The S&P 500 and Dow Jones Industrial Average lost just 1.0% last week. This was a victory of sorts over Europe and Japan that were down more than 5.0%. The markets are being held hostage to the uncertainty over the vote this week on whether the UK will stay or leave the European Union. “Brexit” seems to be dominating the news headlines.

The markets also suffered a blow as the head of the Federal Reserve suggested a slow approach to rate increases. Janet Yellen indicated the U.S. economy will likely remain in a slow 2.0% growth mode through 2018.

The fed fund futures market immediately reduced the prospect of a July rate increase to just 7%. As well, there is only a 24% probability the Federal Reserve will raise rates in December. Global bond yields continued to plunge last week. The yield on the German 10-year debt falling below zero for the first time in history.

In the U.S., the 10-year Treasury note fell below 1.60% for the first time since 2012. The near panic into very low yielding instruments suggests that much of the loss of confidence in the economy is already priced into the financial markets. Entering the new week, stocks are oversold and under-believed. This has been a bullish short-term configuration for most of the seven-year bull market. As a result, the 2025 area on the S&P 500 is anticipated to offer good support with an increased likelihood for another attempt to overcome the 2100 level in the weeks ahead.

The stock market remains on firm ground and continues to outpace from a technical perspective what was seen in 2015 prior to the August-September correction. Last year, the broad market was contracting, the new high list was deteriorating and only 35% of the industry groups within the S&P 500 were in uptrends. In the current example, stock market breadth remains positive and nearly 60% of the industry groups are in defined uptrends.

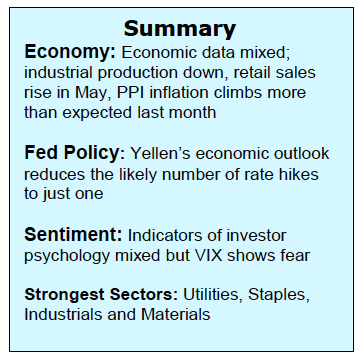

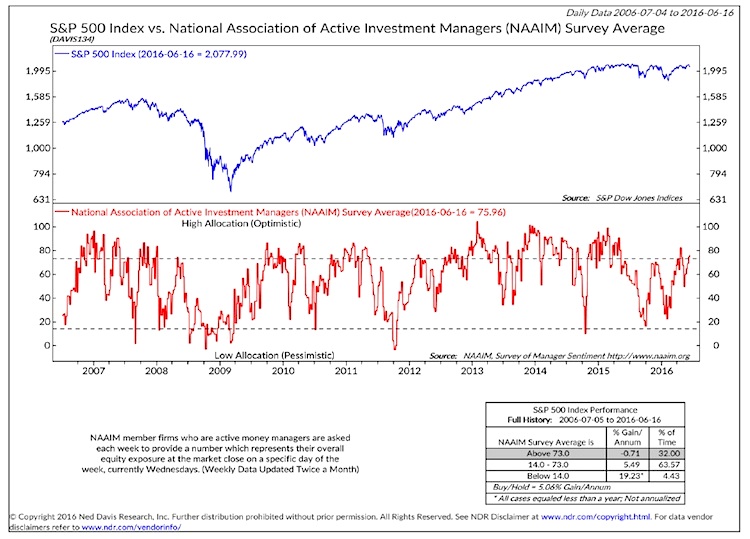

Historically, prior to a significant stock market correction, the number of stocks hitting new 52-week lows begins to expand. This is not the case in the present example as the number of issues hitting new-52 week lows has not increased while the number of stocks reaching new 52-week highs continues to expand. Encouragement can also be found from the sentiment indicators that show caution and skepticism have quickly returned. This is seen in the significant increase in the demand for put options and from the latest survey from the American Association of Individual Investors that shows more bears than bulls. Additionally, the CBOE Volatility Index (VIX), which is a reliable indicator of the mood of investors, soared the past two weeks from 13 to 22 suggesting fear has entered the building. The last time the VIX traded at these levels was near the bottom in February.

Thanks for reading.

Twitter: @WillieDelwiche

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.