By now I am sure you have heard how horrible September usually is for the markets.

Indeed, the start of September looks a lot worse than it did at the end of August.

Nonetheless, be careful trading on adages.

And be careful not to become too extreme in sentiment.

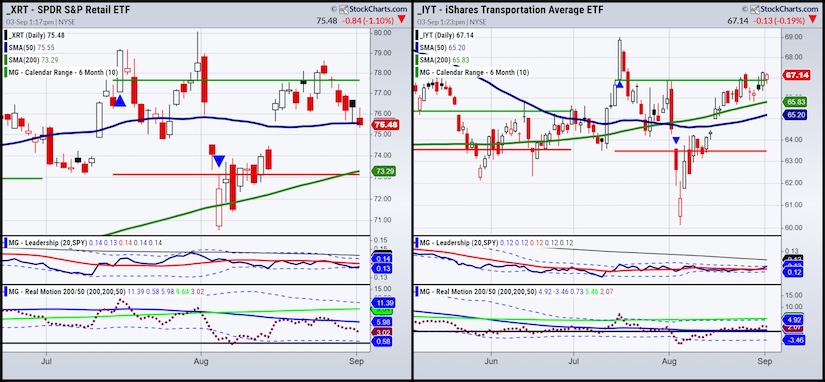

NASDAQ is down, true, but the Retail Sector ETF (XRT) is trying to hold around the 50-Day Moving Average (DMA).

The Transportation Sector ETF (IYT) is well above the 50-DMA and holding the July 6-month calendar range high.

You have to look at the inside sectors for perspective.

On another note, since we are in a new season, I thought this a good time to also make my daily market updates more consistent in terms of themes for each day.

Hence, going forward:

Technical Monday-that will feature a technical setup that looks interesting

Turnaround Tuesday-this will cover a stock, sector, commodity that either turned direction up or down, or looks to be ready to do so soon

Hump Day Wednesday-this Daily will focus on the midweek setup with expectations for the remainder of the week

Thursday-no Daily that day

Finale Friday-as per usual, we will cover the week’s performance in the Economic Modern Family and how to plan for the upcoming week.

Since today is Tuesday, the turnaround theme looks obvious with the sell off, especially in tech, but what else looks ripe for a turnaround?

Here are two stocks to look at.

In the true spirit of turnaround Tuesday, the 2 stocks I am featuring are both very beat up, which would make the turnaround quite spectacular if happens.

Full disclosure, we have no position in either of these stocks.

Stratasys (SSYS) is a 3-D printing company. The stock peaked in July 2023 and has had a massive move lower.

After a gap lower post earnings, the stock reversed that same day and now is trading within the range that day (2 trading days ago).

We like 3-D printing and yet, the companies are perhaps the worst in turning profits.

If SSYS leaves an island bottom, we will be keen to see follow through.

MP Materials (MP) reported and announced a huge buyback program. This company mines rare earth minerals.

Another one in a downtrend since April 2022, we like the bullish divergence on our Real Motion momentum indicator.

Therefore, we will watch for a phase change should the price clear back above the 50-DMA (blue line).

Twitter: @marketminute

The author may have a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author and do not represent the views or opinions of any other person or entity.