- Q4 S&P 500 EPS growth expected to come in at 13.2%, the highest growth rate in three years

- Large cap outlier earnings dates this week include: AMD, JNPR, HON, ALGN

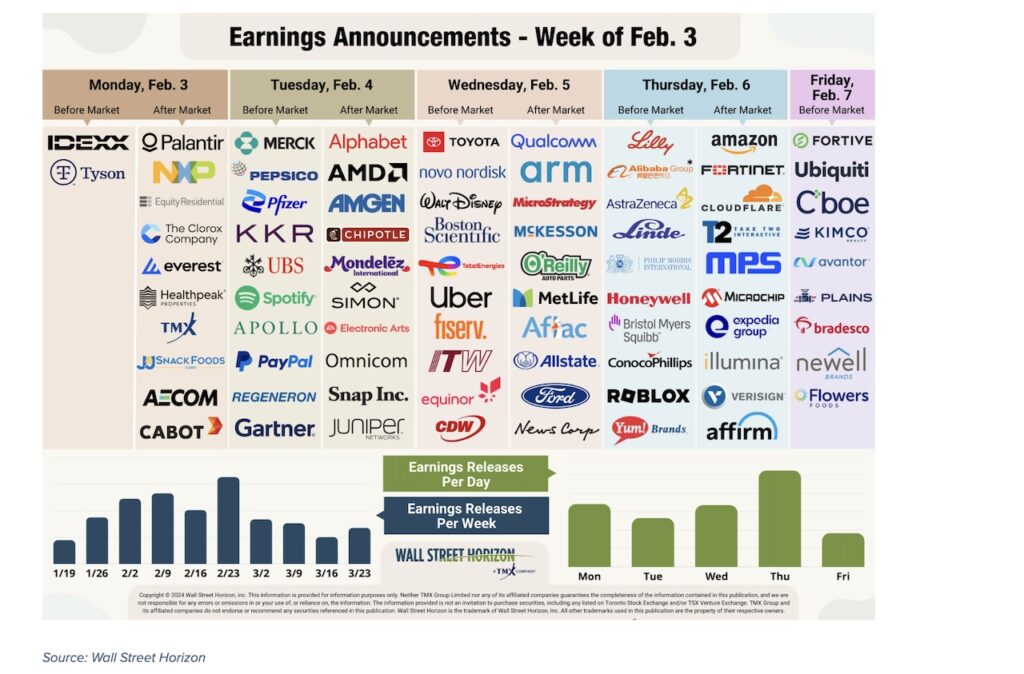

- Peak season begins this week and runs through February 28

The Magnificent 7 kicked off fourth quarter reporting in a similar fashion to the Q3 season. Tesla once again missed expectations when they reported on Wednesday, on both the top and bottom-line this time (vs. only missing on revenues in Q3), yet investors seemed unbothered.1 While the stock initially fell, it ended up ~8% by the end of the week.

After struggling through the first half of 2024, Tesla’s shares began to improve in the second half of the year, and then rose even more after Donald Trump was elected US president in November. Tesla’s CEO Elon Musk’s close relationship with the president and his position as the leader of the newly created Department of Government Efficiency, has led investors to believe there are more favorable policies and less oversight of EV companies which would benefit Tesla.2

Microsoft also followed a similar pattern to last quarter, beating on the top and bottom-line, but issuing light revenue guidance once again which led to investors taking the stock down over 9% in the following trading session.

The only name to buck the trend on Wednesday was Meta, while softening user growth led to a decline in the stock after the Q3 report, the company impressed shareholders in Q4 by reporting a 21% increase in quarterly revenue.3 Furthermore, Meta’s continued investments in artificial intelligence throughout its social media properties appears to be paying off, and further investments to the tune of $60 – $65B are planned this year.4 CEO Mark Zuckerberg said he expects Meta AI to reach a billion users in 2025.5

Apple continued the party on Thursday, reporting revenues that grew 4% YoY thanks to a boost from the Services segment.6 This as well as a guidance for “low to mid single digit” sales growth for their fiscal Q2 helped investors look past the continuing deceleration of iPhone sales, mostly due to weakness in China.7 The stock rose 3% after the report.

But all wasn’t well in AI land last week, as Chinese-based DeepSeek unexpectedly released a cheaper, more nimbly built generative AI tool akin to ChatGPT.8 Details on how it was built are still being sorted, but it came at the expense of Nvidia shares which tumbled 17% by the end of the US trading day last Monday. This marked the largest one-day percentage loss for NVDA going back to March 2020, but the market cap loss of $600B was the steepest in US history.9 Nvidia will report Q4 earnings on February 26.

Overall the Q4 earnings season continues to come in better-than-expected. That has thrust quarterly growth to 13.2% according to FactSet, the best rate in three years, with revenue growth trailing behind at 5%.10

On Deck This Week

Big tech continues their reporting this week when Alphabet releases results on Tuesday, and Amazon on Thursday.

Outlier Earnings Dates This Week

Academic research shows that when a company confirms a quarterly earnings date that is later than when they have historically reported, it’s typically a sign that the company will share bad news on their upcoming call, while moving a release date earlier suggests the opposite.11

This week we get results from a number of large companies on major indexes that have pushed their Q4 2024 earnings dates outside of their historical norms. Seventeen companies within the S&P 500 confirmed outlier earnings dates for this week, thirteen of which are later than usual and therefore have negative DateBreaks Factors*. Those names are Advanced Micro Devices (AMD), Pentair (PNR), Fair Isaac Corp (FICO), Juniper Networks, Inc. (JNPR), Hologic Inc (HOLX), Cencora (COR), Align Technology (ALGN), Corteva (CTVA), Johnson Controls International (JCI), Xcel Energy (XEL), Honeywell International (HON), Aptiv (APTV) and MarketAxess Holdings (MKTX). The four names with positive DateBreak Factors are Everest Re Group (EG), Healthpeak Properties (DOC), Willis Towers Watson (WTW) and IQVIA Holdings (IQV).

Advanced Micro Devices

Company Confirmed Report Date: Tuesday, February 4, AMC

Projected Report Date (based on historical data): Tuesday, January 28, AMC

DateBreaks Factor: -2*

* Wall Street Horizon DateBreaks Factor: statistical measurement of how an earnings date (confirmed or revised) compares to the reporting company’s 5-year trend for the same quarter. Negative means the earnings date is confirmed to be later than historical average while Positive is earlier.

Advanced Micro Devices is set to report their Q4 2024 results on Tuesday, February 4, a week later than expected. While they are still adhering to their Tuesday reporting trend, they have pushed their report into the 6th week of the year (WOY), after reporting in the 5th WOY for the last two years. This will be the latest AMD has reported for Q4 in ten years, and only the second time they have reported in February.

AMD, along with the rest of the chip sector, had a rough go early last week due to worries over the AI app DeekSeek. The bad luck continued when AMD’s stock was downgraded by Melius Research on Tuesday due to concerns around stiff competition, primarily from Nvidia.12 This comes after a flurry of other downgrades in the past few months from analysts at Wolfe Research13, Bank of America14, HSBC15, and Goldman Sachs16.

Juniper Networks

Company Confirmed Report Date: Tuesday, February 4, AMC

Projected Report Date (based on historical data): Tuesday, January 28, AMC

DateBreaks Factor: -3*

Juniper Networks is set to report their Q4 2024 results on Tuesday, February 4, a week later than expected. While they are still adhering to their Tuesday reporting trend established over the last two years, they have pushed their report into the 6th week of the year (WOY), after reporting in the 5th WOY or even the 4th WOY for the past decade. This will be the latest JNPR has reported for Q4 in ten years, and the first they have reported in February.

Oftentimes companies delay earnings reports when working through a merger or acquisition. That could possibly be the reason for JNPR’s late earnings date, as Hewlett-Packard announced a $14B bid for the company back in January 2024.17 Just this week, however, that deal was blocked by the US Department of Justice, on concerns that joining the second and third-largest wireless networking providers would reduce competition and innovation in the industry.18

Q4 Earnings Wave

With the Q4 season getting started a little later this year, the peak weeks are expected to fall between February 3 – 28, with each week expected to see over 1,200 reports. Currently, February 27 is predicted to be the most active day with 872 companies anticipated to report. Thus far, only 61% of companies have confirmed their earnings date (out of our universe of 11,000+ global names), so this is subject to change. The remaining dates are estimated based on historical reporting data.

Twitter: @ChristineLShort

The author may hold positions in mentioned securities. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.