Investors tend to follow the Dow Jones Industrial Average and Dow Jones Transportation Average to gauge the economy and the popular stock market signal, “Dow Theory”.

Though laggards this year, both indices remain important and may be nearing a crossroads.

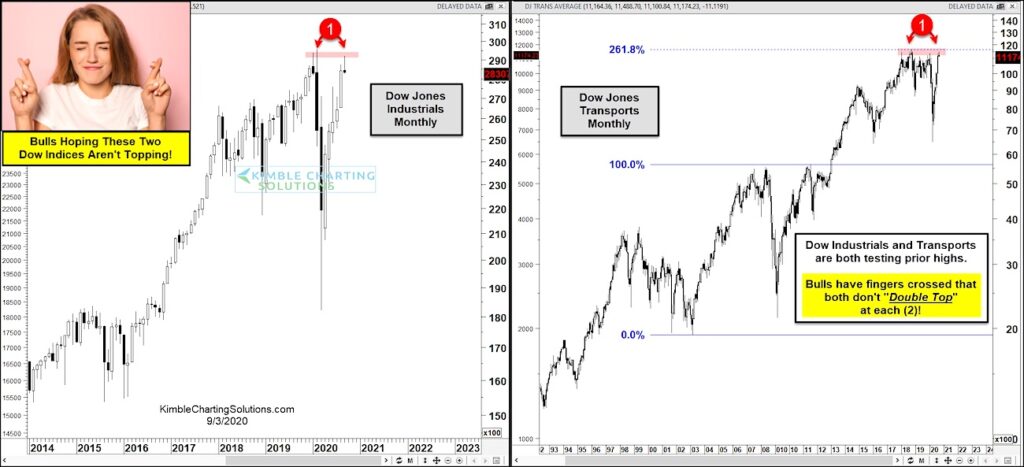

In today’s 2-pack, you can see that these popular stock averages have rallied back to test their respective highs at each (1).

In fact, the Dow Transports are testing dual resistance (prior highs and 261.8 Fibonacci extension level).

As well, the Dow Industrials have been susceptible to past “monthly” reversals from this price area.

So a reversal this month would raise the prospect for “double top” patterns. Let’s just say that stock bulls are hoping these Dow Indices are not double topping!!

Dow Jones Industrial Average and Transportation Average Charts

Note that KimbleCharting is offering a 2 week Free trial to See It Market readers. Just send me an email to services@kimblechartingsolutions.com for details to get set up.

Twitter: @KimbleCharting

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.