The following research was contributed to by Christine Short, VP of Research at Wall Street Horizon.

- The S&P 500’s Q2 EPS beat rate has been impressive, but overall corporate earnings growth trends are less sanguine

- In focus this week are unusual events from three companies that span the sector and thematic spectrums

- Activist investors may also make their presence known among underperforming stocks as the 2023 bull market rolls on

We’re more than halfway through corporate earnings season. It’s time for a status check as many more big names report Q2 results. There’s an interesting trend the data geeks can delve into: While the EPS beat rate among S&P 500 companies is strong, just as it was over the previous period, the blended earnings growth rate for large-cap US stocks has actually dipped lower. Second-quarter per-share profits are seen as having fallen by 7.3% through last Friday, according to FactSet. That is worse than what analysts projected back on June 30 (-7.0%).¹

The Good Times Are Here. Are Better Earnings Quarters Ahead?

Still, the consensus is that the April through June stretch will mark the cycle low in corporate profits. And there’s more good news for the bulls – full-year 2023 and 2024 S&P 500 EPS forecasts have crept up just modestly with next-12-month earnings total summing to $236 and change on a per-share basis. But with stocks settling higher for a third straight week on July 28th, forward valuations are not exactly in the cheap camp. FactSet also notes that the projected P/E is now 19.4x. The tech sector accounts for much of the valuation premium considering its 27.4x estimated earnings multiple is at a more than 20% premium to its 5-year average just above 22x.

We continue to put a spotlight on areas away from the glamour stocks, but we do see unusual activity in one ‘super’ hot AI-related company.

Shedding Light on a Late Confirmation Timing Event

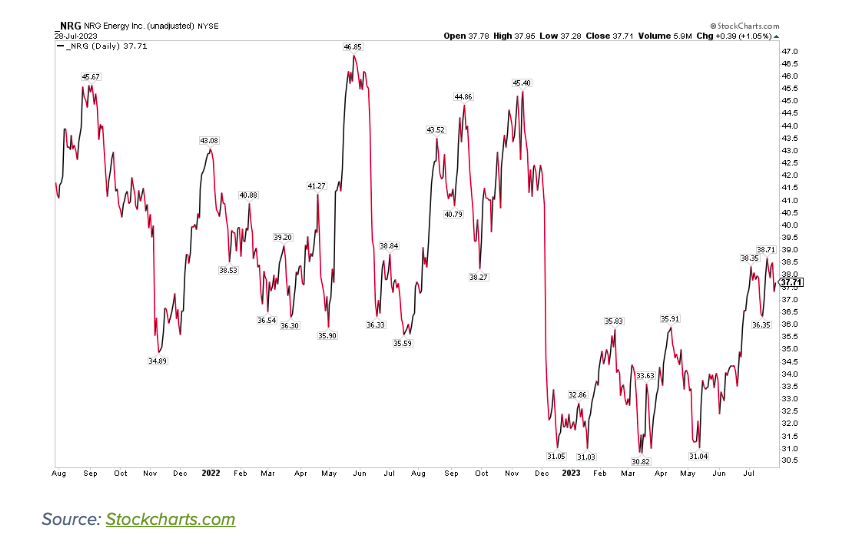

Keeping with last week’s theme of cyclicals and value equities, NRG Energy (NRG) has been powering higher over the last handful of weeks. The Electric Utilities industry company within the Utilities sector is based in Houston and trades at a very low 6.1 forward operating P/E ratio. The company has also been in the news lately for some activist investor chatter: Elliott Management has been calling for a new CEO to take the helm along with a boardroom shakeup. Elliott already has a $1.0 billion stake in the $8.6 billion market cap utility, and it demands better growth. Current CEO Mauricio Gutierrez could come under pressure if bottom-line results continue to run soft – recent quarterly EPS figures have been weak relative to expectations.

Wall Street Horizon expected NRG to issue results on Thursday, August 3, based on historical reporting trends. However, the company confirmed a later date of Tuesday, August 8 BMO. Both the earnings announcement date and the confirmation date were a week later than expected. Be on guard for potential news on the activist situation and possible further negative figures in the upcoming release.

NRG: Shares Rally After Holding $30 in May, About Flat YoY

Delayed Earnings: Do Not Pass Go, Do Not Collect $200?

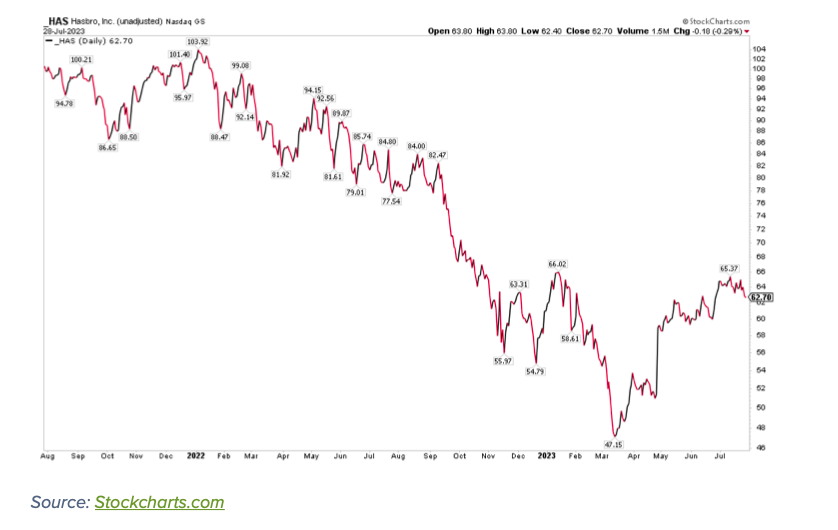

Before NRG’s big day, investors will be toying around with one household Consumer Discretionary name. Hasbro (HAS), a $8.7 billion market cap company headquartered in Rhode Island, has, like NRG, been on the ascent following a tough previous six months. The turnaround story hopes to continue when it reports Q2 numbers this Thursday morning. But will the Furby-trade bring about fun for the bulls? Or will they throw a tantrum? Again, let’s see what unusual corporate event activity our team spots.

The S&P 500-listed company delayed its earnings report, unfortunately for the bulls. On July 18, Wall Street Horizon updated its earnings date from July 18 unconfirmed to July 27 unconfirmed. The next day, though, Hasbro confirmed Q2 numbers to be released on Thursday, August 3, resulting in a later-than-usual reporting date. Does Hasbro’s management team have some Magic up its sleeve, or will the Q2 report be one for the Dungeons & Dragons? Clues point to the bearish side.

HAS: A Sorry! 1-Year Performance, But Shares Charged Up Since March

Bullish Preliminary Earnings from SuperMicro

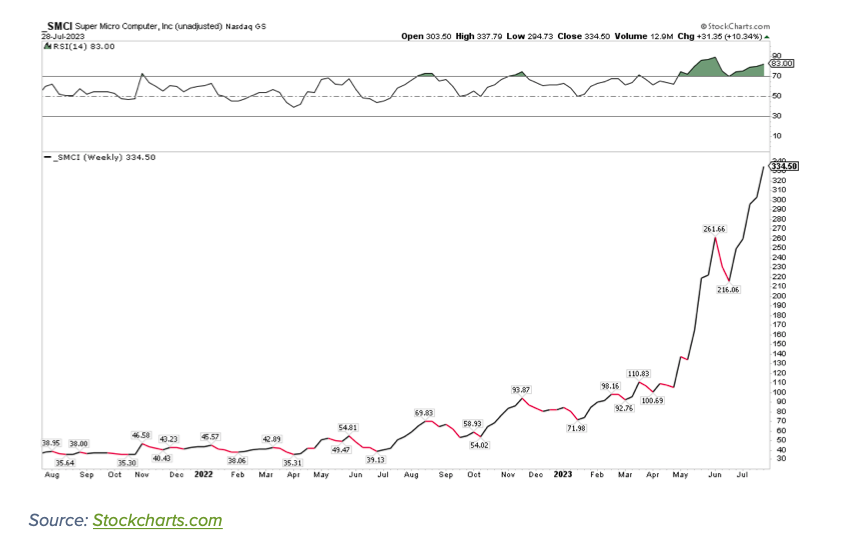

We couldn’t stay away from the AI theme for too long. One of the biggest beneficiaries of the white-hot theme is SuperMicro Computer (SMCI). Twice the size of NRG and Hasbro, the $17.2 billion market cap Technology Hardware, Storage, and Peripherals industry company within the Information Technology sector boasts just about the strongest momentum you’ll find across the global stock market.

Since ChatGPT’s November 30, 2022, launch, shares are higher by 270%. As of last Friday, its weekly Relative Strength Index (RSI) 14-day reading, a measure of how strong a stock’s price action has been relative to its own history, was at an extremely lofty 83 level. To say traders and thematic investors have been piling into this AI name is an understatement.

AI Boom: SMCI Up 3-Fold Since Early May

Like last quarter, SMCI issued preliminary earnings. On July 20, shares dipped 4% even though the firm said that it expects to post higher Q4 2023 revenue compared to its previous guidance. Net sales are now seen in the $2.15 billion to $2.18 billion range versus the prior $1.7 billion to $1.9 billion range. GAAP and non-GAAP EPS targets were also increased.

Perhaps some profit-taking was top of mind among investors, or maybe Taiwan Semi’s lackluster Q2 earnings results cast dark clouds over the entire chip and AI space that day. Since the preliminary earnings guidance, SMCI has ripped higher by better than 15%, so buying the dips has been a winning play. Be on guard for volatility around its complete Q4 report on Tuesday, August 8 AMC.

The Bottom Line

The bulls remain in charge. That goes for growth sectors, cyclical stocks, and the value style. Still, investors must be mindful of what signals individual companies are passing along through corporate event activity. Unusual earnings events can impact option pricing and suggest possible moves post-reporting. There’s a lot to consider as we progress through the back half of the Q2 reporting period.

For more information on the data sourced in this report, please email: info@wallstreethorizon.com

Wall Street Horizon provides institutional traders and investors with the most accurate and comprehensive forward-looking event data. Covering 9,000 companies worldwide, we offer more than 40 corporate event types via a range of delivery options from machine-readable files to API solutions to streaming feeds. By keeping clients apprised of critical market-moving events and event revisions, our data empowers financial professionals to take advantage of or avoid the ensuing volatility.

Christine Short, VP of Research at Wall Street Horizon, is focused on publishing research on Wall Street Horizon event data covering 9,000 global equities in the marketplace. Over the past 15 years in the financial data industry, her research has been widely featured in financial news outlets including regular appearances on networks such as CNBC and Fox to talk corporate earnings and the economy.

Twitter: @ChristineLShort

The author may hold positions in mentioned securities. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.