While we clearly have some tempered optimism for 2020 from current price levels in the stock market (and bond market) – see our article on Valuations, Spreads, and Politics – it is not all bad news.

There are a number of encouraging signs that the slowing pace of global economic growth is at least stabilizing or dare we say improving.

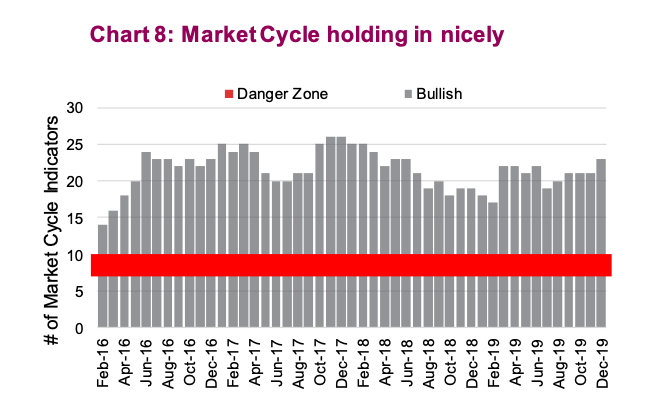

Equally encouraging is our Stock Market Cycle Framework. This multi-disciplinary model that incorporates over 30 market indicators / signals from North Amercian and global economic data, sentiment, momentum, valuations, rates and fundamentals continues to remain healthy.

With 23 bullish market signals, this is the most since mid 2018 (see chart above).

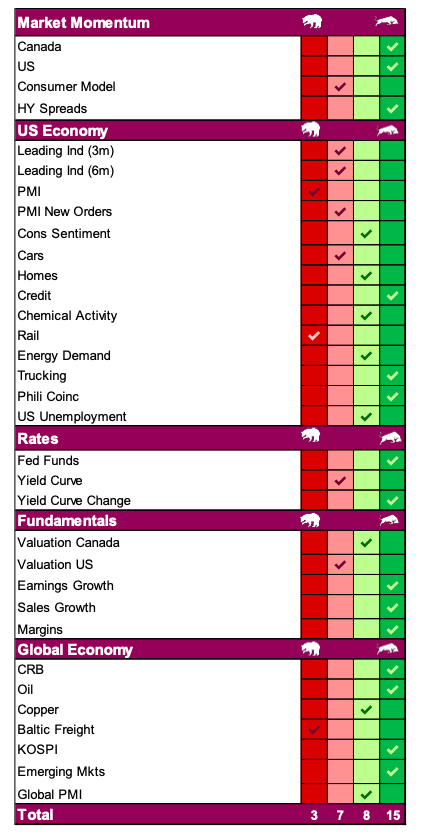

Market momentum remains supportive, which is not too surprising. The U.S. economic indicators have shown some signs of improvement in consumer sentiment and transportation demand.

The global economic signals are largely positive and the market fundamentals remain good.

On the rate side, while the flat yield curve is negative, it has been getting steeper which is good news. The yield curve, which inverted for a number of months in 2019, remains a concern for the health of the market cycle.

Historically, an inverted yield curve has been a precursor of a recession and even though it has steepened, this doesn’t mean there isn’t a recession on the horizon.

Taken as a whole, our Market Cycle remains positive for a continuation of the current bull market. That doesn’t rule out a correction but does imply if we see one, it could prove to be yet another buying opportunity in this aging bull market.

Charts are sourced to Bloomberg or Richardson GMP unless otherwise stated.

Twitter: @ConnectedWealth

Any opinions expressed herein are solely those of the authors, and do not in any way represent the views or opinions of any other person or entity.