates to counter slowing economies and avoid recessions. This reversal, seen in markets like the U.S., UK, Germany, and Canada, is driven by falling short-term yields as investors bet on further rate cuts.

Moreover, the steepening of yield curves reflects growing concerns over potential recessions but also hints at confidence that central banks, particularly the Fed, may engineer a soft landing for the economy. By month end, the U.S. Aggregate Bond was up 1.3% while Canadian bonds, measured by the FTSE Canada Universe Bond, was up 1.9%.

Markets are well known to ‘climb a wall of worry’ and have done that very well this year. We entered the year on the lookout for a recession and slowdown in earnings growth, but those fears have diminished, and markets have now embraced thoughts of an economic ‘soft landing’ in the U.S. which the data appears to corroborate.

Source: Charts are sourced to Bloomberg L.P., Purpose Investments Inc., and Richardson Wealth unless otherwise noted.

Twitter: @ConnectedWealth

The author or his firm may hold positions in mentioned securities. Any opinions expressed herein are solely those of the authors, and do not in any way represent the views or opinions of any other person or entity.