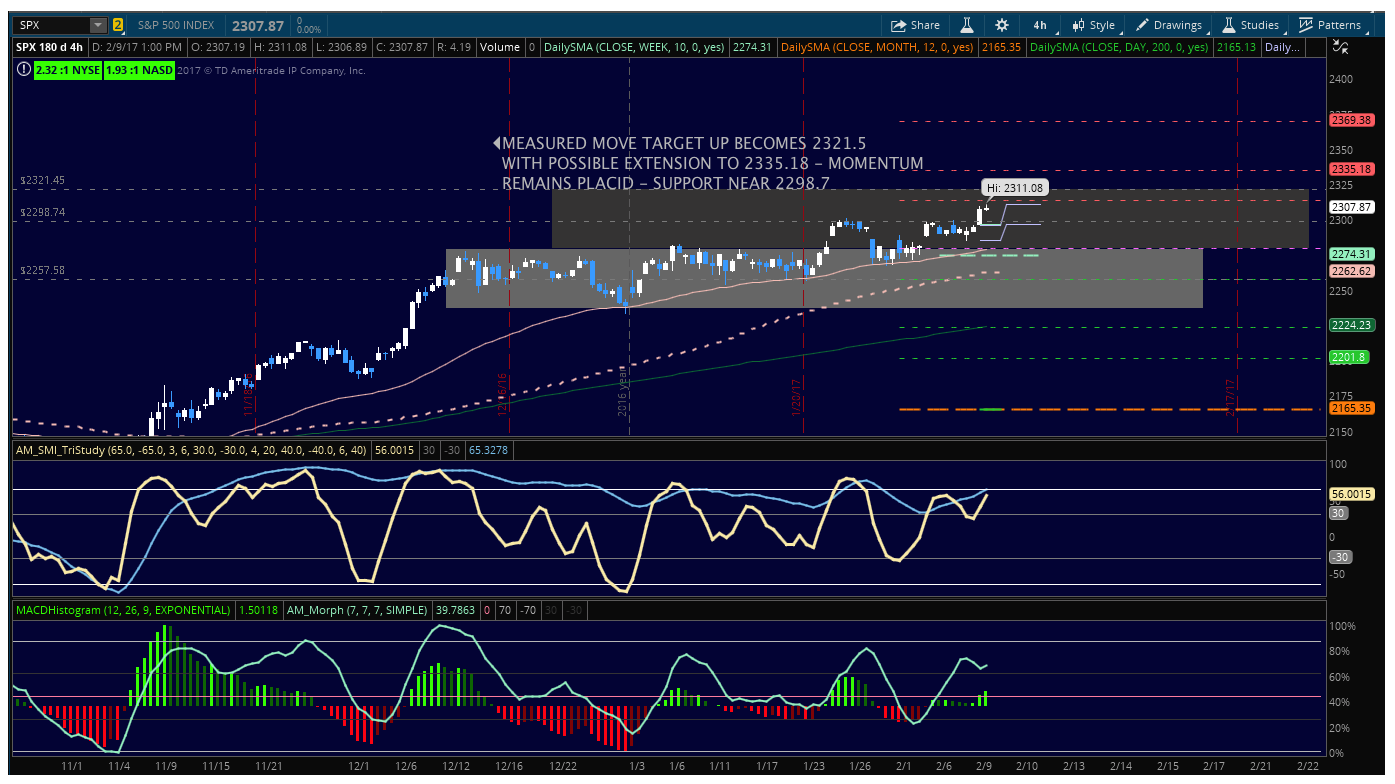

S&P 500 Futures Considerations For February 10, 2017

Tax reform news kept markets higher yesterday, and overnight gains in Europe and Asia are allowing for more gains this morning. Buying breakouts is still not the best bet for risk versus reward, but buying pullbacks has been golden. As with yesterday, pay attention to support zones on the S&P 500 (INDEXSP:.INX) and Nasdaq (INDEXNASDAQ:.IXIC) and do your best not to get caught up in what you think the market ought to be doing and what the market is actually doing.

Buying pressure will likely strengthen above a positive retest of 2309.75, while selling pressure will strengthen with a failed retest of 2297

Price resistance sits near 2309.75 to 2314.25, with 2318 and 2323.5 above that. Price support holds between 2302.25 and 2299.5, with 2297 and 2291.75 below that

See today’s economic calendar with a rundown of releases.

TODAY’S RANGE OF MOTION

E-mini S&P 500 Futures Trading Outlook For February 10

Upside trades – Two options for entry

- Positive retest of continuation level -2309.25

- Positive retest of support level– 2304.75 ( watch also for sellers near 2307.25)

- Opening targets ranges – 2290.25, 2295, 2297.25, 2299.5, 2301.75, 2304.5, 2306.75, 2309.75, 2314.25 , 2317.5, 2321 and 2323.75

Downside trades – Two options for entry

- Failed retest of resistance level -2306.5 (careful here – very countertrend)

- Failed retest of support level– 2302.75

- Opening target ranges – 2304.75, 2302.75, 2299.5, 2297, 2294.25, 2291.75, 2288.5, 2284.5, 2279.75, 2276.25, 2274.25, 2272.25, 2269.5, 2264.5, 2260.5, 2256, 2253.5 and 2249.75

Nasdaq Futures

The NQ_F advanced its bullish trend yesterday and is sitting near highs set overnight. The slope of trend is shifting somewhat, making buying the breakouts even more dangerous, but patience into support or confirmation tests of new highs, has been quite advantageous to the trader. Momentum remains slightly divergent, but buyers continue to ignore this. Use caution with size up here, and timing will become more important the longer the stretch continues.

- Buying pressure will likely strengthen with a positive retest of 5227.25 but we are near the top of the current expansion zone

- Selling pressure will strengthen with a failed retest of 5202.25

- Resistance sits near 5227.25 to 5233.5, with 5240.25 and 5246 above that

- Support holds between 5202.25 and 5197, with 5186.25 and 5180 below that

Upside trades – Two options

- Positive retest of continuation level -5217.25

- Positive retest of support level– 5210.5

- Opening target ranges – 5204.25, 5210.5, 5217.25, 5222, 5227, 5233.5, and 5240.25

Downside trades- Two options

- Failed retest of resistance level -5217.25

- Failed retest of support level– 5210.5

- Opening target ranges –5202.25, 5197, 5186.25, 5180, 5173.75, 5167.25, 5161.5, 5157.25, 5154.5, 5151.5, 5145.5, 5140.5, 5137.5, 5133.25, 5128.5, 5123.75, 5119.75, 5113.25, 5106.5, and 5102.5

Crude Oil –WTI

With the hold of 53.11 as anticipated yesterday, oil held its uptrend into resistance and is approaching the first target area upward near 53.88 where sellers had positioned well for the fade down at the last test. Support holds near 52.90, but little appears to promote a breakout event long in oil today.

- Buying pressure will likely strengthen with a positive retest of 54.4

- Selling pressure will strengthen with a failed retest of 52.9

- Resistance sits near 53.86 to 54.05, with 54.34 and 54.54 above that.

- Support holds between 52.9 and 52.63, with 52.26 and 52.06 below that.

Upside trades – Two options

- Positive retest of continuation level -53.92 (watch for sellers at 54.06)

- Positive retest of support level– 53.39

- Opening target ranges – 53.63, 53.88, 54.06, 54.19, 54.34, 54.51, 54.76, 55.02, 55.19, and 55.35

Downside trades- Two options

- Failed retest of resistance level -53.69

- Failed retest of support level– 53.2 ( watch 52.9 for buyers)

- Opening target ranges – 53.39, 53.21, 53.02, 52.9, 52.64, 52.37, 52.2, 52.06, 51.91, 51.72, 51.52, 51.22, 51.04, 50.82, 50.47, 50.3, and 50.16