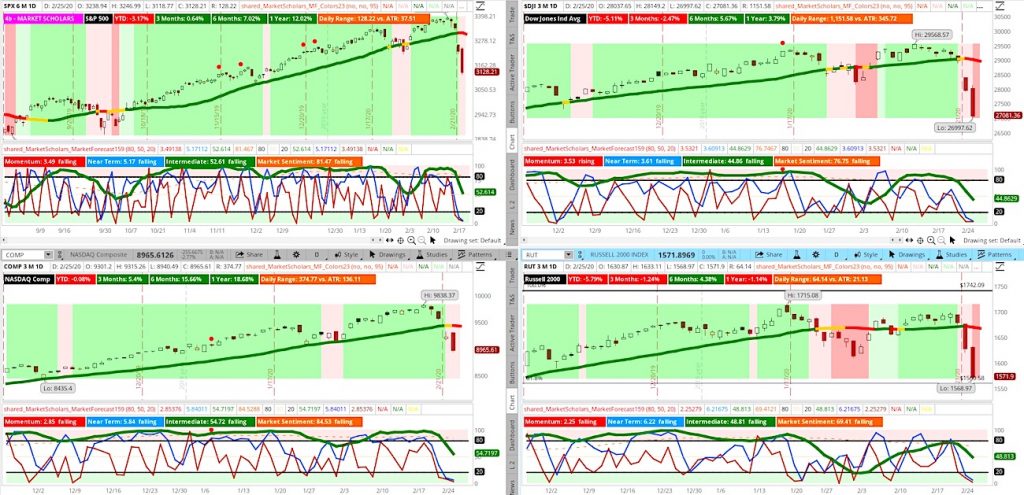

The S&P 500 Index has fallen quickly to Fibonacci retracement support levels at half the prior bullish intermediate run that started off the October low.

This has caused short-term trading sentiment to hit extreme lows.

While the stock market may bounce in the short term in the next day or two, there’s a good chance we’ll not only re-test lows but form a divergent low near the top of the Volume Profile value area near 3,000.

In the past four days, the S&P 500 has dropped more than seven percent. This has signaled extreme lows in the past.

Again, short-term pops are likely but not necessarily new bullish intermediate runs yet. Also, the S&P 500 is more than 5% below the 30-day simple moving average.

This pattern is another example of an extreme low that leads to quick, short bounces – especially with little volume resistance above us.

The VIX Volatility Index traded slightly above 30 on an intraday basis and closed more than 115% above the $VIX3MO. This pattern usually suggests a long-term Market Sentiment pullback, which suggests we may be in the pullback process for a couple of months – a process that includes multiple quick bounces with re-tests of this extreme bottom we’re forming right now.

The trading range and volume hit extreme levels the past two days. This is another indication that we’re going to set the low near this area but we may in a bottoming process for a lengthy period of time.

Long-term bond yields and gold prices continue to show levels that indicate while we may have a lengthy pullback in terms of time, we are most likely not headed towards a bear market or recession. This suggests that once we form the low, we can bounce into a new long-term run into the end of the year.

Get market insights, stock trading ideas, and educational instruction over at the Market Scholars website.

Stock Market Video – February 26, 2020

Twitter: @davidsettle42 and @Market_Scholars

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.