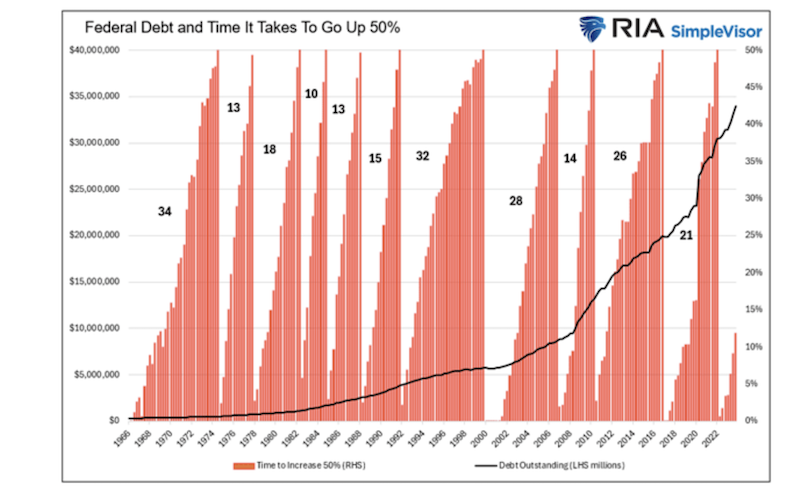

Since the pandemic-related bazooka of fiscal stimulus, the outstanding Federal debt has risen appreciably. In nominal dollar terms, the recent debt surge is mindboggling.

However, the increase is on par with the government’s negligent ways over the last fifty years.

The red bars show the percentage increase in debt starting in 1966. The bars reset to zero every time they hit 50%. The numbers to the left of each series of bars correspond to the number of quarters it took for every 50% increase.

Over the last sixteen quarters, 2020 through 2023, the outstanding federal debt has risen by 46%. Of the 11 times the debt has increased by 50% since 1966, five occurred over 15 quarters or less.

That said, the repercussions of relying on stimulus for economic growth and growing debt faster than the ability to pay for it have significant economic consequences. The recent surge in debt will only further handicap our economy and prosperity in the future.

There are predominantly two ways our growing debt load negatively impacts economic growth, as we will share.

#1 Manipulated Interest Rates Cripple Capitalism

Growing debt faster than one’s income is a Ponzi scheme. No matter how politicians sugarcoat fiscal stimulus, there are no two ways around such a characterization. Individuals and corporations that run such a scheme ultimately end up bankrupt. The same holds for governments, but they tend to have much longer runways.

The Federal Reserve allows the government to perpetuate its Ponzi scheme. The Fed keeps borrowing costs lower than they should be through lower-than-market interest rates and asset purchases.

Not only is the growing ratio of debt to income problematic, but it is also a sure sign that the debt in aggregate is used for unproductive purposes. In other words, the debt costs more than the financial benefits it provides. If it were productive debt, income or GDP would rise more than the debt.

In the long run, unproductive debt reduces a nation’s productivity, aka economic potential.

Negative Real Rates And QE

A lender or investor should never accept a yield below the inflation rate. If they do, the loan or investment will reduce their purchasing power.

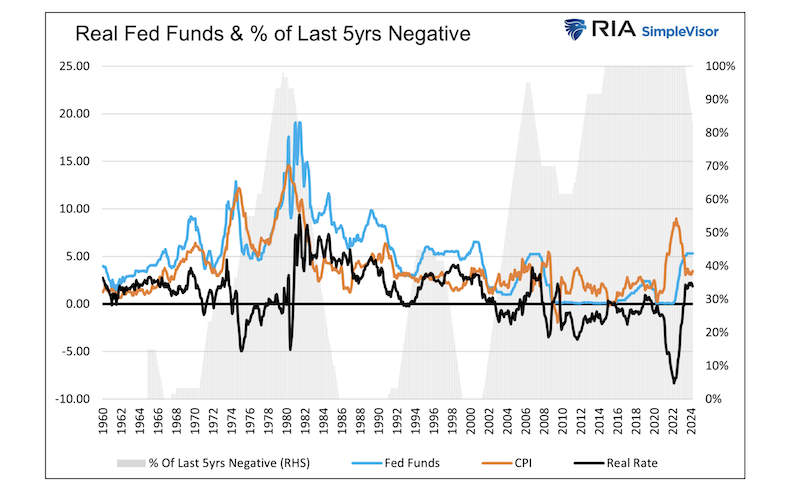

Regardless of what should happen in an economics classroom, the Fed has forced a negative real rate regime upon lenders and investors for the better part of the last 20+ years. The graph below shows the real Fed Funds rate (black). This is Fed Funds less CPI. The gray area shows the percentage of time over running five-year periods in which real Fed Funds were negative. Negative real Fed Funds have become the rule, not the exception.

Starting in 2008, with QE, the Fed began using its balance sheet to manipulate interest rates further. Currently, the Fed holds $8 trillion in Treasury and mortgage-backed securities. Their Treasury holdings account for almost 25% of all Treasury securities outstanding to the public.

By reducing the supply of bonds on the market, they effectively lower interest rates below where the free market would price them. This makes fiscal stimulus more appetizing for politicians and, by default, encourages even greater federal debt loads.

Like the Fed’s negative real rate interest rate policy, QE also reduces interest rates, allowing for more unproductive federal and private sector debt.

#2 Negative Multiplier

As we note, debt increasing faster than economic growth proves that borrowing and spending are unproductive. Unproductive government debt or private sector debt also results in a negative economic multiplier. Essentially, the ultimate expense of the debt outstrips its benefits over the long run.

Economists define the multiplier effect as the change in income divided by the change in spending. Over an extended period, if the change in spending is more significant than the change in income, the effect of said spending is negative. Replace GDP for income and government debt for spending to compute the government’s spending multiplier.

Multiplier = Change Income / Change Spending

Government Multiplier = Change GDP / Change Debt Outstanding

To help appreciate the negative multiplier, let’s consider the two rounds of stimulus checks sent to the public during the pandemic. Consumers and businesses spent a large percentage of the funds on goods or services that no longer provide economic benefit. The initial result of the direct stimulus was a massive boost to economic activity. Three to four years later, the economic growth spurt is finished, and the debt and its annual interest costs remain. The interest on the debt is capital that will not be put to productive use.

Yesterday’s tailwind is slowly becoming tomorrow’s headwind.

There are other economic considerations as well.

Ricardian Equivalence

This economic theory states that when individuals anticipate tax increases to finance current and future government spending, they increase their savings to offset the expected tax burden. Therefore, any increase in government spending financed by debt may not stimulate consumption and investment, potentially resulting in a negative multiplier effect.

Crowding Out

High levels of government borrowing can lead to crowding out of private investment. This occurs when government borrowing forces higher interest rates, making it more expensive for businesses and individuals to borrow for investment. Further, as banks are asked to hold more government debt, they have less ability to lend to the private sector. Consequently, private investment, likely to be more productive than government spending, may decline.

Capitalism Is Eroding

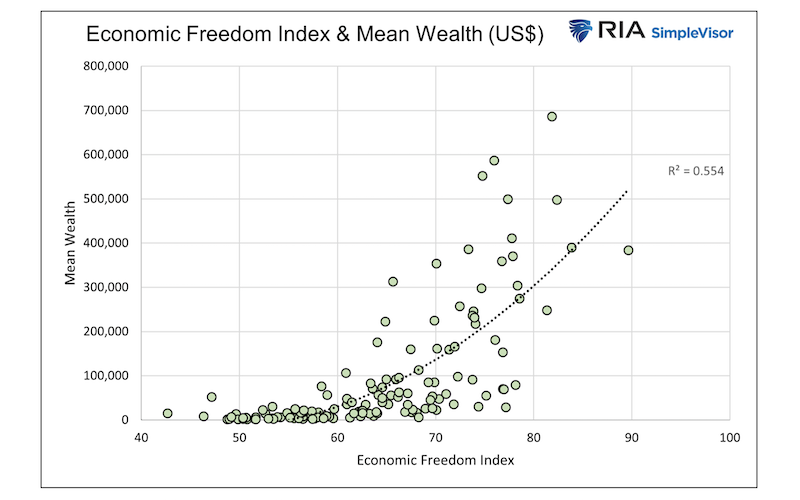

The graph below shows why capitalism matters. It plots the Heritage Foundation’s Index of Economic Freedom, a measure of capitalism, versus the average family wealth for 137 countries. As shown, economic freedom and wealth have a strong positive correlation.

With that relationship in mind, government spending is a key component of the economic freedom index. Massive government stimulus spending reduces our index score. Further, while not a part of the score, manipulation of free market interest rates also detracts from the benefits of capitalism. As our index score falls, denoting the retreat from capitalism, so does our wealth.

Summary

Nothing is free, it’s just a question of how it’s paid for. While the government spends like there is no tomorrow and the Fed does everything in its power to help them, we must understand that the longer-term consequences of their actions are weaker economic growth and growing wealth disparity, as we discuss in Fed Policies Turn The Wealth Gap Into A Chasm. To wit:

QE may have served as an emergency way to add bank reserves to the system and boost confidence. However, its continued use, even during economic prosperity periods, only makes the wealth gap wider.

We should take the matter personally because, as we have shown, there is a strong link between government borrowing and our prosperity. While the cost of deficits may not be higher taxes, it does show up invisibly in lesser wages and wealth than we otherwise could attain. Any wonder why millennials are on track to be the first generation to fail to exceed their parents in income?

Twitter: @michaellebowitz

The author or his firm may have positions in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.