Despite the rise of variants, higher yields and structural wobbles in pockets of the market (GameStop + possibly the largest margin call in history), the stock market and the world is in a better place than it was 3, 6, 9 and most certainly 12 months ago.

Vaccine rollouts continue to inject a little market optimism with each jab. Yields are rising for good reason, the economy is improving. Earnings growth is back and we are finally seeing a more healthy rebalancing from growth dominance to a period of value outperformance.

Don’t worry we haven’t gone all ‘pompom shaking bullish’ on you, but even with the S&P 500 at 4,000 and the TSX at 19,000, we still see upside this year in equities. The economic recovery is pretty much in the bag which will help earnings continue to growth, making the current elevated valuations a bit more tenable.

Yields, if they rise too far or too fast, could very easily trigger a risk-off episode or a correction. We believe this would be one of the potential buying opportunities of 2021 as there’s simply too much stimulus and economic momentum to trigger an extended bear market.

The true bear market is out there though, lurking as always, but we believe there is plenty of time. The warning signs could be inflation rising enough that central banks pivot into a tightening behaviour. That’s a long ways off as inflation hasn’t started to rise and the banks remain steadfast on leaving things accommodative for longer.

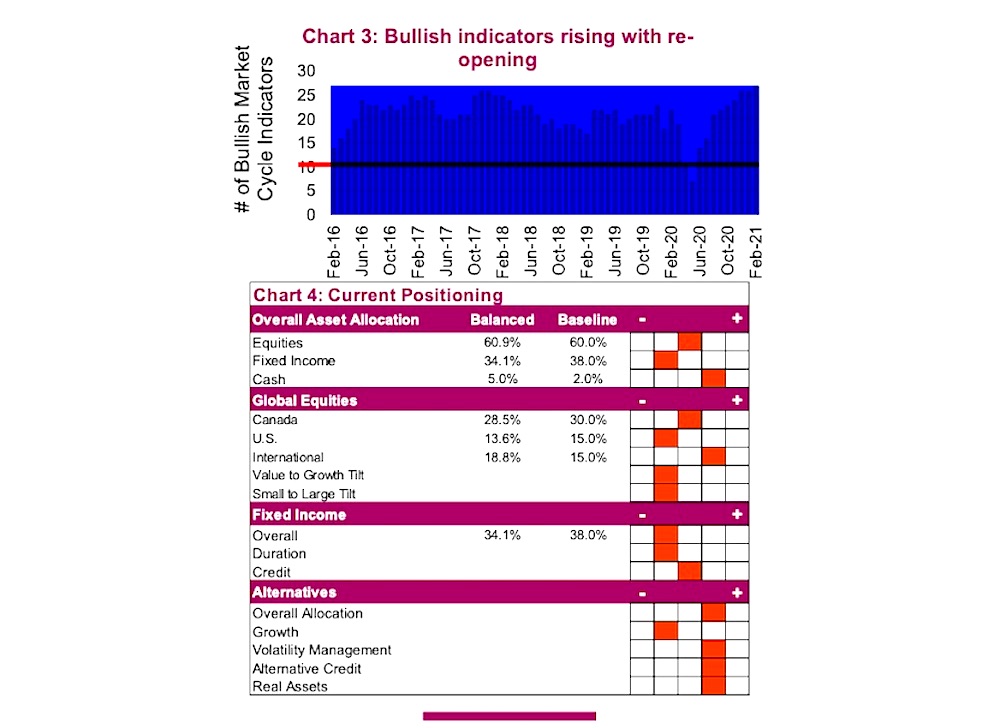

Market cycle indicators have rebounded strongly with momentum with global & North American economic indicators and rates largely positive. Valuations metrics remain the source of the few bearish indicators. There is a lot of economic momentum out there.

Positioning

Despite a positive outlook, we remain roughly at our baseline equity allocation. We expect we’ll add more if a yield-induced pullback materializes. Within equities we have an underweight in the U.S., market weight in Canada and overweight globally. Within these allocations we are more value and smaller cap tilted.

Bond allocation is underweight, less duration and more neutral credit exposure. Credit is balanced across investment grade, some high yield and preferreds.

We have leaned more towards alternative credit given low yields and risks of continued rising yields from these levels. Plus, we are using alternatives as a source for portfolio stability among the volatility management mandates. Again, as we believe traditional bond allocations will be challenged in the near term, limiting their defensive contribution.

Overall, reasonable exposure should markets continue to climb but also enough thoughtful defense and dry powder in case there is a wobble along the way.

Source: Charts are sourced to Bloomberg L.P. and Richardson Wealth unless otherwise noted.

Twitter: @ConnectedWealth

Any opinions expressed herein are solely those of the authors, and do not in any way represent the views or opinions of any other person or entity.