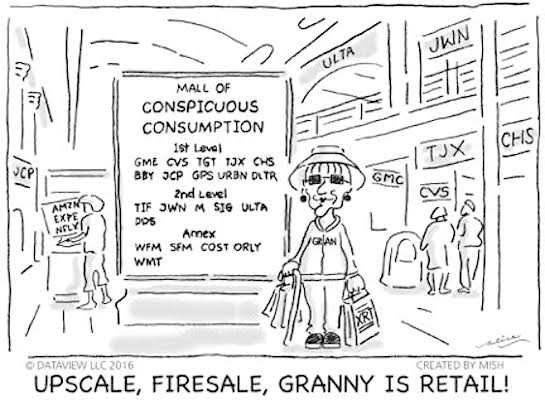

Just when you thought the market and most of the economic Modern Family were done for, along comes our senior member Granny Brick and Mortar Retail ETF (XRT).

I would not exactly call her the guardian of the inner sanctum of the stock market though.

But, with the close in XRT over the 50-DMA today, she at least fills the bill for this statement:

“Before I’d load up long on anything, I’d wait for any of these 4 (Russell 2000 IWM, Biotechnology, IBB, Retail XRT and Regional Banks KRE) to clear back over their 50-DMAs for a return from a bearish into a recuperation phase.”

I’ve been following the economic Modern Family for years.

A pattern I have not seen in a while, is Granny Retail at the lead.

Furthermore, in years past, once XRT took her cane and headed to the mall, she found herself a willing driver- the Transportation ETF (IYT).

Although premature in getting bullish, we can at least change our focus tomorrow from Semiconductors to this more reliable duo.

Both IYT and XRT are well under their 200-DMAs. XRT grazed the 50-DMA while IYT closed green, but not green enough.

The Daily charts are clear.

If Retail holds over the 50-DMA helping the Transportation sector to recover, then maybe, the market will get some end-of-the-quarter legs.

However, before you hop in your car for some retail therapy, we need to see a couple of price points clear and confirm.

First, we need to see Transportation IYT clear its 50-DMA at 184.00.

Plus, we watch for second day confirmations.

That means that XRT must close above 44.67 again.

And, if IYT does manage to fly through 184.00, we will need to see a second close on Friday above that level.

Should those confirmations occur, then you will probably see the Russell 2000 make its way up to and hold above 152.07.

Would we get bullish then?

Well, like a shop that showcases beautiful window dressing, we will consider the possibility of end-of-quarter window dressing.

And again, watch for follow through once the new quarter begins.

S&P 500 (SPY) – Want to at least see a close over 281.30 the 10 DMA

Russell 2000 (IWM) – The 50-DMA resistance is at 152.07 with support at 148.20, then 145.

Dow (DIA) – 257.35 the resistance at the 10-DMA and support at the 50-DMA or 253.65

Nasdaq (QQQ) – 178.90 is the 10-DMA resistance to clear. If cannot clear, expect more downside with 172.70 the 200 DMA

KRE (Regional Banks) – Another member of the Family showing some legs. 50.95 is the 200-week moving average and pivotal if it can manage that level by the end of the week

SMH (Semiconductors) – I’d still like to see a flush down to 100-101, but if it clears 106.25 and sticks, could halt the flush temporarily.

IYT (Transportation) – 184 or bust!

IBB (Biotechnology) – No love here right now-110.32 the number to clear should it turn around

XRT (Retail) – Unconfirmed Recuperation Phase. 44.67-the 50 DMA and the 200-WMA. Can Granny hold up?

The author may have a position in the mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.